11 Usc 522 Withholding

Description

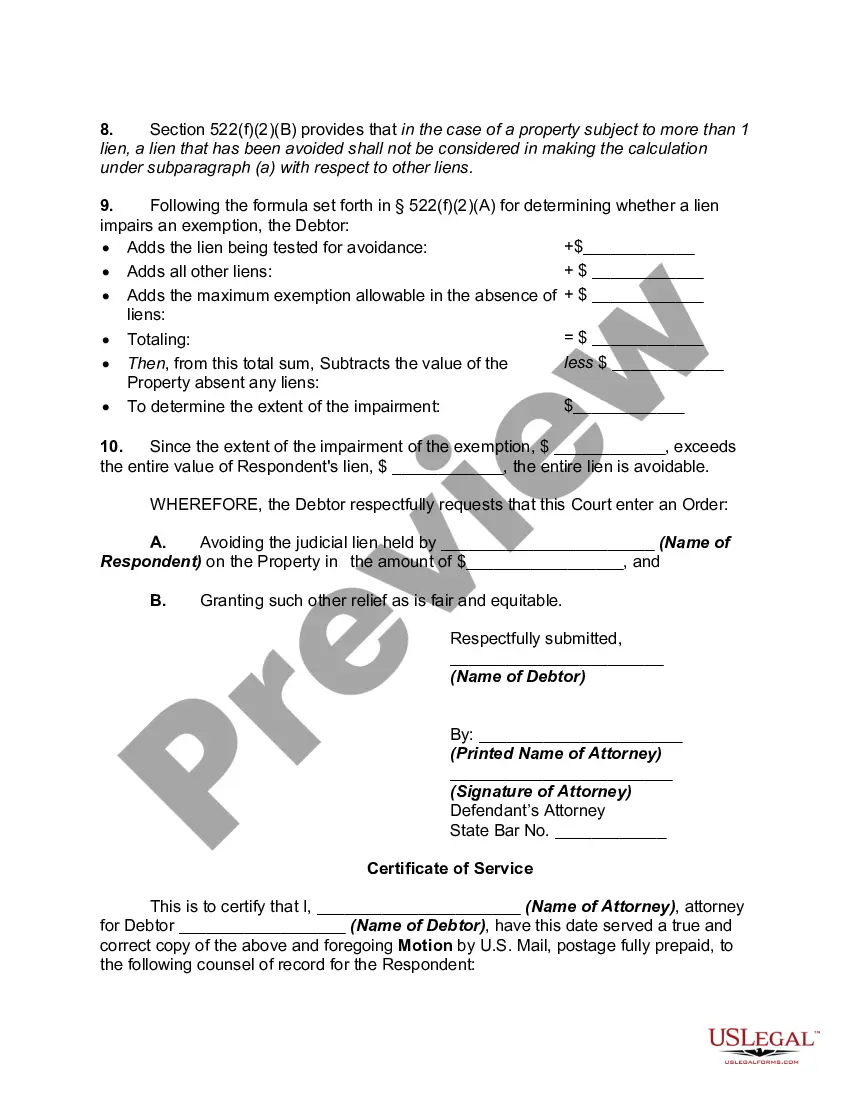

How to fill out Motion To Avoid Creditor's Lien?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of creating 11 Usc 522 Withholding or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of more than 85,000 up-to-date legal forms addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-compliant forms carefully put together for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can easily locate and download the 11 Usc 522 Withholding. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No worries. It takes minutes to register it and explore the catalog. But before jumping directly to downloading 11 Usc 522 Withholding, follow these tips:

- Review the document preview and descriptions to make sure you have found the document you are looking for.

- Make sure the form you select complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the 11 Usc 522 Withholding.

- Download the form. Then complete, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us now and transform form execution into something easy and streamlined!

Form popularity

FAQ

Avoiding A Judgment Lien ? § 522(f)(1)(A) The enabling statute for avoiding a judgment lien is 11 U.S.C. § 522(f)(1)(A), which permits a debtor to avoid a judgment lien to the extent that it impairs the debtor's exemption of the asset in question ? most commonly, the debtor's principal residence.

Generally, the types of assets that you can keep in a bankruptcy include: personal items and clothing. household furniture, food and equipment in your permanent home. tools necessary to your work. a motor vehicle with a value up to a certain limit, usually an older vehicle qualifies. certain farm property.

After you file for bankruptcy in Canada, some of your assets may be sold to repay money you owe to your creditors. These assets are called non-exempt property.

California Homestead Exemption and Bankruptcy Using the revised exemption for 2021, a debtor may have $600,000 of equity in their Los Angeles or Orange County home and still file a Chapter 7 bankruptcy with their home being protected. The homestead exemption in Riverside County is $400,500.

?value? means fair market value as of the date of the filing of the petition or, with respect to property that becomes property of the estate after such date, as of the date such property becomes property of the estate.