Spouse Surviving Estate For Rent

Description

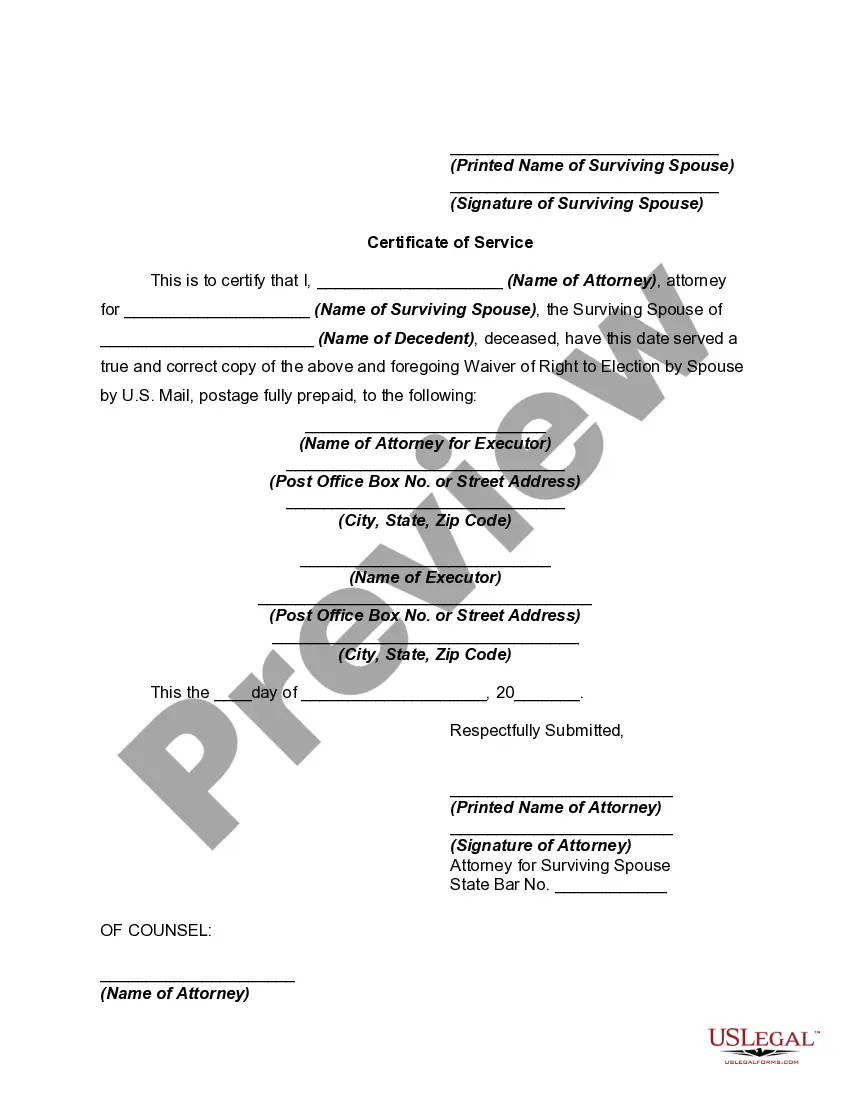

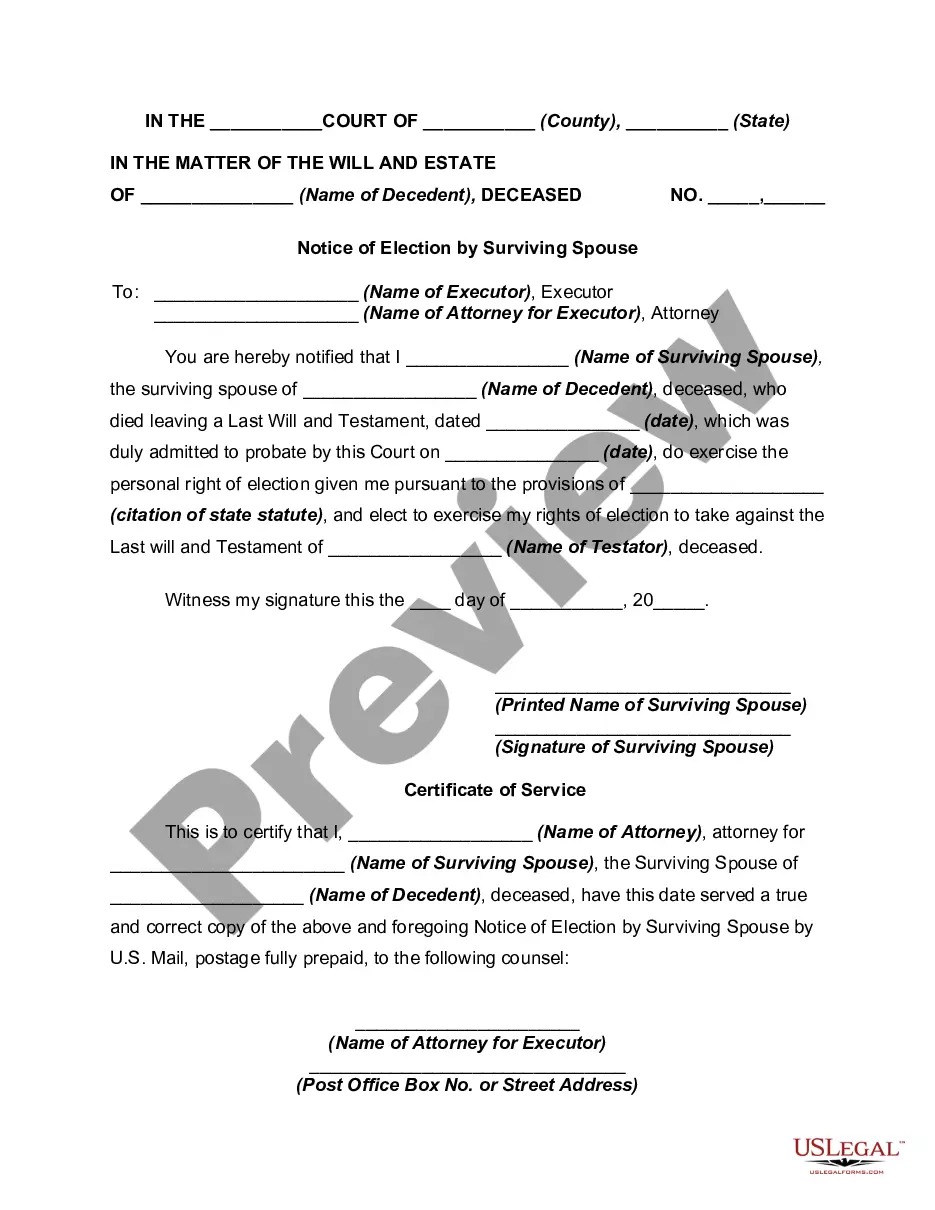

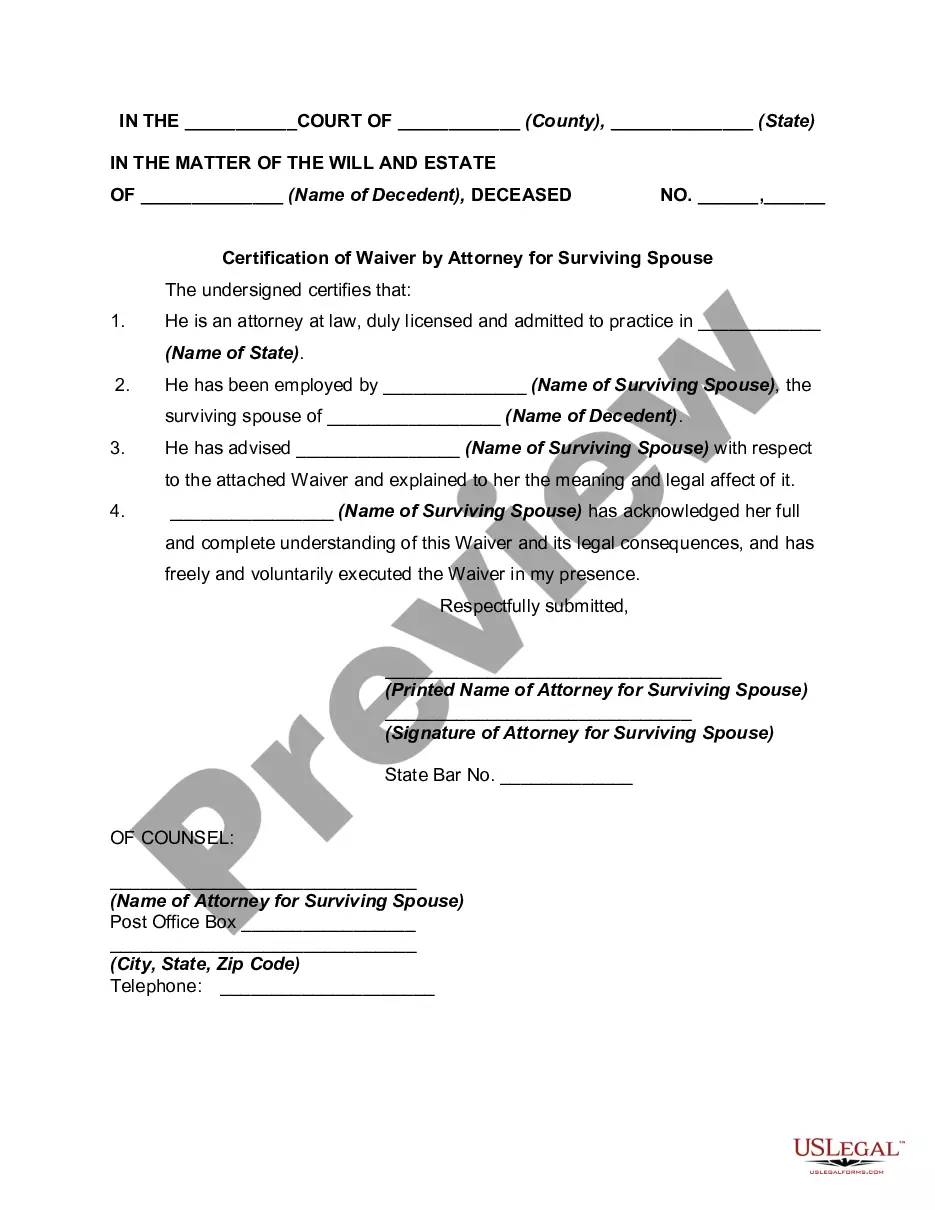

How to fill out Waiver Of Right To Election By Spouse?

- If you are a returning user, log in to your account and download the required form template. Confirm that your subscription is active, renewing it if necessary.

- If you are a new user, start by checking the Preview mode and the form description to ensure you select the correct document that complies with your local jurisdiction.

- If the form doesn't meet your needs, utilize the Search tab to find a suitable template. Confirm its accuracy before proceeding.

- Once you have the right document, click the Buy Now button, select your preferred subscription plan, and create an account to access the library.

- Proceed with your purchase by entering your payment details or using your PayPal account. Confirm the transaction.

- After purchase, download the form to your device for completion, and access it at any time from the My Forms section of your profile.

US Legal Forms empowers individuals and attorneys alike to efficiently create and execute legal documents. With a vast collection of over 85,000 customizable forms, you can ensure that your documents are both precise and compliant.

Don’t let the complexities of legal paperwork overwhelm you. Start using US Legal Forms today and streamline your estate management process!

Form popularity

FAQ

When a spouse dies, various tax implications arise, particularly concerning estate taxes and potential capital gains. The surviving spouse may need to account for changes in tax status and plan accordingly to manage the estate effectively. Awareness of these implications can help you navigate a spouse surviving estate for rent more efficiently. Utilizing services from uslegalforms can provide vital insights for tax planning.

Setting up an estate for a deceased spouse involves several essential steps, including filing for probate and gathering necessary documents. You will need to identify assets, settle debts, and distribute property according to the will or state law. Understanding the processes involved in a spouse surviving estate for rent is key to ensuring everything is managed smoothly. Uslegalforms can simplify document preparation to facilitate this setup.

To avoid paying higher taxes after a spouse passes away, consider timely filing for the estate tax exemption. Engaging in estate planning strategies such as establishing trusts can minimize tax liabilities. Additionally, understanding how to manage a spouse surviving estate for rent can provide financial flexibility. Uslegalforms offers resources and templates that can make this process easier.

The widow's exemption refers to the benefits available to a surviving wife regarding estate taxation. In many cases, a widow can claim a higher exemption limit, ensuring her spouse's entire estate can transfer without tax burdens. This provision underscores the importance of planning around a spouse surviving estate for rent to optimize financial outcomes. Explore options on uslegalforms to help navigate these benefits.

The spousal exemption on the estate tax allows a surviving spouse to inherit an estate without facing immediate tax consequences. This exemption can cover the entire value of the deceased spouse's estate, providing a vital financial cushion. Understanding this exemption is crucial when managing a spouse surviving estate for rent effectively. Utilizing tools from uslegalforms can guide you through the relevant processes.

When your spouse passes away, it's crucial to avoid making hasty decisions regarding the spouse surviving estate for rent. Don't rush to sell properties or distribute assets without understanding your legal rights and obligations. Taking time to seek guidance can help you navigate the emotional and financial complexity of this time. Resources like US Legal Forms can assist you in making informed decisions.

A wife is typically entitled to collect Social Security benefits based on her deceased husband’s earnings record. The amount she receives can be up to 100% of his benefit if she reaches full retirement age or a reduced amount if she claims earlier. This benefit serves as vital support in managing the spouse surviving estate for rent and maintaining financial stability.

If your husband passes away, you may be entitled to various benefits from the spouse surviving estate for rent. This includes rights to assets from the will, personal property, and potentially life insurance proceeds. It's vital to review these entitlements as they can significantly impact your financial situation during this difficult time.

The step-up in basis is an important tax concept that applies to rental properties when a spouse dies. Essentially, the property’s value is adjusted to its current market value at the time of death. This means the surviving spouse may benefit financially, especially if they intend to sell the property. Knowing how this works can help you manage your spouse surviving estate for rent wisely.

When a husband passes away, his wife has specific rights concerning the spouse surviving estate for rent. She may inherit a portion of the estate, even if there is a will. Typically, a surviving spouse is entitled to assets held in joint tenancy, as well as any community property. Understanding these rights is crucial, and platforms like US Legal Forms can help clarify the legal process for you.