Spouse Shares Blank With A

Description

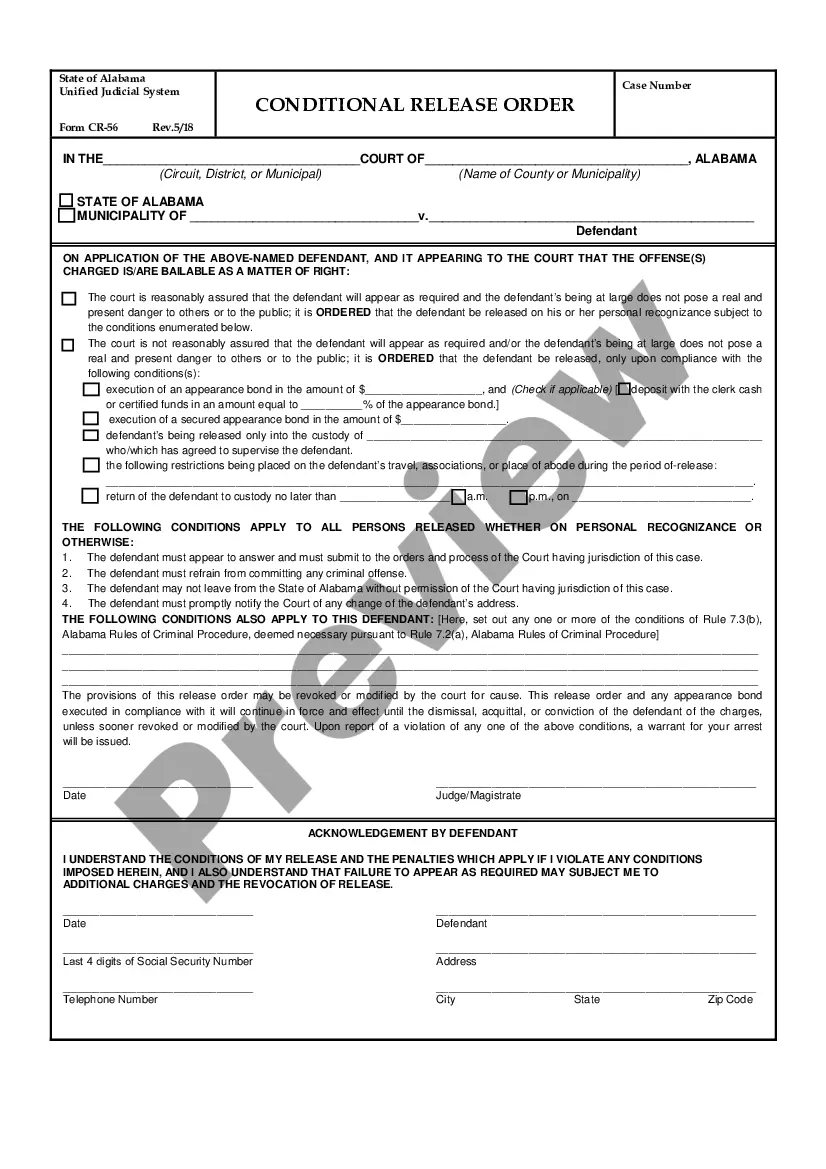

How to fill out Waiver Of Right To Election By Spouse?

- For returning users, log in to your account to access previously used forms. Ensure your subscription is active; renew if necessary.

- If you are new to US Legal Forms, start by browsing the extensive library. Use the Preview mode to review the form description and confirm it matches your requirements.

- If you don’t find the right document, utilize the Search feature to locate forms that are specific to your local jurisdiction.

- Select the desired form and click the 'Buy Now' button. Choose a subscription plan that suits your needs and register an account for full access.

- Complete your payment using your credit card or PayPal, then download the form directly to your device.

- Access your downloaded documents anytime via the 'My Forms' section in your profile.

By utilizing US Legal Forms, you benefit from a robust collection of legal documents that outnumbers many competitors, paired with expert assistance for form completion. This ensures accuracy and compliance with legal standards.

Start experiencing the ease of obtaining legal documents today! Visit US Legal Forms and take the next step toward empowering your legal journey.

Form popularity

FAQ

Claiming 0 typically results in higher tax withholding, which could lead to a larger refund, while claiming 1 generally lowers your withholding amount. Consider your situation carefully; if you're unsure, you might consult tax guidance for personalized advice. Remember, understanding how your spouse shares blank with a W-4 can play a pivotal role in deciding the correct claim number for your needs.

To fill out a federal tax withholding form, gather all necessary documents, including your income and previous tax information. Follow the prompts within the form to input your filing status and any deductions. Ensure you understand how your spouse shares blank with a W-4 to maximize accuracy. This will help you manage your withholding effectively and avoid issues come tax season.

It depends on your combined income and tax situation. If both spouses earn income, it may be beneficial for one spouse to claim all the dependents to maximize tax credits. However, you should assess your overall financial scenario to make the best decision. Understanding how both spouses share blank with a W-4 could lead to optimal withholding and tax savings.

Filling out a federal withholding form starts with entering your personal information accurately. You’ll also need to complete the sections that address your filing status, dependents, and additional income or deductions. The form guides you through each step, and having clarity on your spouse shares blank with a W-4 will enhance your accuracy. This process can help ensure you are withholding the correct amount from your paycheck.

To accurately manage your federal withholding, first consider your total income and eligible deductions. A proper evaluation of how much tax you owe can help you avoid overpaying or facing a tax bill at the end of the year. You may use the IRS withholding calculator to assist you in determining your most suitable withholding amount. Remember, your spouse shares blank with a W-4 can simplify this process.

While sharing is essential, it’s not always necessary to divulge every thought or feeling. Focusing on meaningful communication strengthens your relationship. A spouse shares blank with a supportive partner who understands the importance of balance. Prioritize what matters most and maintain openness.

Keeping secrets can harm trust in a relationship. However, some information might not need to be shared to maintain peace or privacy. A spouse shares blank with a partner when there is understanding and mutual respect. Consider the impact of any withheld information on your relationship.

Husbands should share significant thoughts and feelings, but complete transparency isn't necessary. Sharing important details fosters trust, while some matters can be personal. A spouse shares blank with a partner who values honesty, yet understands the need for privacy in certain areas. Open communication is key.

Every relationship is unique, and while sharing is vital, not everything needs to be disclosed. It's about balance; some personal thoughts or experiences can remain private. Ultimately, a spouse shares blank with a partner who trusts and respects individual space. Openly discuss what is comfortable for both of you.

It's important to address negativity in a constructive manner. Open and honest communication often helps; express your feelings without laying blame. Set boundaries on negative comments while encouraging supportive dialogue. Remember, a spouse shares blank with a partner who understands and respects each other's feelings.