Spouse Elective Shares Formula

Description

How to fill out Waiver Of Right To Election By Spouse?

Whether for commercial purposes or personal matters, everyone must confront legal issues at some point in their existence. Completing legal documents necessitates meticulous attention, starting with selecting the appropriate form template.

For example, if you choose an incorrect version of a Spousal Elective Shares Formula, it will be rejected when you submit it. Therefore, it is crucial to have a trustworthy source of legal documents such as US Legal Forms.

With an extensive US Legal Forms catalog available, you won’t need to waste time searching for the suitable sample across the web. Utilize the library’s easy navigation to find the correct form for any circumstance.

- Locate the sample you require by utilizing the search field or catalog browsing.

- Review the form’s description to confirm it meets your needs, state, and locality.

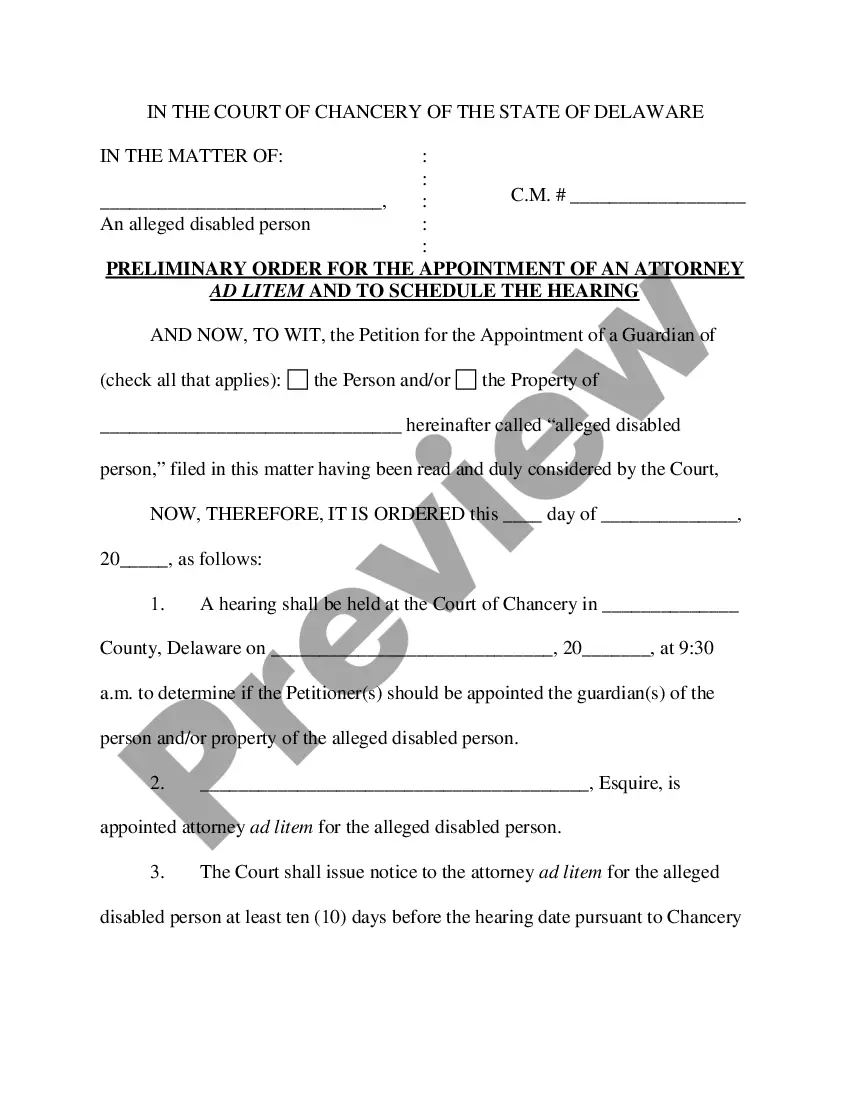

- Click on the form’s preview to review it.

- If it is the wrong form, return to the search function to find the Spousal Elective Shares Formula sample you need.

- Download the file when it fits your criteria.

- If you possess a US Legal Forms profile, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the appropriate pricing choice.

- Fill out the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you desire and download the Spousal Elective Shares Formula.

- Once it is saved, you can complete the form using editing software or print and fill it out manually.

Form popularity

FAQ

Once the petition for the elective share is filed, the court must determine the amount of the elective share by calculating 30% of the fair market value of all of the deceased spouse's property that is subject to the elective estate.

Spousal Right of Election in New York Under the law, a spouse is entitled to an "elective share" of the assets which is defined as the greater of $50,000.00 or one-third of the estate which includes property such as joint bank accounts and certain assets which are known as "testamentary substitutes."

Spousal Right of Election in New York Under the law, a spouse is entitled to an "elective share" of the assets which is defined as the greater of $50,000.00 or one-third of the estate which includes property such as joint bank accounts and certain assets which are known as "testamentary substitutes."

Depending on the facts and circumstances, this would either be half or all of the probate estate. Unlike an elective share, the inheritance to a pretermitted spouse is made up exclusively of probate assets.

By state law, a surviving spouse in Pennsylvania can elect to take one-third of a decedent spouse's property, which includes: Property passing by the will or intestacy: A surviving spouse can take one-third of any property that the decedent included in his or her will.