Spouse Elective Shares For The Future

Description

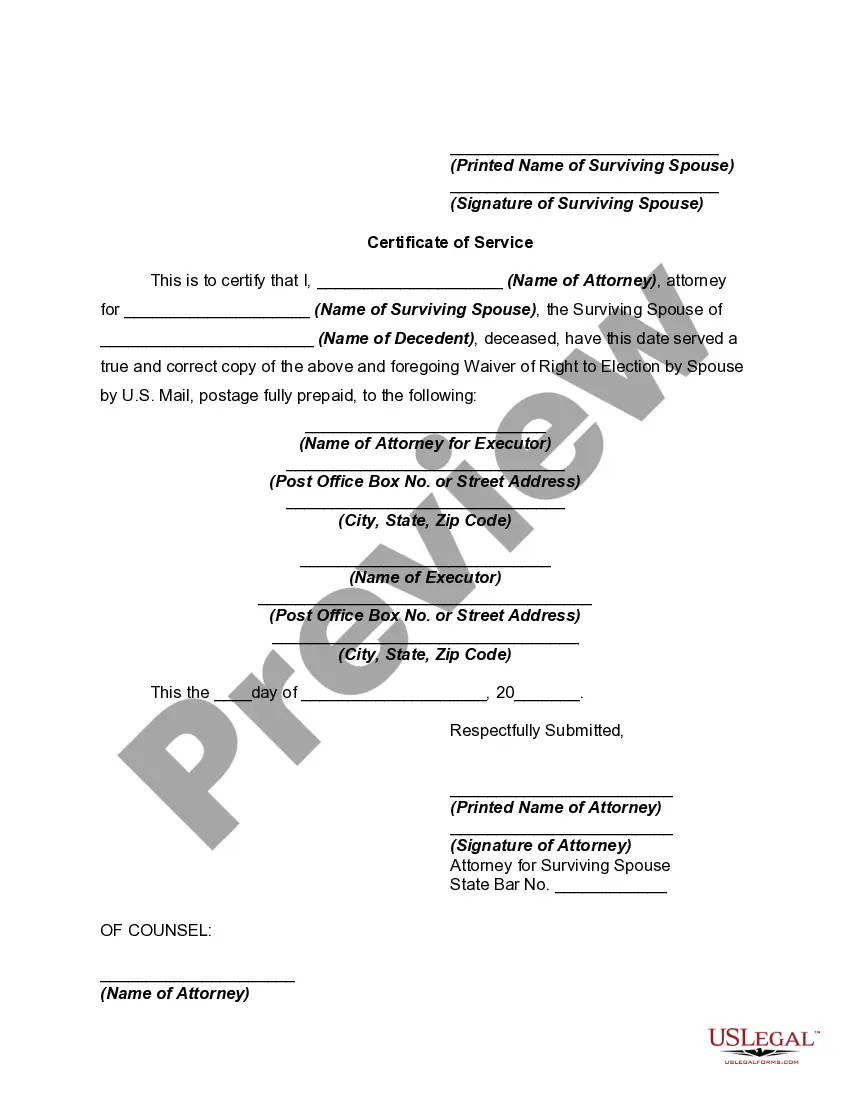

How to fill out Waiver Of Right To Election By Spouse?

- If you are a returning user, log in to access your account. Verify your subscription status to ensure it’s active. If needed, renew it per your payment plan.

- In case this is your first time, begin by reviewing the available templates in the Preview mode. Confirm the selected form aligns with your local laws and fits your requirements.

- Should you require additional templates, utilize the Search tab at the top to find the right one. Look for discrepancies before moving on to the purchase.

- Proceed to buy the document by clicking the Buy Now button and selecting your preferred subscription plan. Create an account for comprehensive access to the forms library.

- Finalize your purchase by entering your payment details or using your PayPal account for smooth transaction processing.

- Download the completed form to your device for easy access and future reference via the My Forms section in your profile.

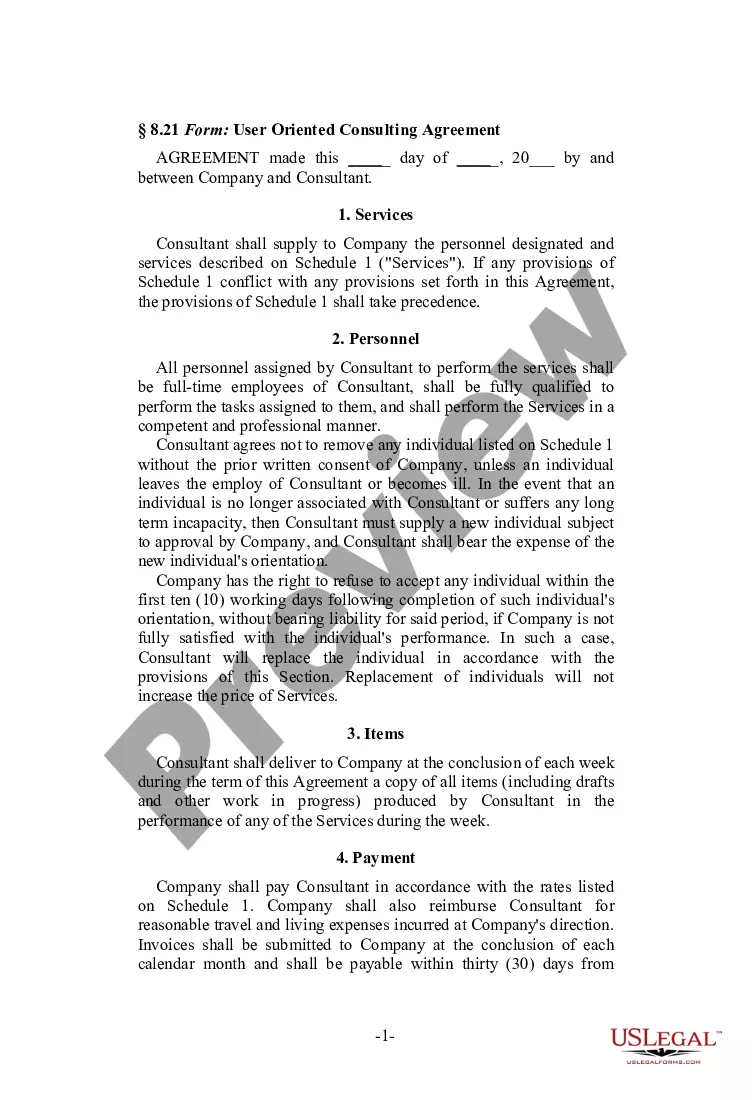

By leveraging US Legal Forms, individuals and attorneys can swiftly execute legal documents with a user-friendly library at their fingertips. With over 85,000 editable forms available, users obtain a significant advantage.

Take charge of your estate planning today! Begin using US Legal Forms for all your legal document needs.

Form popularity

FAQ

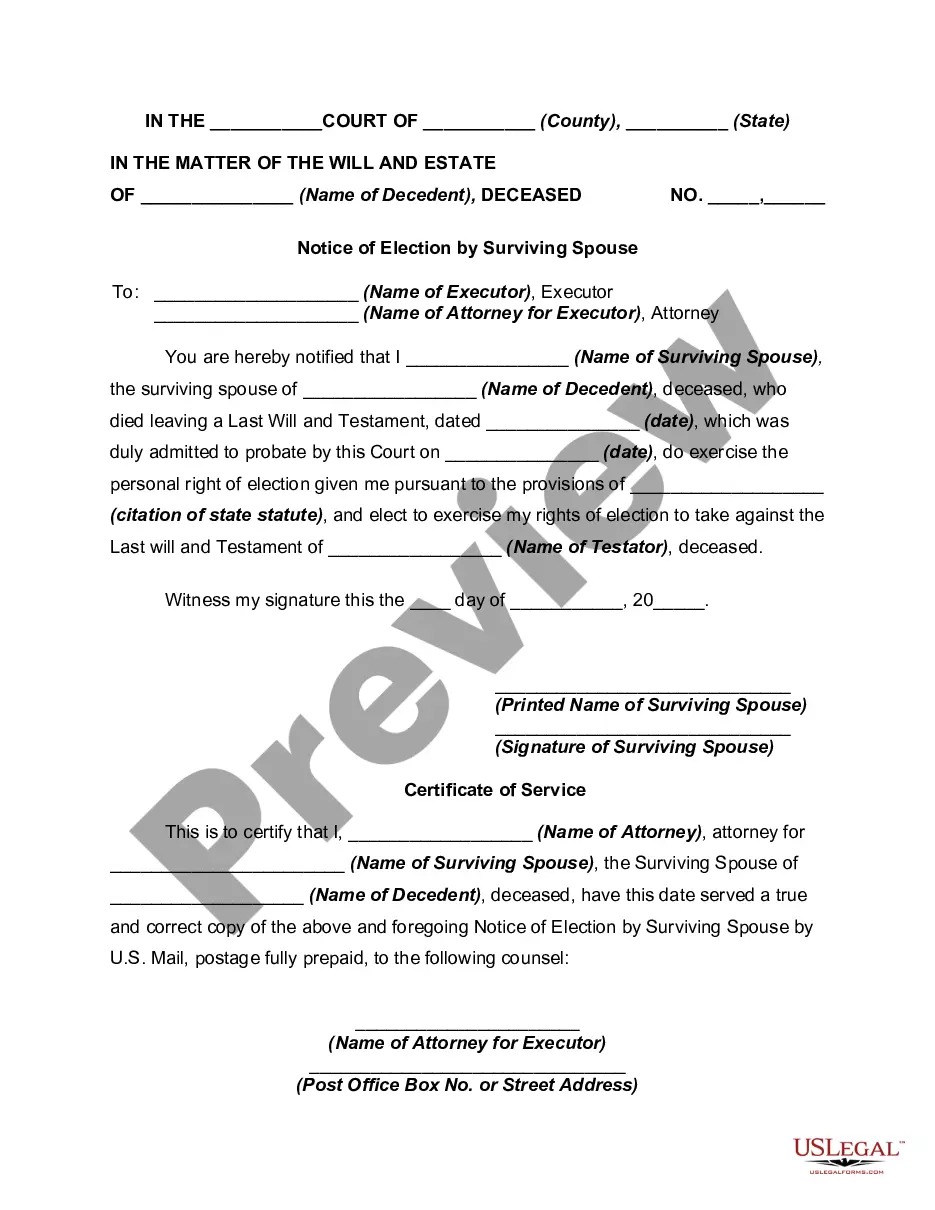

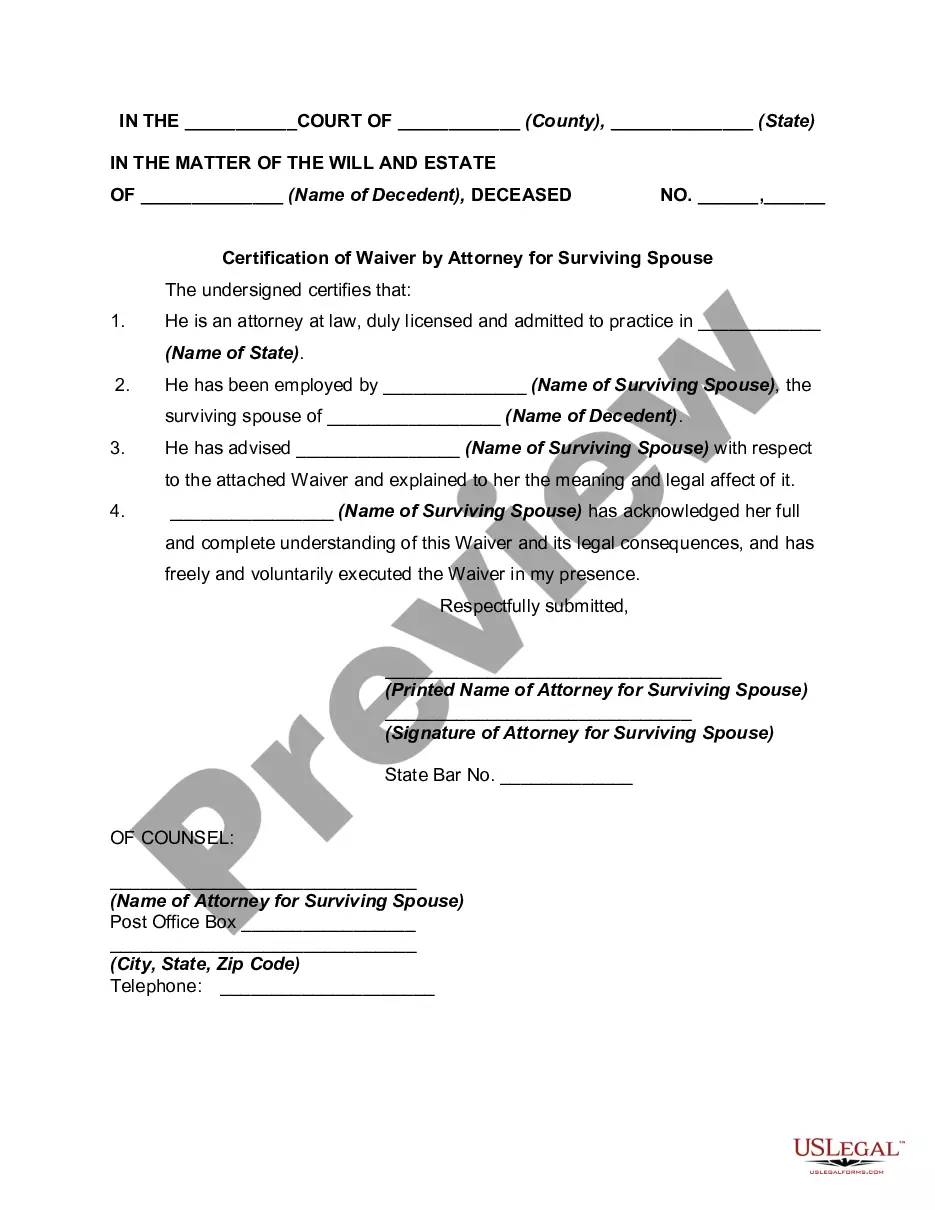

Yes, a spouse can waive their right to an elective share, but this often requires a formal agreement such as a prenuptial or postnuptial agreement. It is crucial to ensure that the waiver is in writing and meets your state's legal requirements for it to be valid. Discussing your decision with a qualified attorney can help ensure that you fully understand the implications for spouse elective shares for the future. The US Legal Forms platform offers templates and legal forms that can assist you in drafting the necessary agreements.

To receive a share as a surviving spouse, you must first determine your state's laws regarding spouse elective shares for the future. Generally, you will need to file a claim in probate court within a specified time frame. This process often involves presenting your marriage certificate and relevant documents to establish your right to a share. For more detailed guidance, you may consider utilizing the US Legal Forms platform, which provides various legal resources to help navigate this process.

An elective share is a legal provision that allows a surviving spouse to claim a designated portion of the deceased spouse's estate, regardless of the will's contents. The purpose of this share is to ensure financial protection for the surviving partner, promoting fairness in asset distribution. This is especially vital in preventing disinheritance and securing the spouse's financial future. If you need more guidance on this topic, USLegalForms offers helpful resources to understand and access the necessary legal tools.

When a husband passes away, the wife may be entitled to a portion of his estate through spouse elective shares for the future. This legal right ensures that a surviving spouse receives a fair benefit from the deceased partner's assets, regardless of what is stated in a will. In many states, laws protect spouses from being disinherited, allowing them to claim their rightful share. If you're navigating these complex issues, platforms like USLegalForms can simplify the process and provide you with necessary legal documents.

A spousal elective share is a legal provision that allows a surviving spouse to claim a specified portion of their deceased partner's estate, regardless of what the will states. This principle ensures that a spouse is not wholly disinherited, providing a safety net that supports their financial stability after loss. The exact share can vary significantly by state, highlighting the importance of understanding local laws. For insights and tools to manage spouse elective shares for the future, US Legal Forms is a valuable resource.

In Florida, the time limit for claiming an elective share is typically within six months of the deceased spouse's death. This timeframe is crucial for ensuring that the surviving spouse can assert their rights to a portion of the estate. Missing this deadline can significantly impact the spouse's financial position and entitlement. For detailed guidance on navigating these timelines and securing spouse elective shares for the future, consider utilizing the offerings from US Legal Forms.

Calculating the elective share involves several systematic steps. Begin by assessing the total value of the estate and any specific gifts made to other beneficiaries. Next, apply the applicable percentage according to state law. Finally, adjust for any advancements that the spouse may have received during the marriage. For assistance with these calculations, US Legal Forms offers resources that simplify the determination of spouse elective shares for the future.

An example of an elective share can be found in a scenario where a spouse dies without a will, leaving behind an estate worth $600,000. If state law entitles the surviving spouse to one-third of the estate, they would be entitled to $200,000. This calculation reflects how elective shares can protect a spouse's financial interests, ensuring they have a claim to assets even if a will attempts to disinherit them. To navigate these complexities effectively, explore resources like US Legal Forms for insights on spouse elective shares for the future.

To calculate a spouse's elective share, start by determining the total value of the deceased spouse's estate. Next, calculate the percentage allocated to the surviving spouse, which typically ranges from one-third to one-half, depending on the state law. After that, consider any gifts made during marriage that may impact the total value. For more precise calculations, you may want to use a reliable resource like US Legal Forms, which can guide you through the process of handling spouse elective shares for the future.

A spouse is not automatically a beneficiary in all situations. While many people think marital status guarantees beneficiary rights, it largely depends on legal documents like wills or trusts and state laws. Understanding spouse elective shares for the future can guide you in ensuring your spouse is appropriately designated as a beneficiary. Using platforms like US Legal Forms can help you create the necessary legal documents efficiently.