Spouse Elective Shares Complete For The Future

Description

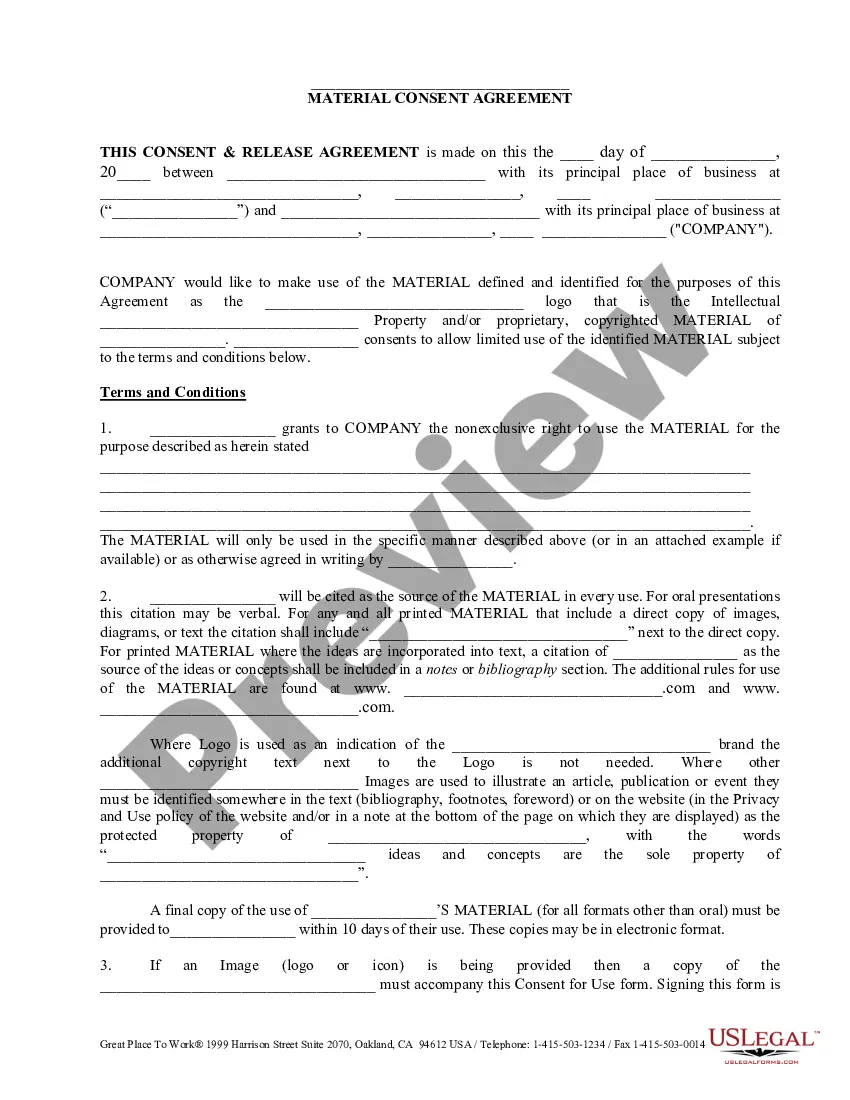

How to fill out Waiver Of Right To Election By Spouse?

- If you're a returning user, log in to access your account and download the required form template by clicking the Download button. Ensure your subscription is active; if not, renew it promptly.

- For first-time users, start by previewing the form and reviewing the description to ensure it meet your specific needs and complies with your local jurisdiction.

- If the current form isn't suitable, utilize the Search feature at the top to find another template that aligns with your requirements.

- Once you've identified the correct form, click on the Buy Now button to select your desired subscription plan. You’ll need to register for an account to access the extensive library.

- Complete your purchase by entering your credit card information or opting for PayPal to finalize your subscription.

- Download your chosen form directly to your device. You can also access it anytime from the My Forms section of your profile.

US Legal Forms empowers users with an extensive library of over 85,000 fillable legal documents, ensuring access to everything you need to complete your spouse elective shares.

With expert assistance available for form completion, you can be confident in the legality and accuracy of your documents. Start your journey today and simplify your legal processes with US Legal Forms!

Form popularity

FAQ

An example of an elective share would be when a spouse inherits a portion of the estate despite a will that states otherwise. If the deceased spouse had a total estate value of $600,000 and a child from another marriage, the surviving spouse could elect to receive $200,000, which is one-third of the estate. Utilizing resources from USLegalForms can provide further insights on how spouse elective shares complete for the future can influence estate planning.

Calculating a spousal elective share involves determining the total value of the deceased spouse's estate. Generally, the surviving spouse is entitled to a one-third share if the deceased had children, and a one-half share if there were no children. You can simplify this process using tools available on USLegalForms, which help clarify these calculations and ensure spouse elective shares complete for the future are correctly addressed.

In Florida, the time limit for claiming a spousal elective share is typically within six months of the deceased spouse's death. This claim must be filed in probate court. It is crucial to act promptly to ensure that the spouse's rights to elective shares complete for the future are respected. Understanding these limits can help in planning your estate more effectively.

A spousal elective share in New York allows a surviving spouse to claim a portion of the deceased spouse's estate, regardless of what is stated in the will. This legal right ensures that you have a financial safety net after the loss of your partner. In New York, the spouse elective share is typically one-third of the estate, which protects your interests and promotes fairness in asset distribution. Utilizing resources like USLegal can help you navigate the complexities involved, ensuring your spouse elective shares complete for the future.

If your spouse dies, you may be entitled to significant assets, including an elective share of their estate, life insurance benefits, and retirement accounts. The specific entitlements can vary based on state laws and existing wills. It's essential to understand your rights, and platforms like US Legal Forms can assist in navigating spouse elective shares complete for the future.

To calculate the elective share, you often assess the total value of the deceased spouse's estate and then apply the state's mandatory percentage for the surviving spouse. This calculation can be complex, and using resources like US Legal Forms can simplify the process, ensuring your spouse elective shares complete for the future are accurately determined.

The percentage of the pension given to a surviving spouse depends on the pension plan terms and relevant laws. Many plans offer around 50% to 100% of the benefits, ensuring financial stability for the surviving spouse. Understanding these details is crucial for anyone considering spouse elective shares complete for the future.

The share of the surviving spouse typically includes a portion of the deceased spouse's estate. This portion can vary depending on state laws, but it often provides substantial financial support. Engaging with a platform like US Legal Forms can help clarify your rights regarding spouse elective shares complete for the future.

After a husband dies, a wife may have rights to property, including the elective share of his estate, depending on the legality of any agreements made prior. She may also retain rights to homestead property, assets, and certain financial benefits. Understanding these rights can significantly impact securing your spouse elective shares complete for the future.

The statute governing elective shares in Florida is found in Chapter 732 of the Florida Statutes. It outlines the rights of the surviving spouse to claim a share of the estate, even if the estate plan indicates otherwise. Knowing the Florida statute helps in navigating potentially complex estate matters, ensuring your spouse elective shares complete for the future.