Supplemental Needs Trust For The Disabled

Description

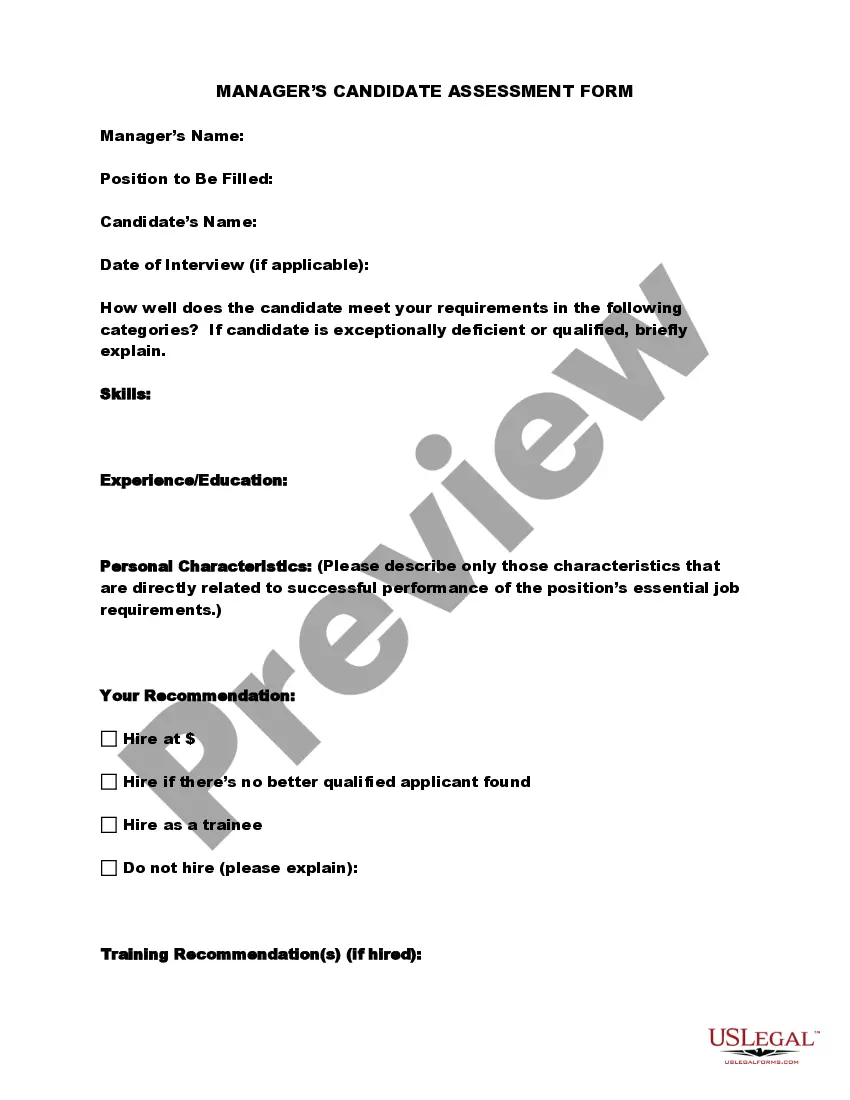

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

- Access the US Legal Forms website and either log in to your existing account or create a new one if you are a first-time user.

- Browse through the extensive library to locate the specific supplemental needs trust form that aligns with your situation and jurisdiction.

- Review the form's preview and ensure it meets all local legal requirements before proceeding.

- Select the Buy Now option and choose your preferred subscription plan that allows you access to the required documents.

- Complete your purchase by entering your payment details, either via credit card or PayPal account.

- After payment is confirmed, download the trust form directly to your device for easy access and future reference.

By using US Legal Forms, you not only gain access to a robust collection of over 85,000 legal documents but also benefit from guidance from premium experts who can assist you in completing your forms accurately.

Start creating your supplemental needs trust today—visit US Legal Forms and ensure your loved ones are protected for the future!

Form popularity

FAQ

Setting up a trust fund for a disabled person typically involves creating a supplemental needs trust for the disabled. Begin by gathering essential information regarding the disabled individual's needs and any current financial resources. Then, consult with a legal expert to draft the trust document, ensuring it meets all necessary regulations and effectively supports the disabled person's future.

To establish a supplemental needs trust for the disabled, start by consulting with a qualified attorney experienced in estate planning and special needs trusts. They will guide you through the process, helping you create customized terms that suit the individual's needs. Following legal guidance helps to ensure that the trust is compliant with state laws and maintains the disabled individual's eligibility for benefits.

A special needs trust, such as a supplemental needs trust for the disabled, comes with certain disadvantages. For instance, establishing these trusts can require ongoing management and administrative costs. Additionally, if funds are not properly maintained, they may affect eligibility for necessary government programs, which is why careful planning and consultation are essential.

There are several types of trusts designed for disabled individuals, including the supplemental needs trust for the disabled, first-party special needs trust, and third-party special needs trust. Each trust has unique features tailored to specific situations and needs. Understanding these options helps you choose the right one based on the disabled person's financial situation and government assistance eligibility.

The best type of trust for a disabled person is often a supplemental needs trust for the disabled. This trust allows individuals to receive financial support without jeopardizing their eligibility for government benefits. By leveraging a supplemental needs trust, you ensure that the disabled individual can enjoy a better quality of life, funded by private resources while maintaining essential aid.

While a supplemental needs trust for the disabled offers many advantages, there are some disadvantages to consider. Establishing and maintaining the trust can incur legal and administrative costs, which may be a concern for some families. Additionally, strict guidelines govern how the funds can be used, and failure to comply could jeopardize the beneficiary's government benefits.

In a supplemental needs trust for the disabled, the owner is typically the trustee, who manages the trust on behalf of the beneficiary. The beneficiary does not own the trust assets directly, which helps maintain eligibility for government benefits. Family members often establish the trust, appointing a trustworthy individual or a professional service to handle the management and distribution of funds.

When the beneficiary of a supplemental needs trust for the disabled passes away, the remaining assets may be distributed according to the trust's terms. It can either pass to heirs or be used to cover any remaining expenses. Importantly, it's essential to have a clear plan in place to manage the trust's assets, ensuring that the funds are used appropriately after the beneficiary's death.

A supplemental needs trust for the disabled allows a beneficiary to receive funds without losing eligibility for government benefits. The trust is funded by family members or friends, ensuring that it supplements the beneficiary's needs without interfering with essential support. It provides financial stability for the disabled, enabling them to access additional resources for medical care and quality of life.

One of the most significant mistakes parents make when setting up a trust fund is failing to specifically design a supplemental needs trust for the disabled. Many overlook how crucial it is to clearly outline the beneficiaries' needs and ensure that the trust does not jeopardize their eligibility for government benefits. Without careful planning, parents may inadvertently create a trust that disqualifies their child from essential support. Utilizing a platform like US Legal Forms can offer the guidance and tools needed to establish a compliant and effective supplemental needs trust.