Motion Jurisdiction Court With Judge

Description

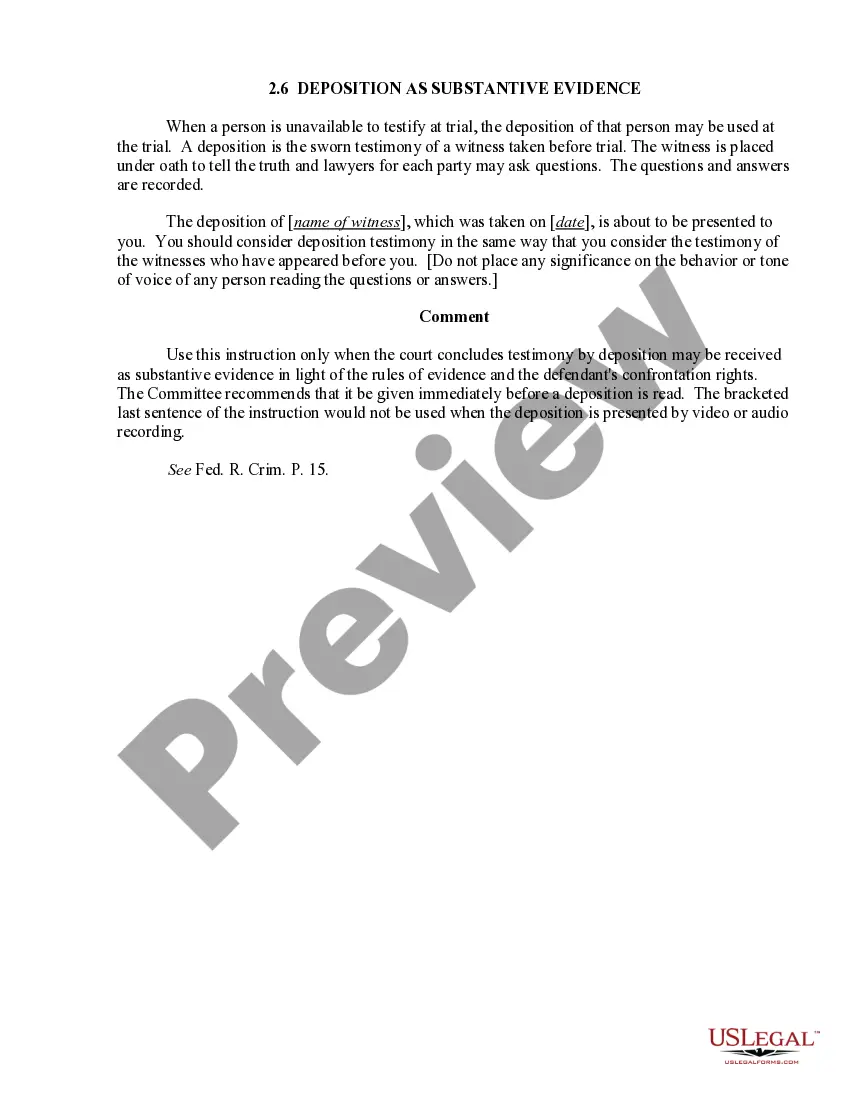

How to fill out Motion To Dismiss Appeal - Not Within Jurisdiction Of Court?

The Movement Jurisdiction Court With Judge presented on this page is a reusable legal blueprint crafted by expert attorneys in alignment with national and local statutes.

For over 25 years, US Legal Forms has served individuals, entities, and legal professionals with more than 85,000 certified, state-specific documents for various business and personal needs. It’s the quickest, easiest, and most dependable way to acquire the papers you require, as the service ensures the utmost level of data confidentiality and anti-malware safeguards.

Select the format you desire for your Motion Jurisdiction Court With Judge (PDF, DOCX, RTF) and store the sample on your device. Print the template to complete it manually. Alternatively, use an online versatile PDF editor to efficiently and accurately fill out and sign your form with a legally-binding electronic signature. Utilize the same document again whenever necessary. Access the My documents section in your profile to re-download any previously acquired forms. Enroll in US Legal Forms to have authenticated legal templates for all of life’s situations at your fingertips.

- Examine the document you require and evaluate it.

- Browse through the example you looked for and preview it or review the form description to ensure it meets your needs. If it does not, use the search field to locate a suitable option. Click Buy Now when you have identified the template you need.

- Choose a subscription and Log In.

- Select the payment plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Retrieve the editable template.

Form popularity

FAQ

A motion for judgment is a request that the court make a decision without going to trial, usually based on the evidence provided in the case. This motion aims to establish a ruling in favor of one party based on the facts presented. Understanding how to effectively utilize a motion for judgment is essential when engaging with a motion jurisdiction court with a judge, as it can lead to quicker resolutions.

Common types of business ownership The most common forms of business ownership are sole proprietorship, partnership, limited liability partnership, limited liability company (LLC), series LLC, and corporations, which can be taxed as C corporations or S corporations.

Partnership. Partnerships are the simplest structure for two or more people to own a business together. There are two common kinds of partnerships: limited partnerships (LP) and limited liability partnerships (LLP).

How to Start a Business in Nevada Choose a Business Idea. Take time to explore and research ideas for your business. ... Decide on a Legal Structure. ... Choose a Name. ... Create Your Business Entity. ... Apply for Licenses and Permits. ... Pick a Business Location and Check Zoning. ... Taxes and Reporting. ... Obtain Insurance.

An overview of the four basic legal forms of organization: Sole Proprietorship; Partnerships; Corporations and Limited Liability Company follows. Please also review this summary of non-tax factors to consider.

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance.

The initial cost to set up an LLC in Nevada is $425. Then, the annual costs are $350 per year. In most states, you just have to file a single LLC formation document. However, in Nevada, you have to file an Articles of Organization as well as a State Business License and Initial List of Managers or Managing Members.

What Legal Structure Is Best for Your Business? Sole Proprietorship. A type of business entity that is owned and run by one individual ? there is no legal distinction between the owner and the business. ... General Partnership. ... Limited Liability Company (LLC) ... Corporations (C-Corp and S-Corp)

How to form a Nevada General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Get a Nevada State Business License, and Research other license requirements.