Promissory Note Notary Form

Description

How to fill out Promissory Note - With Acknowledgment?

Maneuvering through the red tape of standard documents and templates can be challenging, particularly when one does not engage in that professionally.

Even locating the proper template for a Promissory Note Notary Form will be labor-intensive, as it must be legitimate and precise to the very last numeral.

Nevertheless, you will need to allocate significantly less time selecting a suitable template from a source you can rely on.

Acquire the appropriate form in a few straightforward steps.

- US Legal Forms is a resource that streamlines the process of finding the correct forms online.

- US Legal Forms is a single hub you require to access the most recent samples of documents, learn about their usage, and download these samples to complete them.

- This is a collection with over 85K forms applicable in various professional fields.

- When searching for a Promissory Note Notary Form, there is no need to question its legitimacy as all the forms are authenticated.

- Having an account at US Legal Forms will guarantee that you have all the essential samples at your disposal.

- You can store them in your records or add them to the My documents collection.

- You can access your saved forms from any device by clicking Log In on the library website.

- If you do not yet have an account, you can always search for the template you need.

Form popularity

FAQ

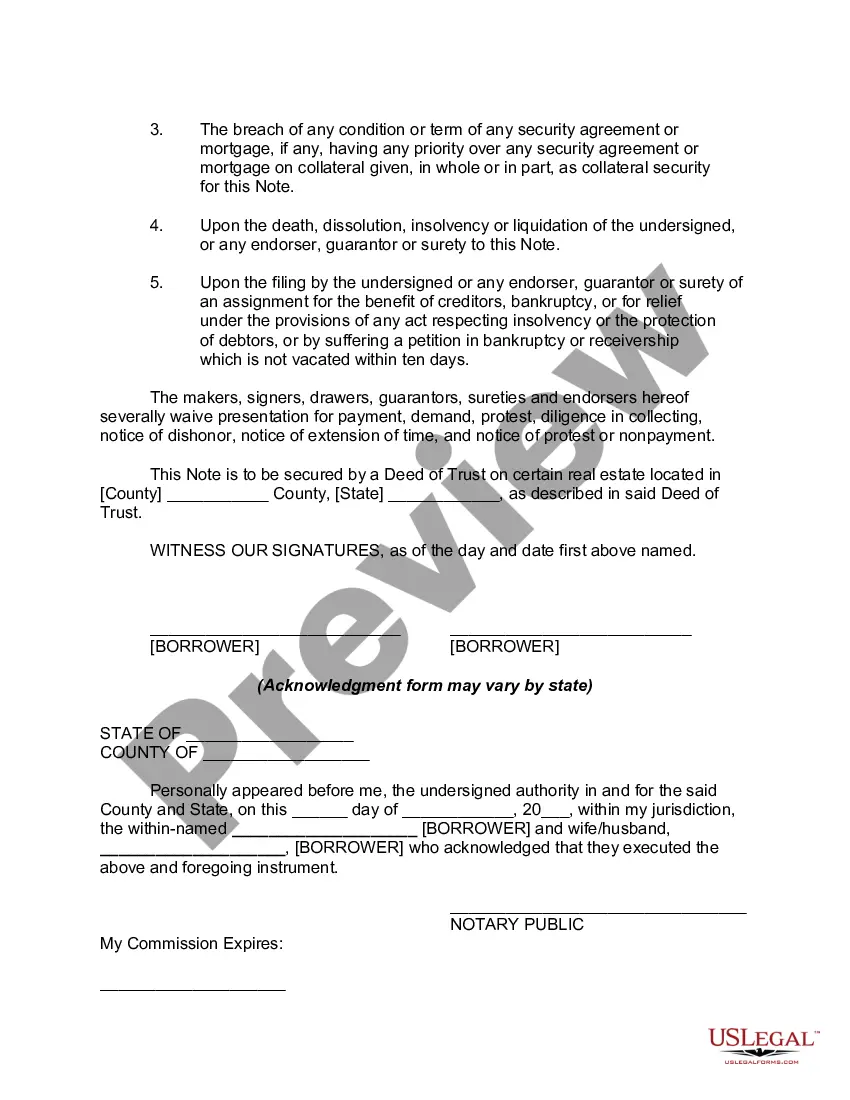

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

In the most sensitive cases, you should notarize your promissory note and any amended versions. This gives your document added authenticity and legal protection. If a borrower defaults or fails to pay, and you need to go to court, a notary signature could do you a solid in the long run.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.