Agreement Between Companies With Mutual

Description

How to fill out Non-Disclosure Agreement Between Two Companies?

Whether you frequently handle documents or occasionally need to send out a legal paper, it's essential to have a reliable source of information where all the samples are pertinent and current.

The initial step you should take with a Mutual Agreement Between Companies is to verify that it is the most recent edition, as it determines its submission eligibility.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

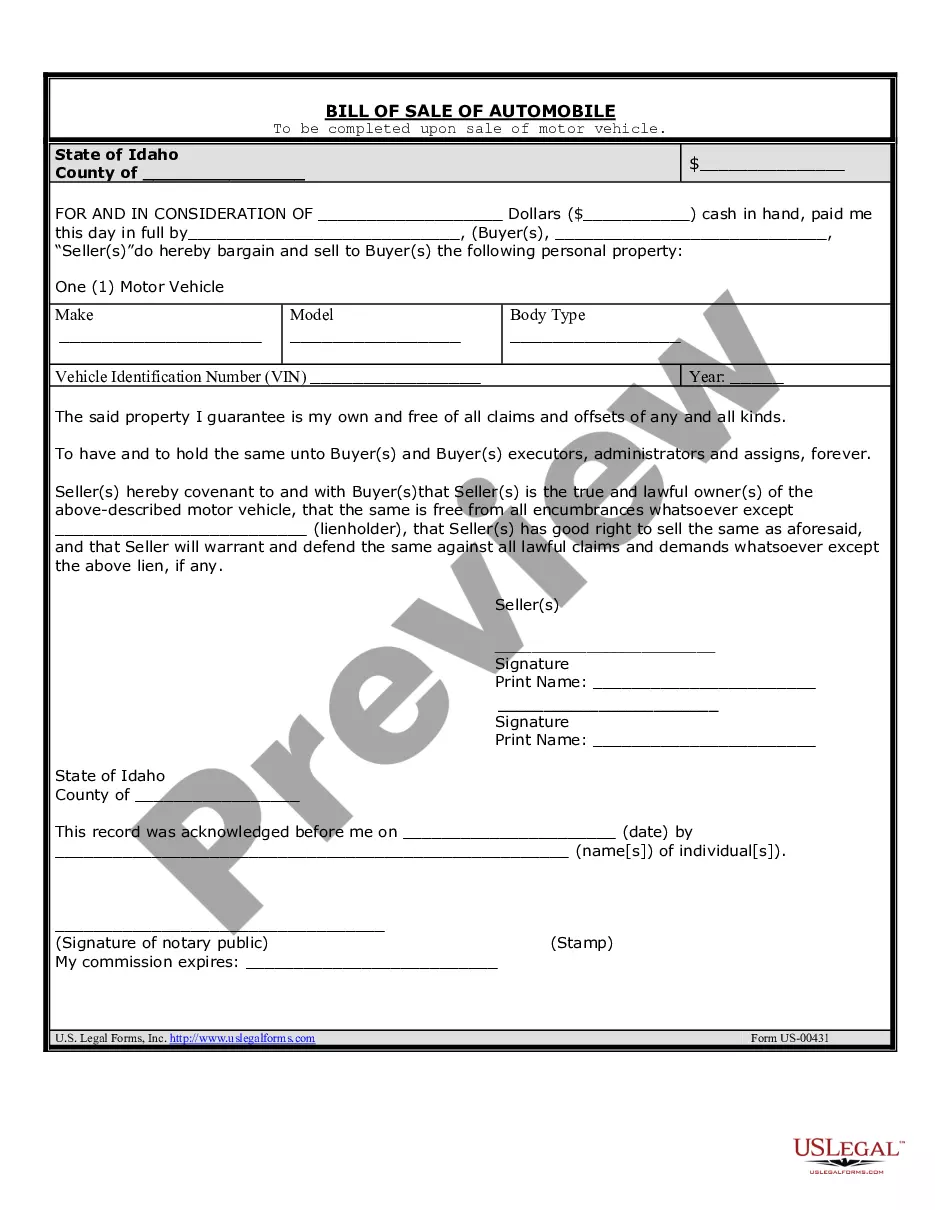

To acquire a form without an account, follow these steps: Use the search menu to locate the form you desire. Examine the preview and outline of the Mutual Agreement Between Companies to ensure it's precisely the one you seek. After verifying the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card details or PayPal account to complete the purchase. Choose the download file format and confirm it. Forget about the hassle of handling legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes almost any document sample you might seek.

- Locate the templates you need, review their relevance immediately and find out more about how they are used.

- With US Legal Forms, you gain access to over 85,000 form templates across a wide range of fields.

- Retrieve the Mutual Agreement Between Companies examples in just a few clicks and save them at any time within your profile.

- A US Legal Forms profile enables you to access all the samples you need more easily and efficiently.

- Simply click Log In in the site header and navigate to the My documents section, where all the forms you require are accessible, eliminating the need to search for the right template or making sure of its applicability.

Form popularity

FAQ

A mutual agreement is a binding contract between two or more parties and can cover any contingency. The difference between a mutual agreement and a settlement not creating a trust, is determined by the operative words, ie "mutually agrees" or "settles".

How to Write a Mutual Agreement?Conduct a Formal Meeting. A meeting with all the parties involved will formalize the future partnership or understanding.Make the First Draft. Writing is a process, especially when creating formal documents.Set the Mutual Terms.Revise and Edit.Set a date for the Agreement Signing.

For example: Mary has offered her used car to John for a price of $10,000 and they have reached a mutual agreement. This means that Mary and John have mutually agreed on the terms and conditions relating to the sale of Mary's car to John.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...