Select The Best Description Of The Mortgage Note For Sale

Description

How to fill out Mortgage Note?

Whether for business purposes or for individual matters, everybody has to deal with legal situations sooner or later in their life. Completing legal papers demands careful attention, starting with choosing the proper form template. For example, if you choose a wrong version of a Select The Best Description Of The Mortgage Note For Sale, it will be turned down once you submit it. It is therefore crucial to get a dependable source of legal files like US Legal Forms.

If you need to get a Select The Best Description Of The Mortgage Note For Sale template, follow these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Examine the form’s description to ensure it matches your case, state, and region.

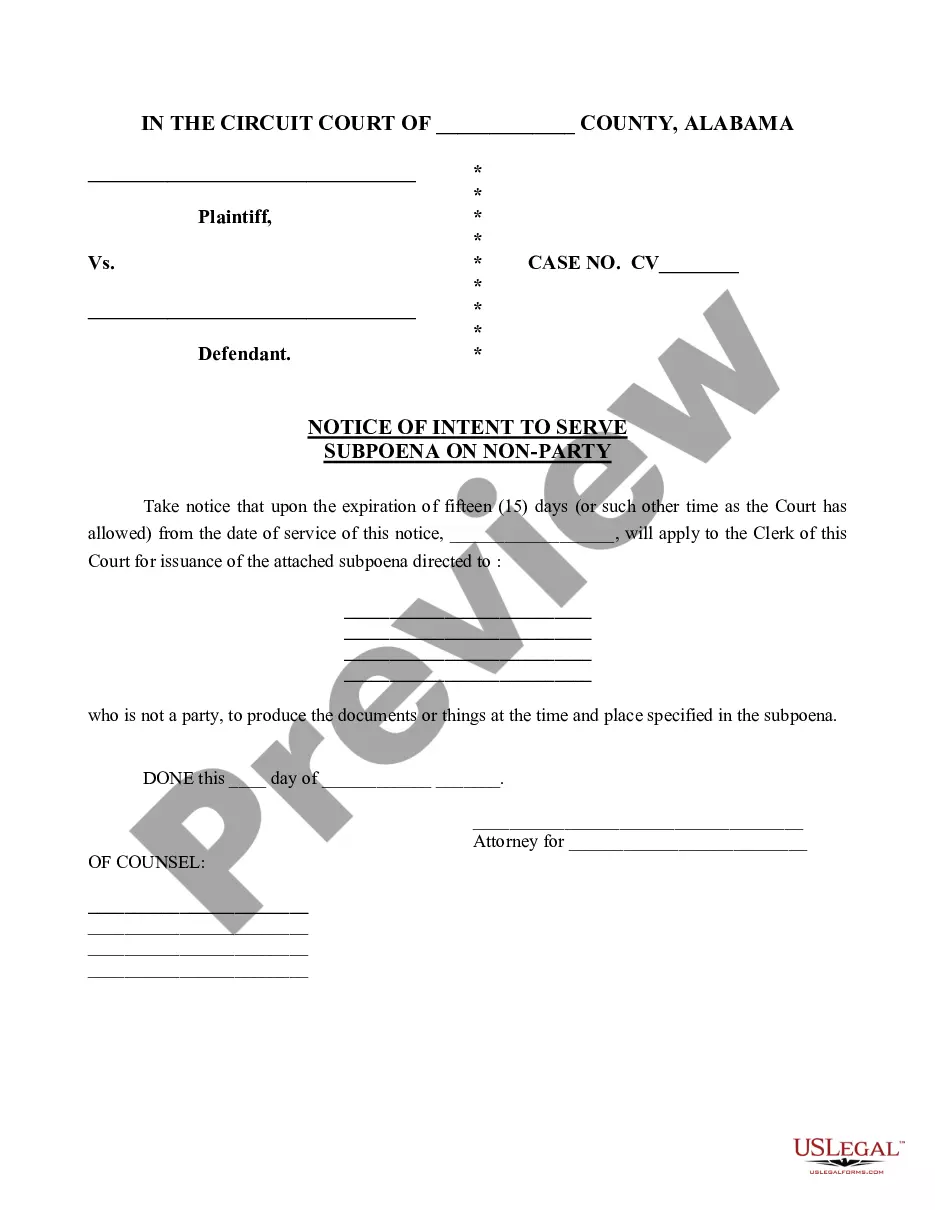

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to find the Select The Best Description Of The Mortgage Note For Sale sample you require.

- Download the file if it matches your needs.

- If you have a US Legal Forms profile, click Log in to access previously saved files in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the profile registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Select the document format you want and download the Select The Best Description Of The Mortgage Note For Sale.

- When it is saved, you are able to complete the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never need to spend time searching for the appropriate sample across the internet. Make use of the library’s straightforward navigation to get the appropriate template for any occasion.

Form popularity

FAQ

Mortgage Note Details The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

The following information will be included in a mortgage note: The exact amount borrowed, which is the total amount you owe on the mortgage. Interest rate. Down payment amount. Your full legal name. Name of the lender. The repayment plan (including the start date and maturity date of the loan)

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

Interest rate and the length of a loan also help determine the value of the note. A higher interest rate and shorter loan term make for a more valuable note. Other note terms, such as a rider on the mortgage affecting the term, can also affect its value. For instance, some private mortgage notes have a balloon rider.