Select The Best Description Of The Mortgage Note Quizlet

Description

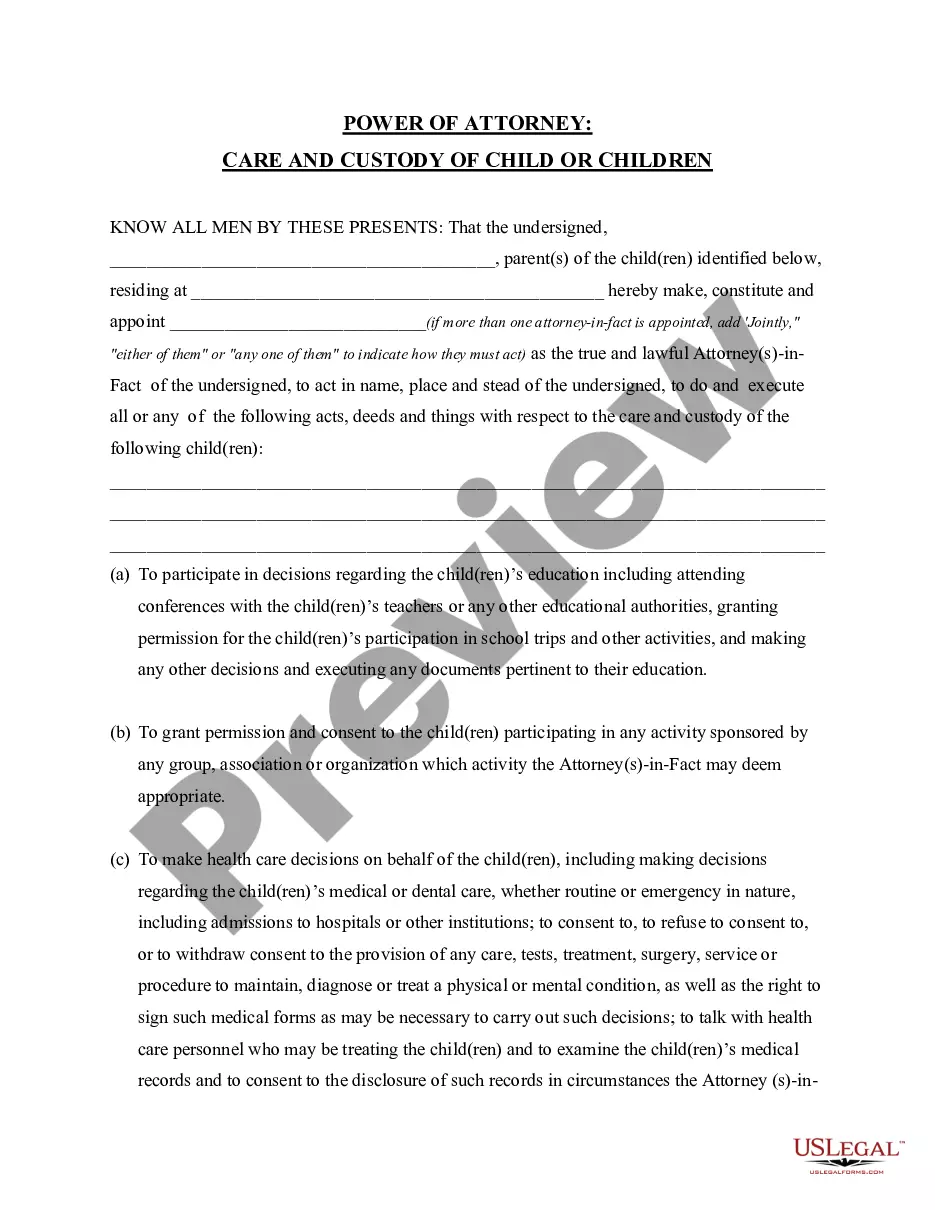

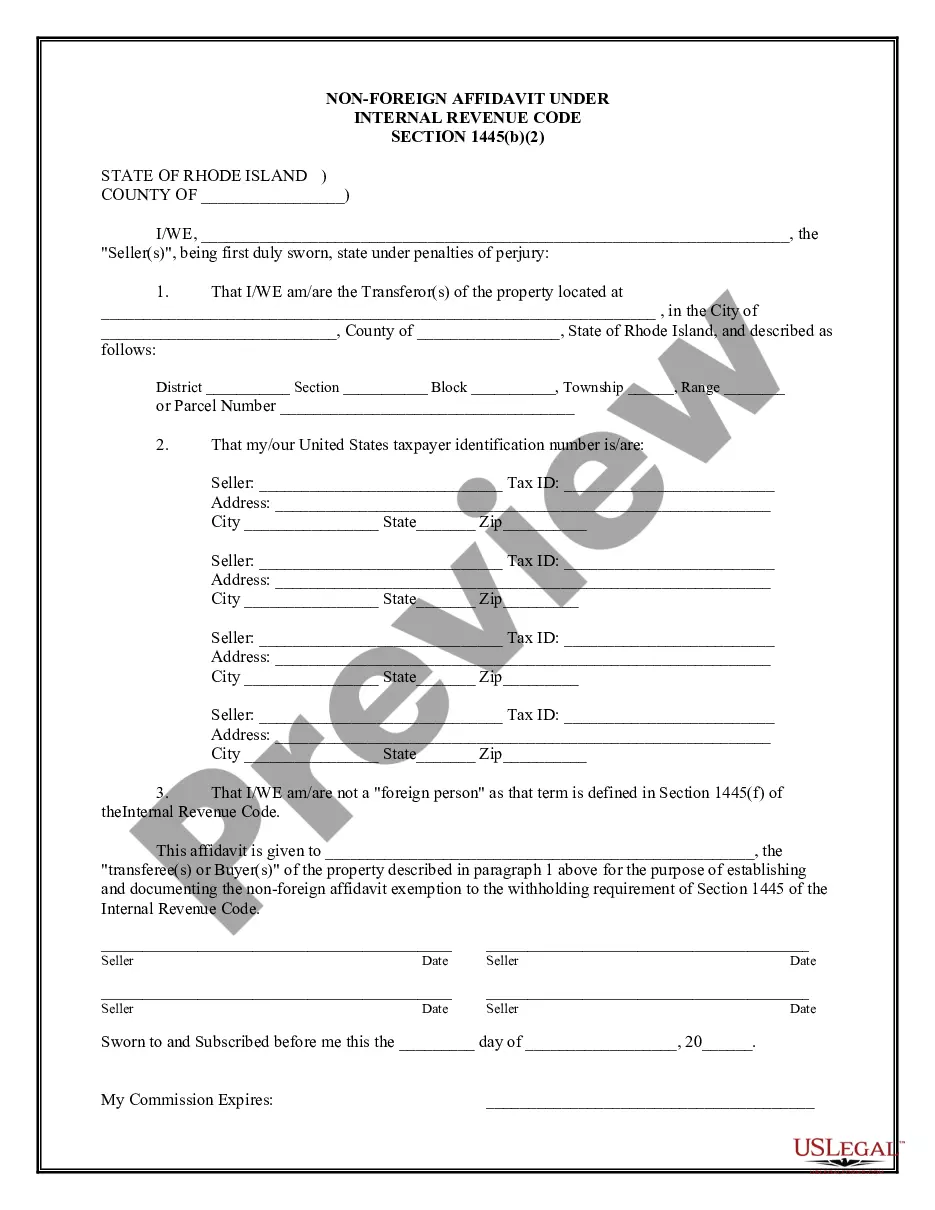

How to fill out Mortgage Note?

- Log in to your US Legal Forms account. If you're a returning user, ensure your subscription is active before proceeding.

- If you're new, begin by exploring the Preview mode to confirm that the form meets your legal requirements and needs.

- If the required form isn’t suitable, use the Search tab to find an alternative template that fits your criteria.

- Once you identify the correct form, proceed to purchase it by clicking the Buy Now button and selecting your subscription plan.

- Complete your purchase by entering your payment information, either through a credit card or your PayPal account.

- After payment, download your document to your device for easy access and future reference in the My Forms section of your profile.

By using US Legal Forms, you gain access to a robust collection of over 85,000 fillable and editable legal documents tailored to meet diverse legal needs.

Take control of your legal paperwork today. Visit US Legal Forms to streamline your document management efficiently!

Form popularity

FAQ

When a purchaser takes a property subject to an existing mortgage, it is important to clarify that the purchaser typically does not become personally liable for the mortgage debt. Instead, the original borrower remains liable for the mortgage. However, the new owner can face foreclosure if the mortgage payments are not made. Understanding this concept is crucial, and utilizing resources like US Legal Forms can help clarify the implications involved with taking over a mortgage.

The ownership of a mortgage and the promissory note typically lies with the lender, which can be a bank or a mortgage company. In some cases, these documents may be sold to investors in the secondary mortgage market. Understanding these relationships can clarify how your mortgage works, prompting you to select the best description of the mortgage note quizlet for better insights.