Financial Report For Apple

Description

How to fill out Financial Record Storage Chart?

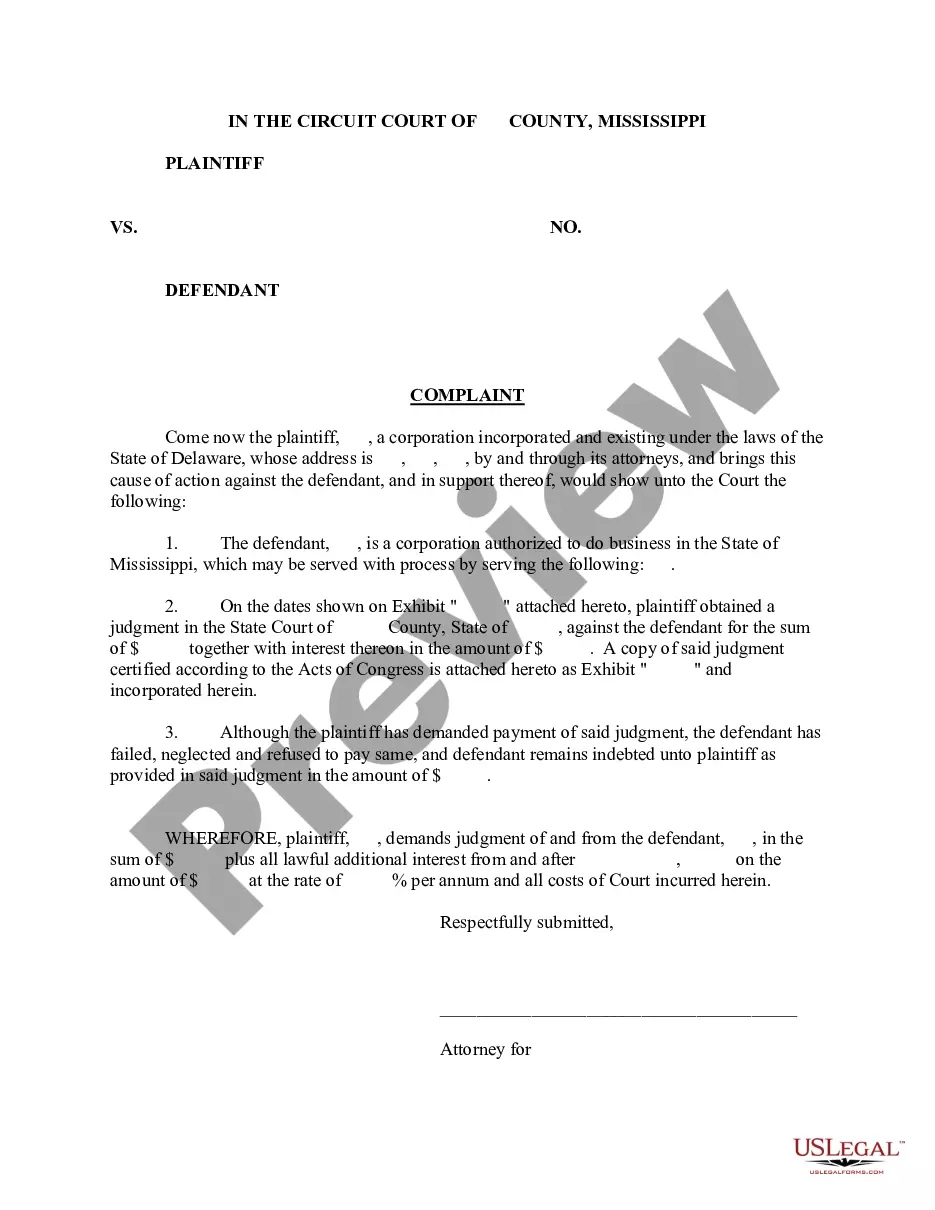

The Financial Statement For Apple you view on this page is an adaptable formal structure created by expert attorneys in accordance with federal and regional statutes and guidelines.

For over 25 years, US Legal Forms has supplied individuals, companies, and lawyers with more than 85,000 certified, state-specific documents for any professional and personal circumstance. It’s the fastest, simplest, and most dependable method to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-malware security.

Register for US Legal Forms to access verified legal templates for all of life’s scenarios at your fingertips.

- Browse for the document you need and review it.

- Subscribe and Log In.

- Acquire the fillable template.

- Fill out and sign the document.

- Download your papers one more time.

Form popularity

FAQ

Mississippi law expressly recognizes quitclaim deeds, so deeds without warranty and no-warranty deeds are unnecessary in Mississippi.

How do I transfer a deed in Mississippi? A processed, signed, and notarized deed must be presented to the Recorder of the Deeds in the same county of the property. Once the deed is accepted and signed, the transfer is complete.

How much does it cost to transfer a deed in Mississippi? On average, the cost to transfer a deed in Mississippi starts around $250, plus the cost of filing. Who can prepare a deed in Mississippi? All deeds in Mississippi must be signed and recorded by witnesses in the presence of a public Notary.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county chancery clerk's office before your death. Otherwise, it won't be valid. You can make a Mississippi transfer on death deed with WillMaker.

Mississippi law expressly recognizes quitclaim deeds, so deeds without warranty and no-warranty deeds are unnecessary in Mississippi.

A Mississippi general warranty deed is used to transfer real estate in Mississippi and guarantee that the property is free from hidden claims against the title and that the grantor has the legal authority to sell the property.

A quitclaim deed is used to transfer real property from the grantor to the new recipient owner, called the grantee. The grantor will terminate any rights to claim the property using a quitclaim deed, thus allowing all rights to be transferred to the recipient/grantee.

Copies of deeds are housed in the county court house where the land is located. Copies of deeds can also be found in the Secretary of State's Office, provided the deed is on file.