Credit Application For Business

Description

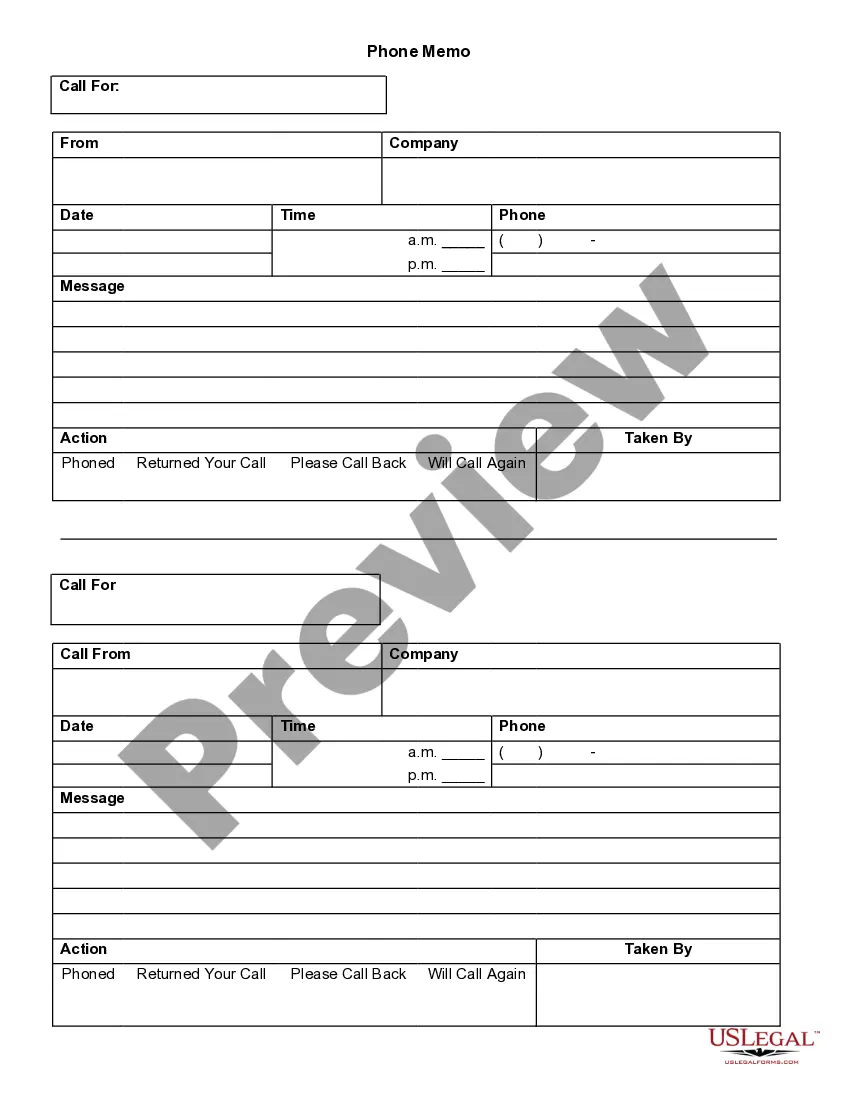

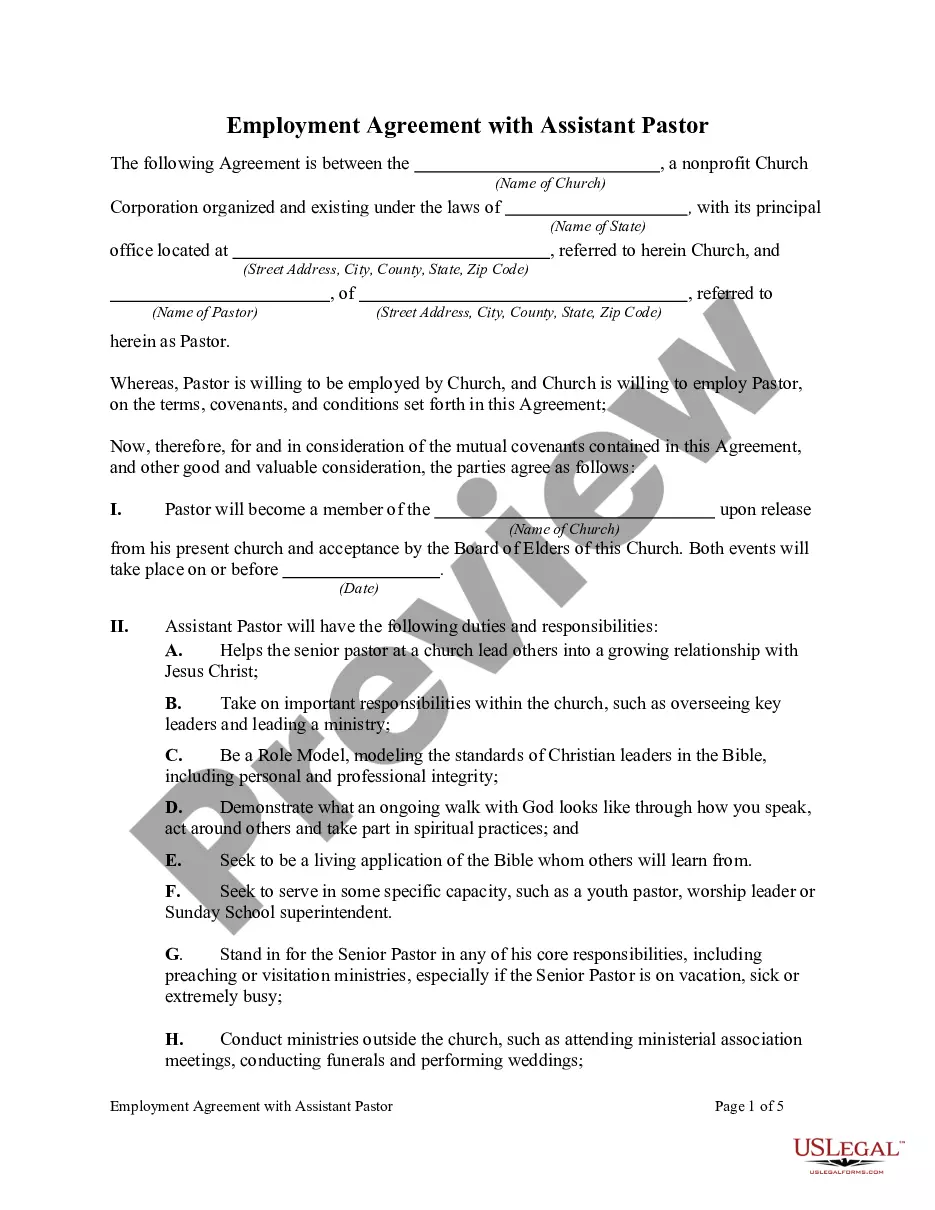

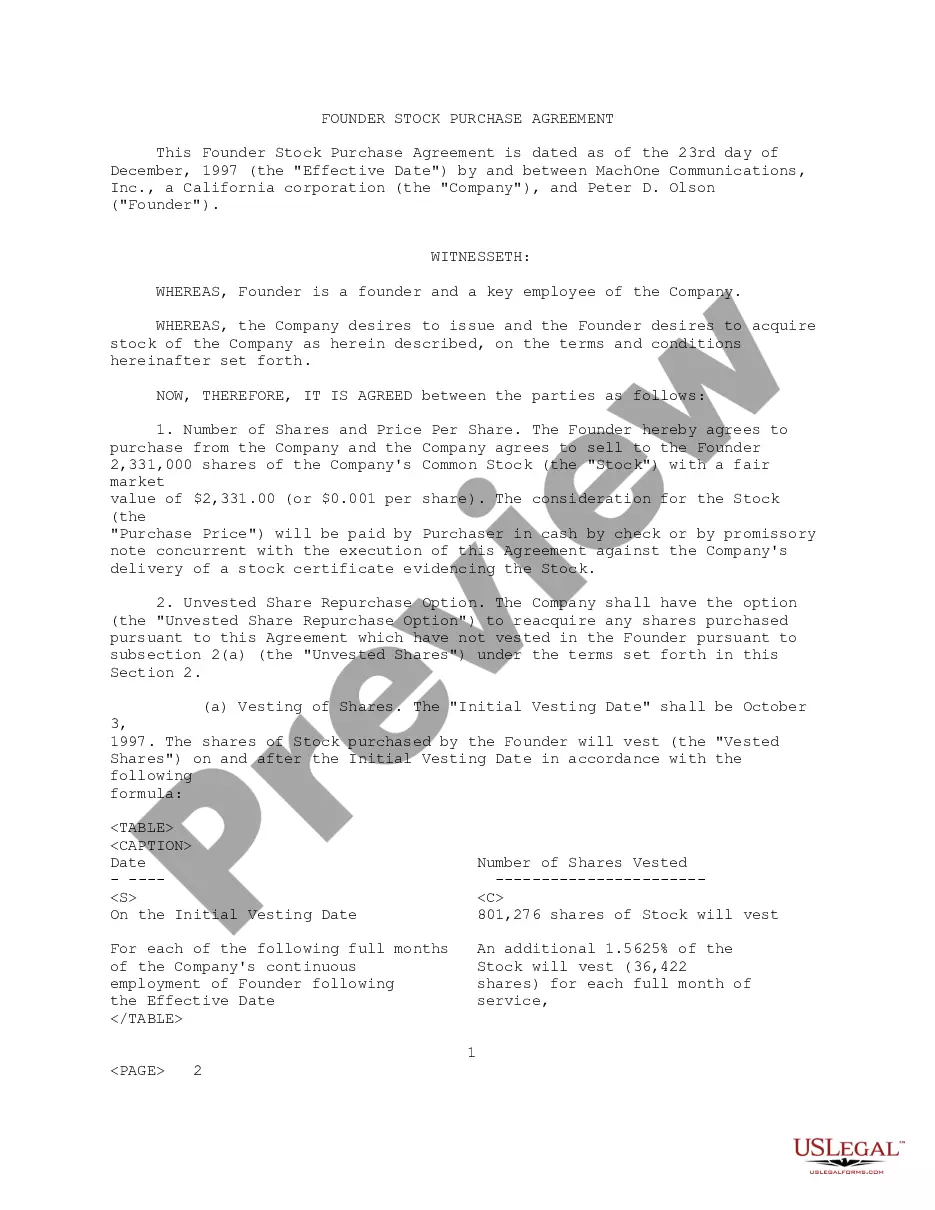

How to fill out Request For Credit Application?

- If you're a returning user, log in to access your account and download the necessary form template by clicking the Download button, ensuring your subscription is active.

- For first-time users, begin by reviewing the preview mode and form descriptions to confirm you have chosen the correct credit application for business that aligns with your local jurisdiction requirements.

- If you need to search for another template, utilize the Search tab at the top of the page to find options that suit your needs. Proceed if you've found a match.

- Purchase the selected document by clicking the Buy Now button and selecting your preferred subscription plan. You'll need to create an account to unlock access to the full library.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Finally, download your form to your device. You can also access it anytime from the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys with a robust library of legal documents, ensuring ease of access and exceptional customer support.

Take advantage of US Legal Forms' extensive resources to secure your business credit application today!

Form popularity

FAQ

Yes, your LLC will have its own credit score that is separate from your personal credit. This score is based on your business's financial activities, including payment history and credit utilization. As you earn credit and manage your debts responsibly, your LLC's credit score will improve. This can enhance your chances of approval when you submit a credit application for business in the future.

To get credit for your LLC, start by establishing a business bank account and ensuring your business is registered with the proper agencies. Next, submit a credit application for business to lenders or suppliers who are open to offering credit. Be prepared to provide details about your business’s revenue, expenses, and financial history. Utilizing services like US Legal Forms can help streamline the application process, making it easier to access credit.

Filling out a business credit card application involves providing detailed information about your business, including its legal name, address, and tax identification number. You should also include information about your revenue, number of employees, and your personal credit history. Ensuring the accuracy of this information is vital for a smooth credit application for business. Using tools like the US Legal Forms platform can guide you through the application process and ensure you don't miss any critical details.

The 5 Cs of credit are character, which signifies your reputation; capacity, which measures your ability to repay; capital, referring to your financial resources; collateral, which serves as security for the lender; and conditions, which include the environment impacting your business. Clarifying each 'C' can strengthen your credit application for business and increase your chances of approval. A thorough understanding of these components enables you to present a well-rounded view of your financial situation to potential lenders.

The 5 Cs of business encompass character, capacity, capital, collateral, and conditions. These principles are essential when applying for business credit, as they form the foundation for how lenders assess your company. Familiarity with these factors allows you to effectively highlight your strengths in your credit application for business. This knowledge can benefit you not only in securing credit but also in managing your business overall.

The 5 Cs of business credit are character, capacity, capital, collateral, and conditions. These factors help lenders evaluate the creditworthiness of a business. A strong understanding of these elements can enhance your credit application for business and improve your chances of approval. Each 'C' plays a crucial role in determining the financial health and reliability of your business.

To establish credit for your business, begin by registering your LLC and obtaining an EIN. Open a business bank account and apply for a credit application for business with local banks or credit unions. As you maintain timely payments and responsible credit usage, your business credit will become stronger, enabling future financing options.

To build LLC credit fast, establish accounts that report to business credit bureaus. This includes opening business credit cards, securing small loans, and maintaining strong payment relationships with vendors. Responsibly managing a credit application for business can significantly improve your credit profile in a shorter time frame.

An LLC can secure credit by establishing relationships with vendors and banks that report to credit bureaus. Opening a business bank account and applying for small business loans or credit lines is essential. By actively utilizing a credit application for business, you can build credit over time and access greater funding options.

To get a business credit file, first ensure that your LLC is registered with the relevant state authorities and has a unique EIN. Once these steps are completed, your business credit file will typically be created automatically. Utilizing a credit application for business with various lenders can also help populate your credit file with essential information.