Checklist For Partner

Description

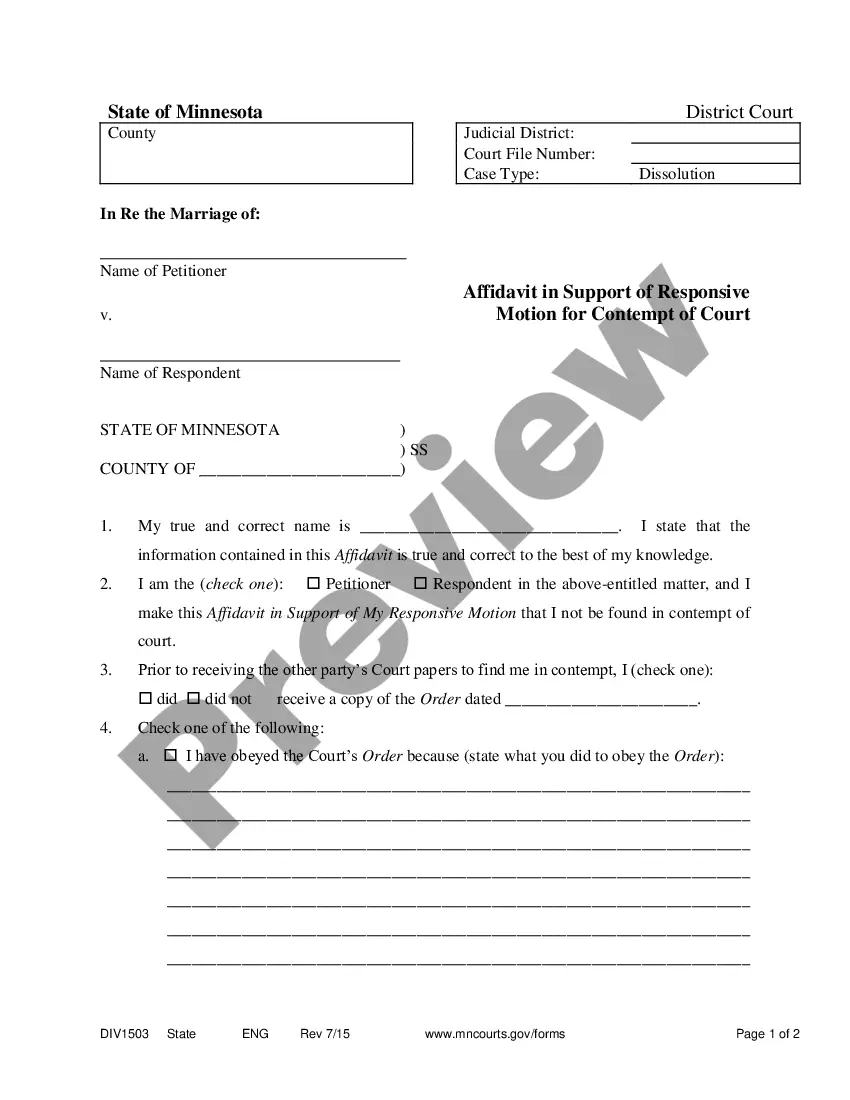

How to fill out Checklist - Partnership Agreement?

Managing legal documents can be daunting, even for the most seasoned professionals.

If you're seeking a Checklist For Partner and lack the time to search for the suitable and current version, the process can be stressful.

US Legal Forms meets all your requirements, from personal documents to business paperwork, all in one place.

Utilize cutting-edge tools to complete and manage your Checklist For Partner effectively.

Here are the steps to follow after finding the document you need: Verify that it's the correct form by previewing and reviewing its description, confirm that it is accepted in your state or county, select Buy Now when ready, pick a subscription plan, choose your desired file format, and Download, complete, sign, print, and submit your documents. Leverage the US Legal Forms online catalog, supported by 25 years of expertise and trustworthiness. Improve your daily document management with a streamlined and user-friendly process today.

- Access a repository of articles, guides, and materials relevant to your circumstances and needs.

- Save time and effort searching for the documents you require by using US Legal Forms' advanced search and Preview feature to find Checklist For Partner.

- If you possess a membership, Log In to your US Legal Forms account, search for the document, and obtain it.

- Check your My documents section to review the documents you've downloaded previously and manage your folders as desired.

- If this is your first experience with US Legal Forms, register for an account to gain unlimited access to all the platform's advantages.

- A comprehensive online form catalog could revolutionize the way anyone navigates these challenges.

- US Legal Forms stands as a frontrunner in the realm of online legal documents, offering over 85,000 state-specific legal forms at your convenience.

- With US Legal Forms, you can access tailored legal and business forms based on your state or county.

Form popularity

FAQ

The 2 2 2 rule in marriage suggests that couples should prioritize spending quality time together every week. This includes going on a date night every two weeks, taking a short trip every two months, and having a mini-vacation every two years. By following this checklist for partner, you can enhance your relationship and maintain a strong emotional connection. Regularly engaging in these activities fosters communication and shared experiences, which are vital for a healthy partnership.

As an unmarried couple, you cannot file jointly; each person must file their own tax return. However, if you have shared expenses, tracking them with a checklist for partner-related costs can help you understand your financial situation better. This will allow you to claim any eligible deductions on your individual returns.

To show proof of your spouse for tax purposes, you generally need to provide a marriage certificate. This document establishes your marital status and is often required when filing taxes jointly. Keep a checklist for partner documentation handy to ensure you have all necessary paperwork ready when it's time to file.

You cannot claim your girlfriend as a dependent on your tax return unless she meets specific criteria, such as being a qualifying relative. To ensure you handle your finances properly, maintain a checklist for partner-related expenses to keep track of any shared financial commitments. This can help clarify your tax situation and highlight any potential deductions.

You cannot file a tax return on behalf of your girlfriend unless you have power of attorney. If you are supporting each other financially, she will need to file her own return. Consider creating a checklist for partner-related financial support, which can help both of you identify potential deductions and credits you could claim individually.

Filing taxes with your boyfriend involves determining whether you will file jointly or separately. Since you are not married, you will need to file as single individuals. However, if you support each other financially, use a checklist for partner expenses to document any eligible deductions that could be claimed on your individual returns.

When couples file taxes together, they typically choose the married filing jointly option. This allows both partners to combine their income and deductions, which can lead to a lower overall tax rate. A checklist for partner-related expenses can help you track shared costs and deductions, making the process smoother and more efficient.

Married couples have the option to file jointly or separately. Filing jointly often provides tax benefits such as a higher standard deduction and eligibility for various credits. To simplify the process, consider using a checklist for partner-related documents to gather necessary information before filing. This can help ensure you maximize your tax benefits.

Unmarried couples can file taxes individually using their own income and deductions. Each partner reports their income on separate tax returns. If you share expenses, it might be helpful to keep a checklist for partner-related deductions such as mortgage interest or shared utilities. This can streamline your filing process and ensure you claim all eligible deductions.

The 7 7 7 rule for couples is a practical guideline designed to strengthen relationships. It suggests that partners should spend seven minutes a day talking, seven hours a week doing activities together, and seven days a year dedicated to a trip or adventure. By following this checklist for partner, couples can enhance their communication and connection, making their relationship more fulfilling. This approach encourages partners to invest time in each other, fostering a deeper bond and understanding.