Minutes Meeting Board Form With Action Items Template

Description

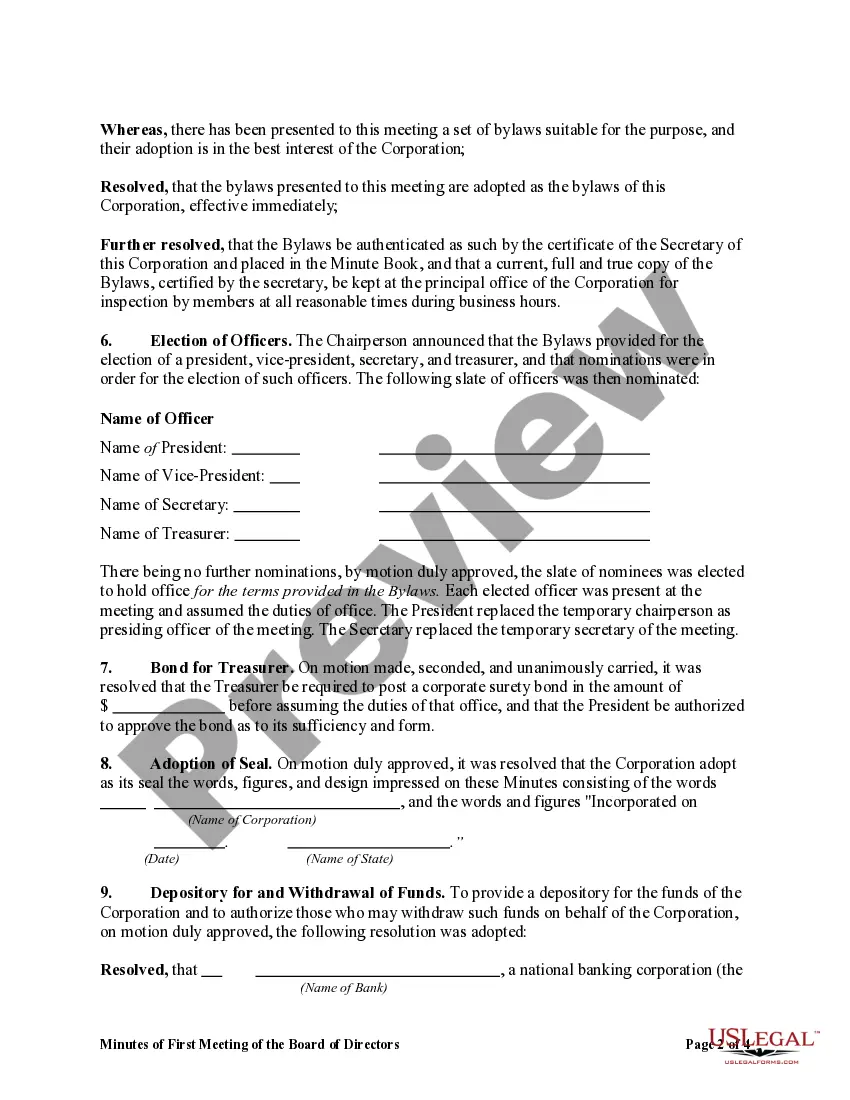

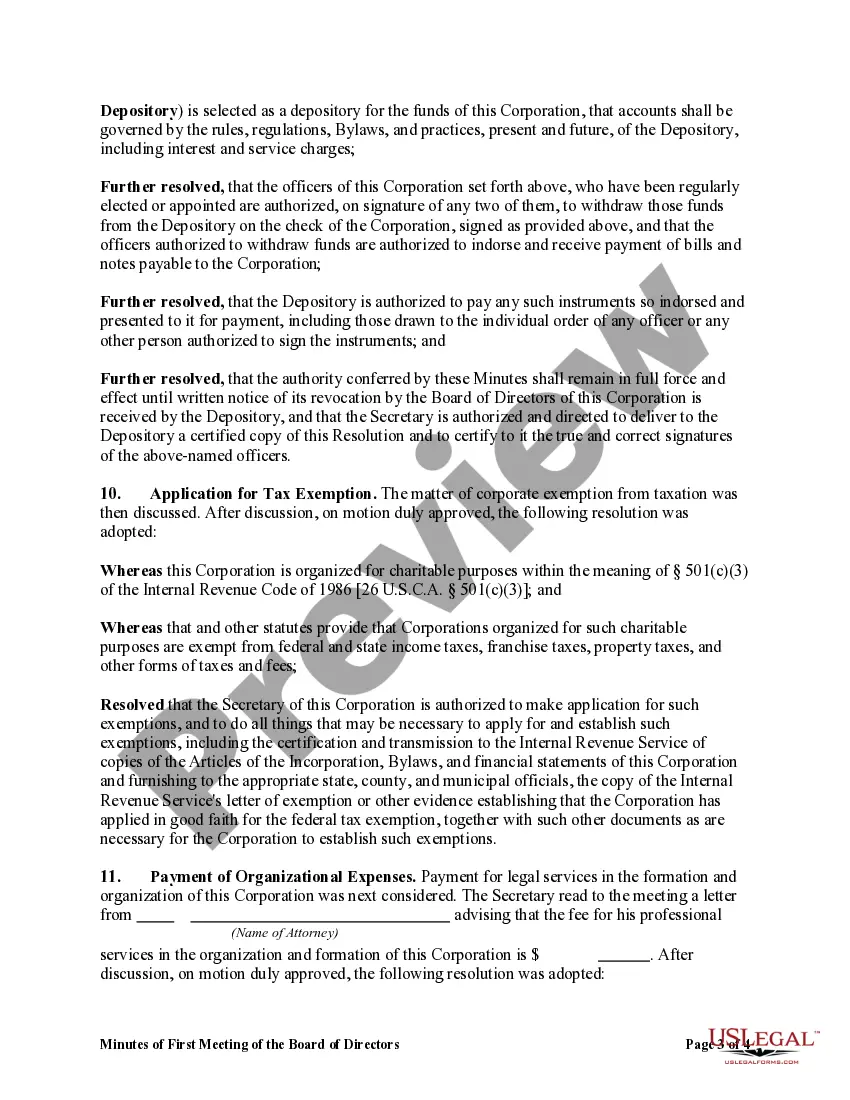

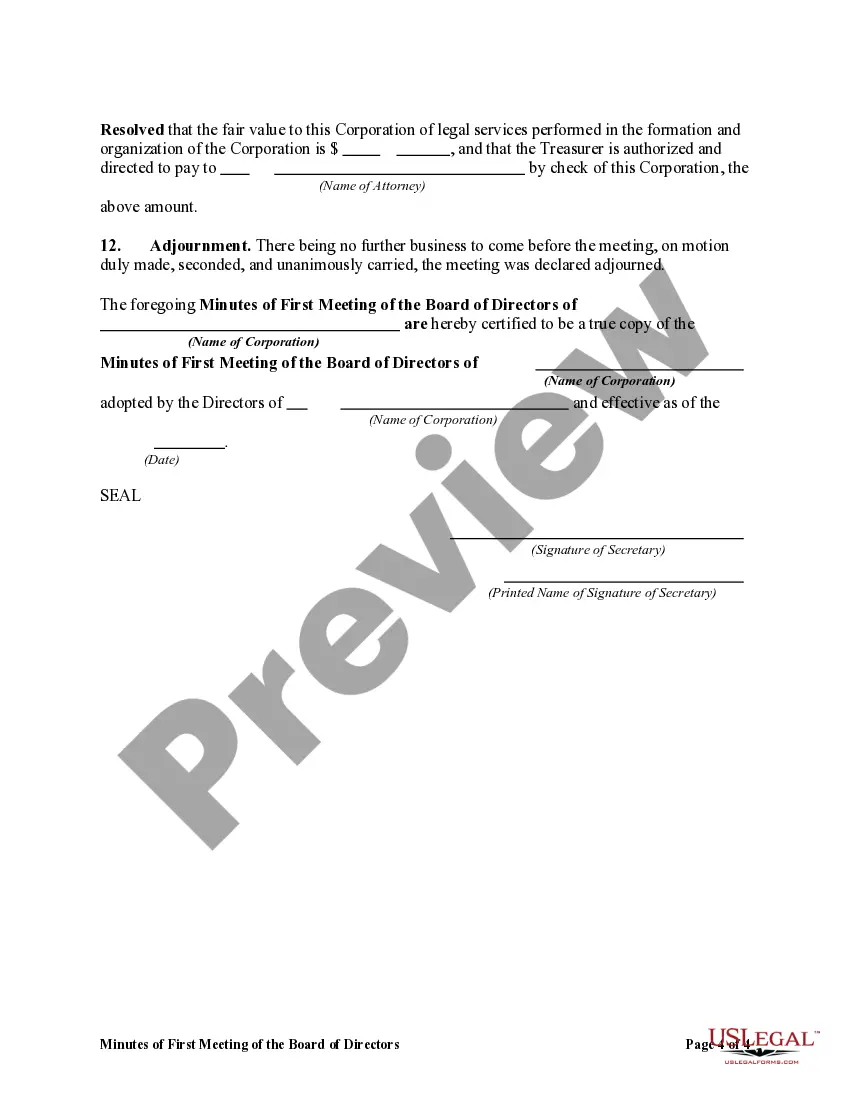

How to fill out Minutes Of First Meeting Of The Board Of Directors Of A Nonprofit Corporation?

Creating legal documents from the ground up can frequently be daunting.

Certain instances may necessitate extensive research and substantial financial expenditure.

If you’re looking for a simpler and more economical method of assembling Minutes Meeting Board Form With Action Items Template or any other paperwork without the hassle, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

However, before proceeding directly to downloading Minutes Meeting Board Form With Action Items Template, consider these suggestions: Review the document preview and descriptions to ensure you’ve located the document you need; confirm that the form aligns with the applicable regulations and laws in your state and county; select the most appropriate subscription option for obtaining the Minutes Meeting Board Form With Action Items Template; then download the file, complete it, sign it, and print it out. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and make form execution simple and efficient!

- With just a few clicks, you can effortlessly access state- and county-specific templates carefully created for you by our legal experts.

- Utilize our website anytime you need trusted and dependable services to swiftly find and download the Minutes Meeting Board Form With Action Items Template.

- If you’re already familiar with our site and have set up an account, simply Log In to your account, choose the form, and download it or re-download it later in the My documents section.

- Don’t have an account? No worries. It only takes minutes to create one and browse the catalog.

Form popularity

FAQ

Form WH-3 is an Annual Withholding Reconciliation form used to report the total amount of state income taxes withheld from individuals throughout the year. Also, it is used to claim an overpayment refund or pay if the taxes are underpaid.

Understanding Indiana's WH-4 Form for State Tax Withholding Employers have to register to withhold tax in Indiana and must have an Employer Identification Number issued by the federal government. Every employee is liable to pay part of Indiana's state payroll taxes, which are charged at a flat rate of 3.23%.

If complete wage and/or employment history records are needed, we recommend contacting the Social Security Administration, Internal Revenue Service, or Indiana Department of Revenue.

The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes from its employees. When completed correctly, this form ensures that a business's withholding taxes by county are reported accurately and timely.

Indiana Form WH-4 is now updated to reflect eligibility for one-time dependent child tax exemption. The Indiana Department of Revenue announced on August 30, 2023, that that an updated Form WH-4, Employee's Withholding Exemption and County Status Certificate, is now available for immediate use.

To register for withholding in Indiana, the business must have an Employer Identification Number (EIN) from the federal government. In addition, the employer should review Departmental Notice #1 which details the withholding rates for each of Indiana's 92 counties.

These searches will reveal any convictions that a person may have in the state of Indiana. An investigation of Indiana court records may be part of a background check that looks into criminal history. This can reveal details about civil judgments rendered against a person and any bankruptcies that might be noted.

Form WH-47, Certificate of Residence, should be completed by residents of these states working for Indiana employers. This certificate is an affidavit showing the employee's state of legal residence and provides proof that no withholding of Indiana state income tax is required.