Charitable Nonprofit Exempt Withholding

Description

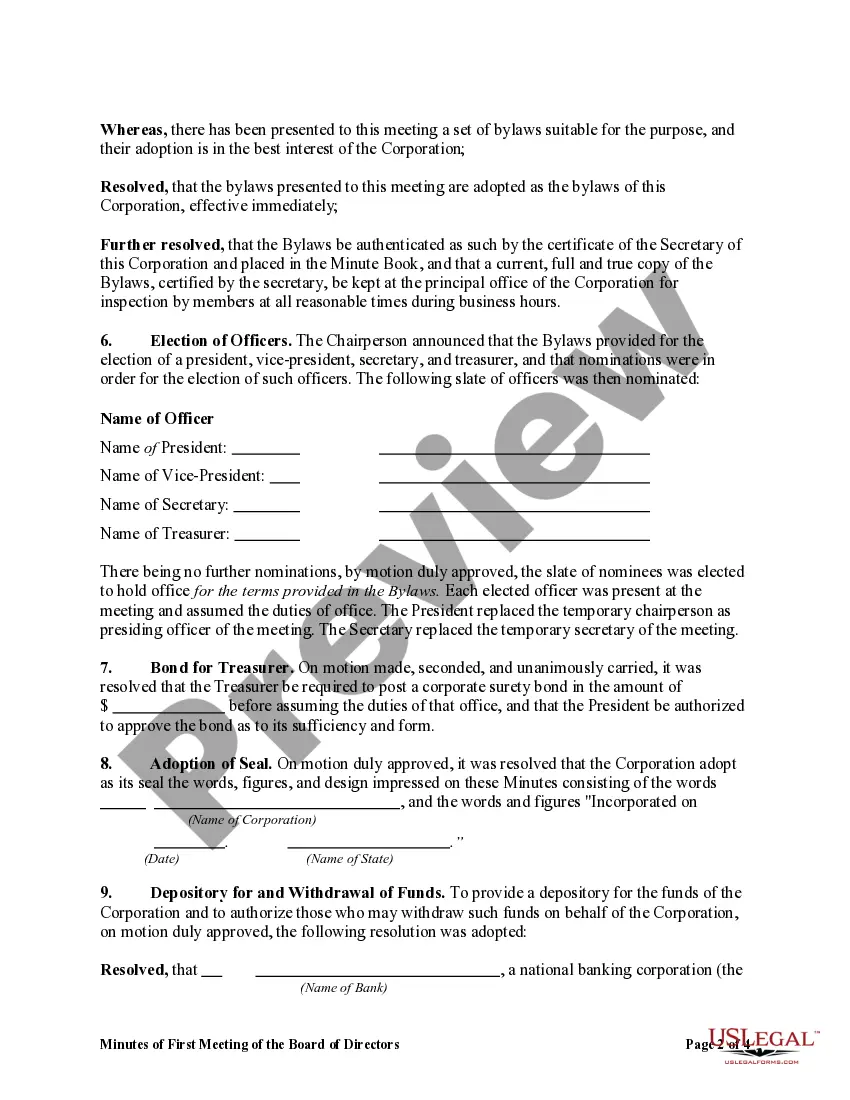

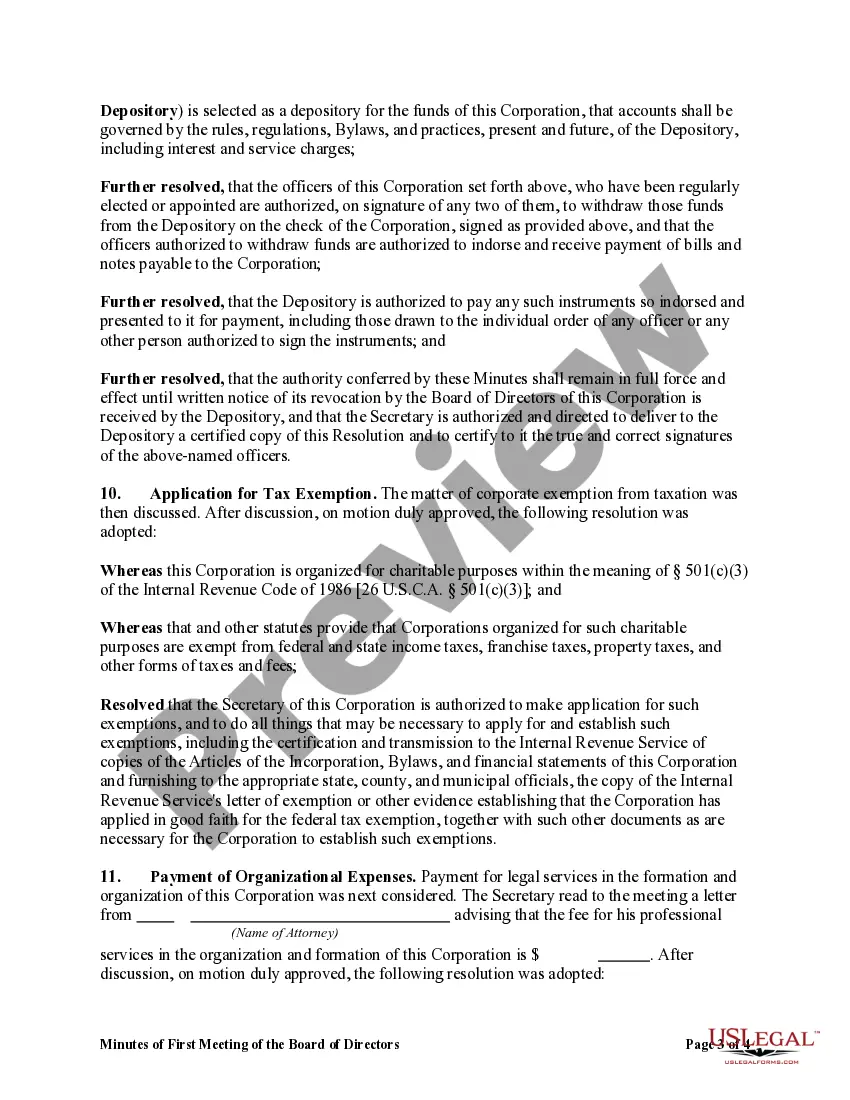

How to fill out Minutes Of First Meeting Of The Board Of Directors Of A Nonprofit Corporation?

Getting a go-to place to take the most recent and relevant legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal papers demands accuracy and attention to detail, which explains why it is very important to take samples of Charitable Nonprofit Exempt Withholding only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and check all the details about the document’s use and relevance for your situation and in your state or region.

Consider the following steps to complete your Charitable Nonprofit Exempt Withholding:

- Utilize the catalog navigation or search field to locate your template.

- Open the form’s information to see if it matches the requirements of your state and area.

- Open the form preview, if there is one, to make sure the form is the one you are looking for.

- Resume the search and find the correct template if the Charitable Nonprofit Exempt Withholding does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Pick the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by choosing a transaction method (bank card or PayPal).

- Pick the file format for downloading Charitable Nonprofit Exempt Withholding.

- Once you have the form on your device, you may change it using the editor or print it and complete it manually.

Remove the headache that comes with your legal documentation. Discover the extensive US Legal Forms library to find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

The answer to this question is YES. The income you earn by working for a nonprofit organization is subject to federal and state/local income and payroll taxes.

If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages. This applies only to income tax, not to Social Security or Medicare tax.

Enter ?Exempt? on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption. Information provided by the IRS. For more information go to (Publication 505).

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

What is a not-for-profit organization? Similar to a nonprofit, a not-for-profit organization (NFPO) is one that does not earn profit for its owners. All money earned through pursuing business activities or through donations goes right back into running the organization.