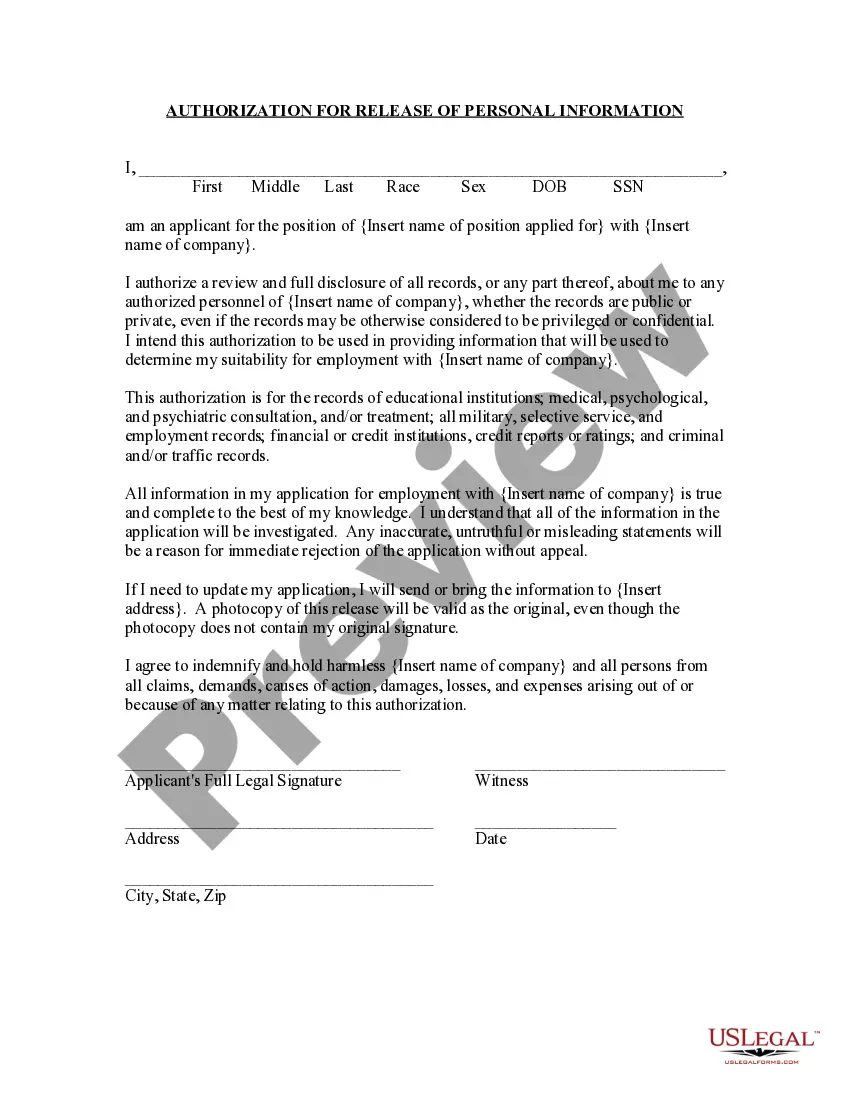

Employee Information Release Form Withholding

Description

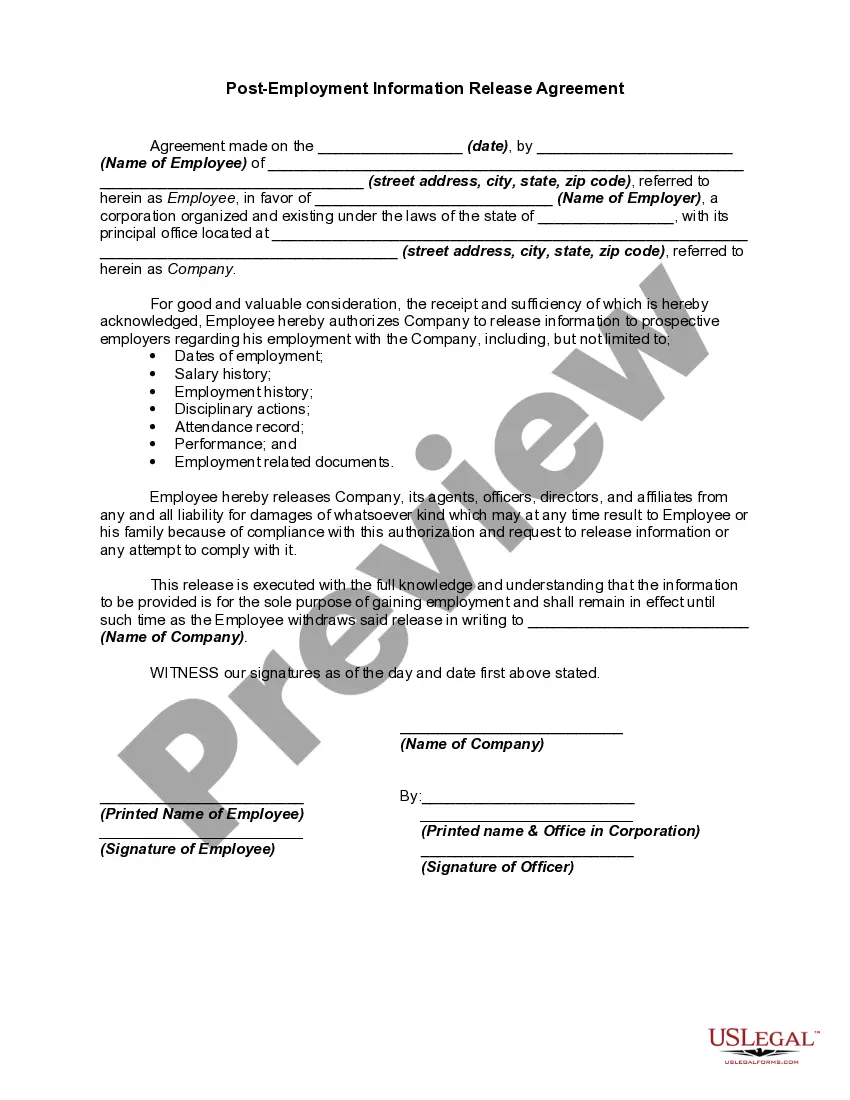

How to fill out Post Employment Information Release Agreement?

There is no longer a requirement to squander time looking for legal documents to satisfy your local state regulations. US Legal Forms has consolidated all of them in one location and enhanced their availability.

Our site provides over 85,000 templates for any business and personal legal situations categorized by state and purpose. All forms are professionally crafted and verified for legitimacy, ensuring you receive a current Employee Information Release Form Withholding.

If you are acquainted with our platform and already possess an account, ensure your subscription is active before procuring any templates. Log In to your account, choose the document, and click Download. You can also revisit all saved documents whenever required by accessing the My documents tab in your profile.

Print your form to fill it out manually or upload the template if you prefer to complete it in an online editor. Preparing official documentation under federal and state laws and regulations is quick and straightforward with our collection. Experience US Legal Forms today to keep your paperwork organized!

- If you haven't engaged with our platform previously, the procedure will require a few additional steps to finalize.

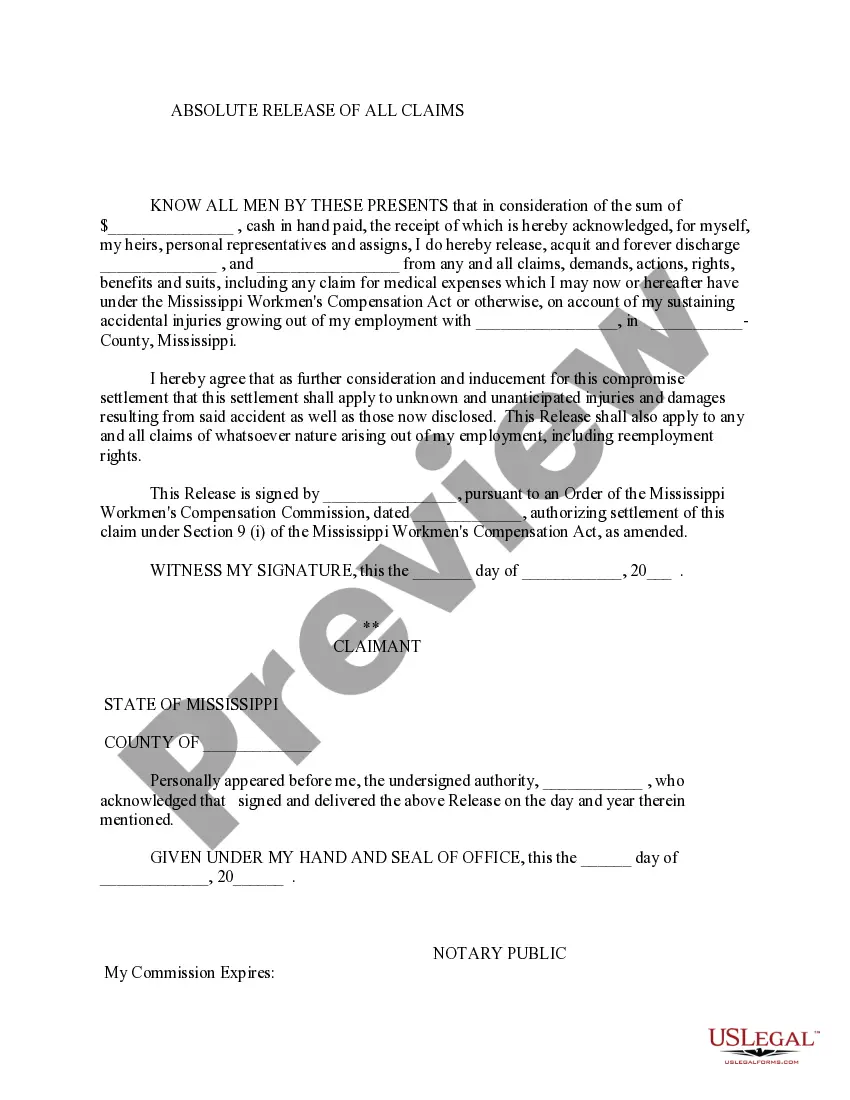

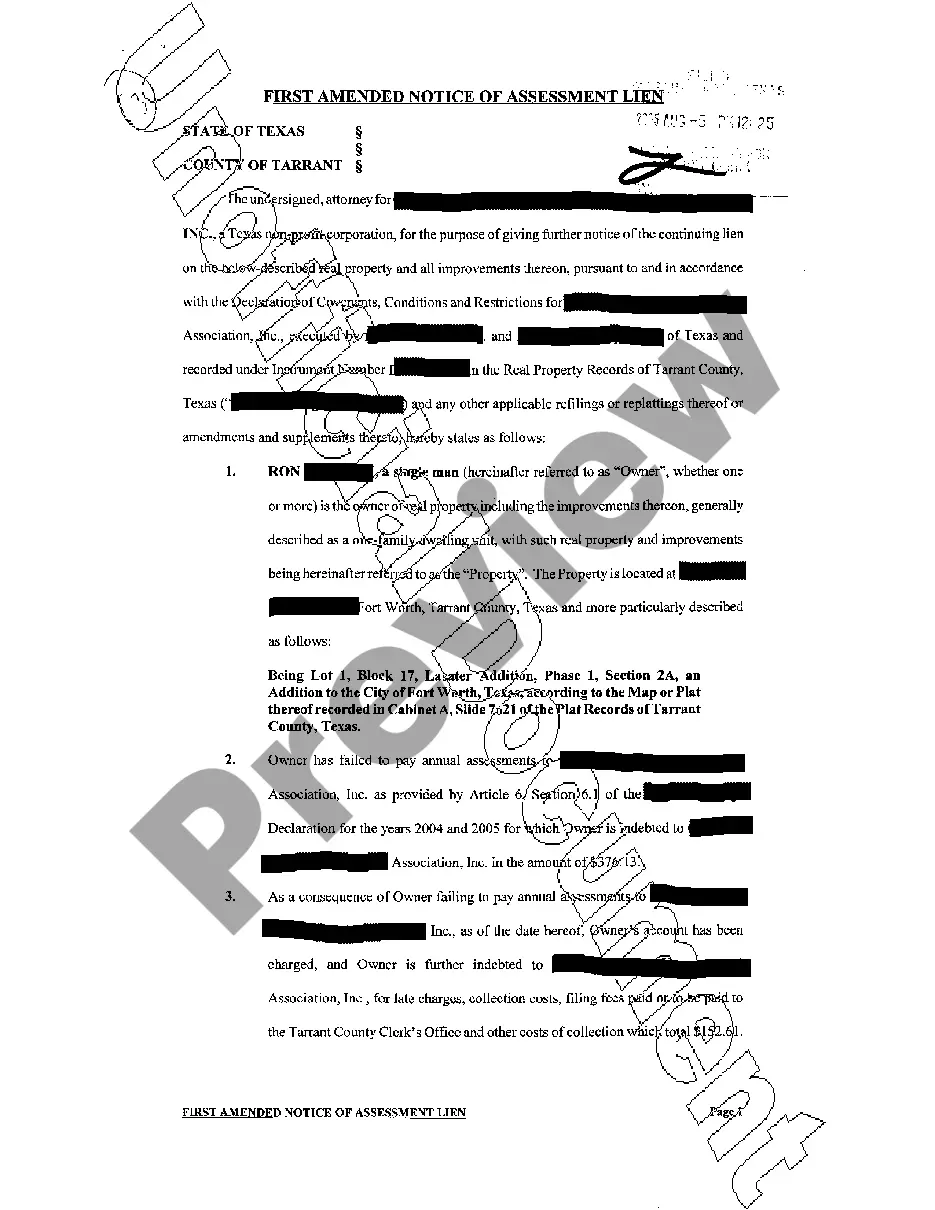

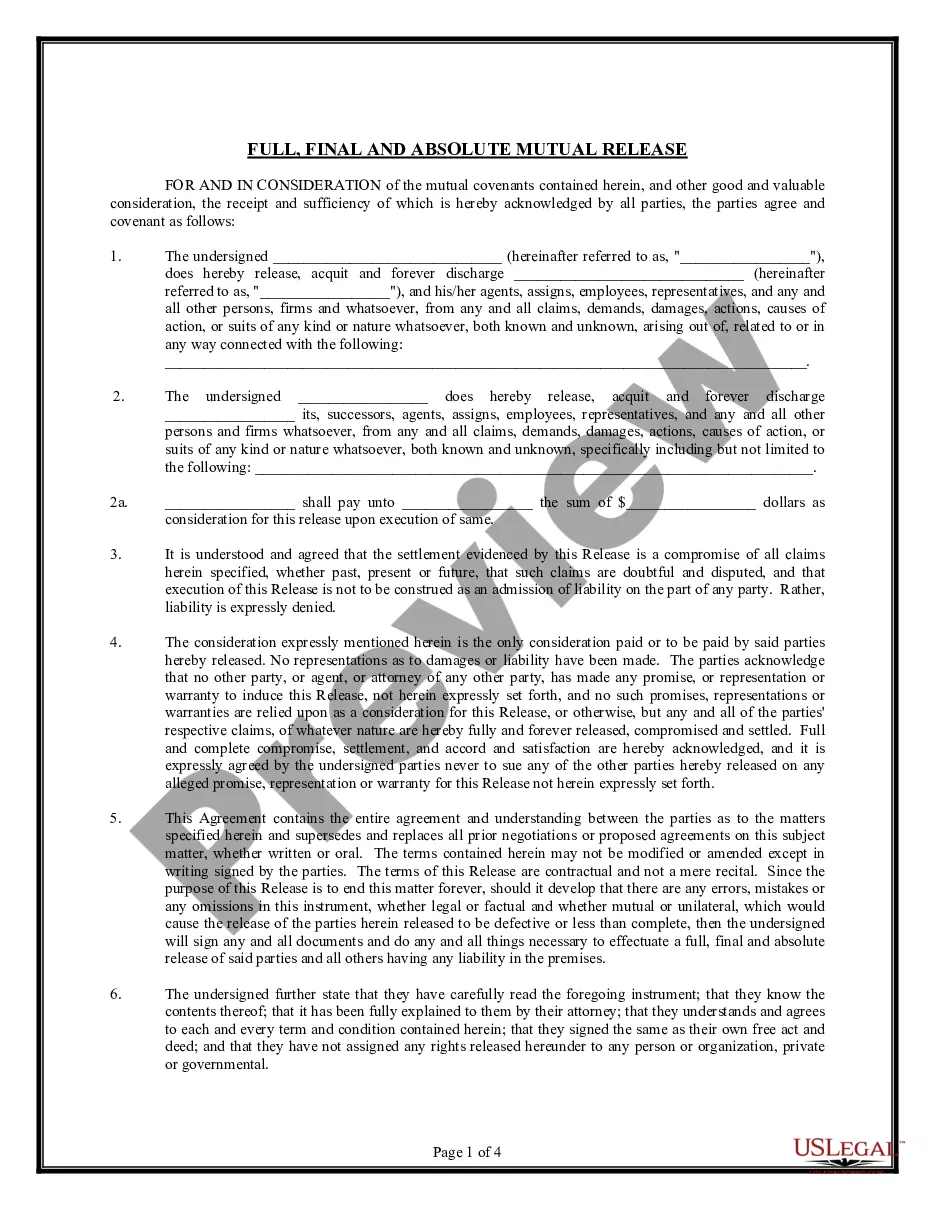

- Examine the page content closely to verify it includes the sample you require.

- To assist with this, utilize the form description and preview options if available.

- Employ the Search bar above to look for another template if the prior one doesn't suit your needs.

- Click Buy Now adjacent to the template title when you identify the appropriate one.

- Choose the most suitable subscription plan and either create an account or sign in.

- Make payment for your subscription using a card or through PayPal to proceed.

- Select the file format for your Employee Information Release Form Withholding and download it to your device.

Form popularity

FAQ

2 tax form shows important information about the income you've earned from your employer, amount of taxes withheld from your paycheck, benefits provided and other information for the year. You use this form to file your federal and state taxes.

The difference between a W-2 and W-4 is that the W-4 tells employers how much tax to withhold from an employee's paycheck; the W-2 reports how much an employer paid an employee and how much tax it withheld during the year. Both are required IRS tax forms.

Q: By what date must W-2s be sent to employees? A: Generally, employers must furnish the W-2 to employees by January 31 each year. If mailing the forms, employers will meet the furnish requirement if the form is properly addressed and mailed on or before the due date.

The Updated Form W-4 The way that you fill out Form W-4, the Employee's Withholding Certificate, determines how much tax your employer will withhold from your paycheck. Your employer sends the money that it withholds from your paycheck to the IRS, along with your name and Social Security number.

Form W-4 tells you, as the employer, the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.