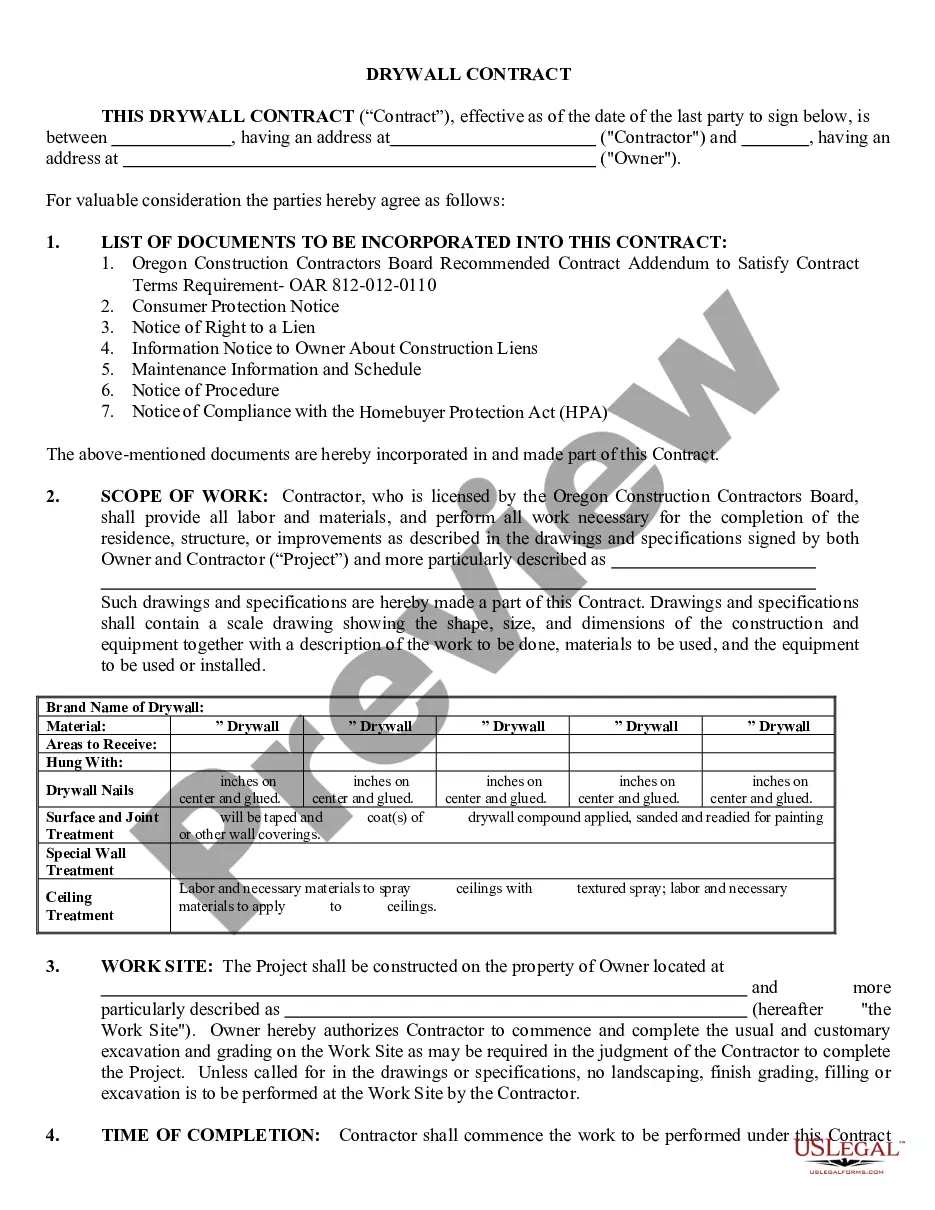

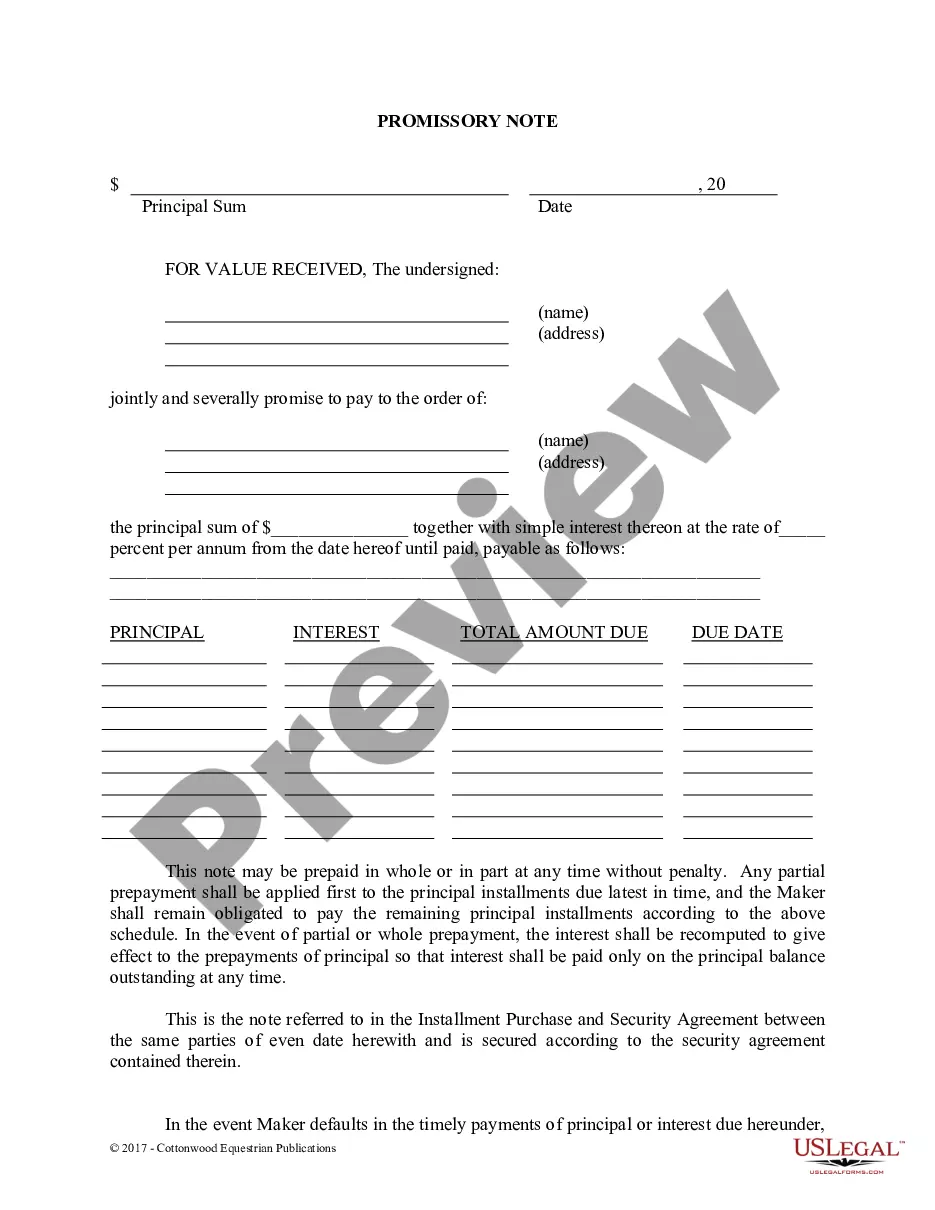

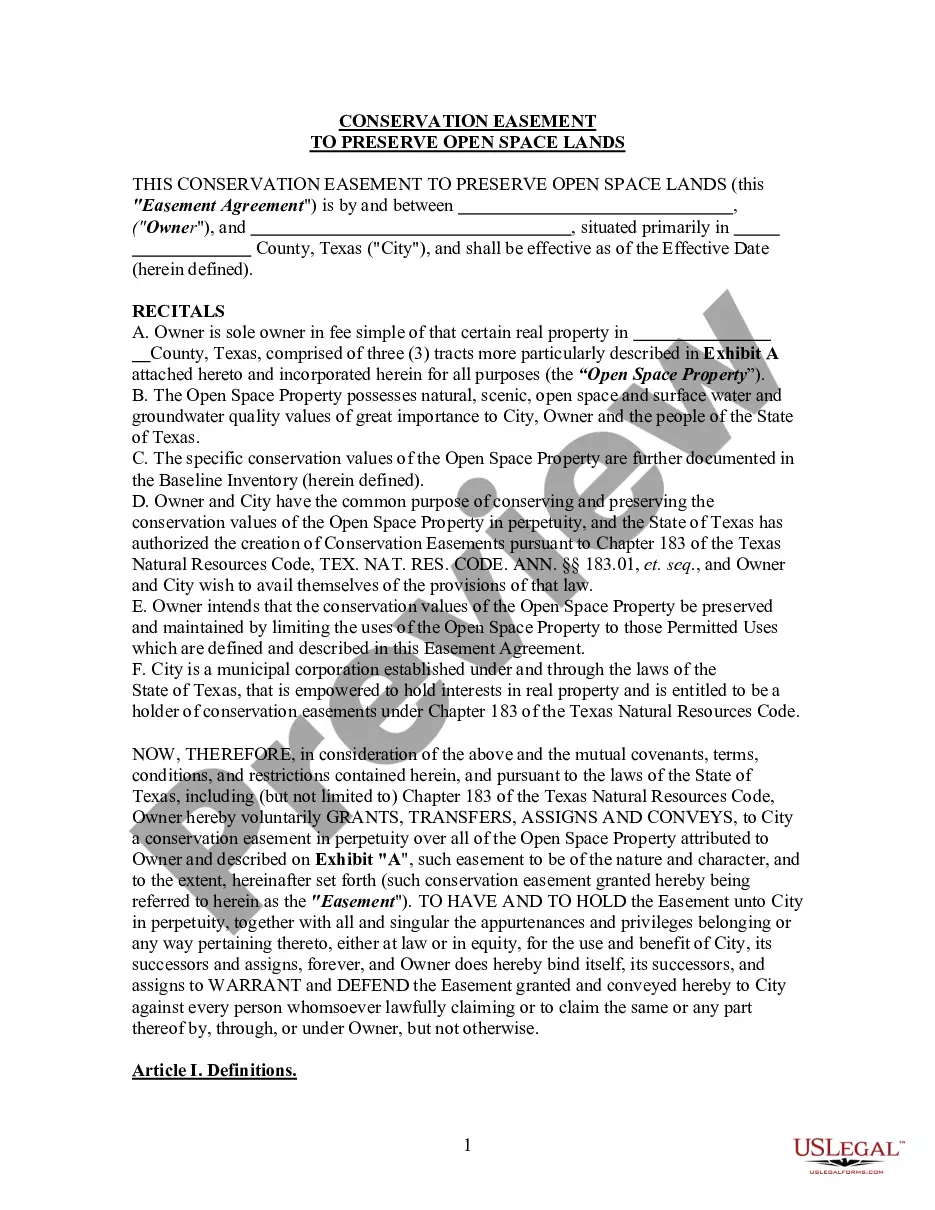

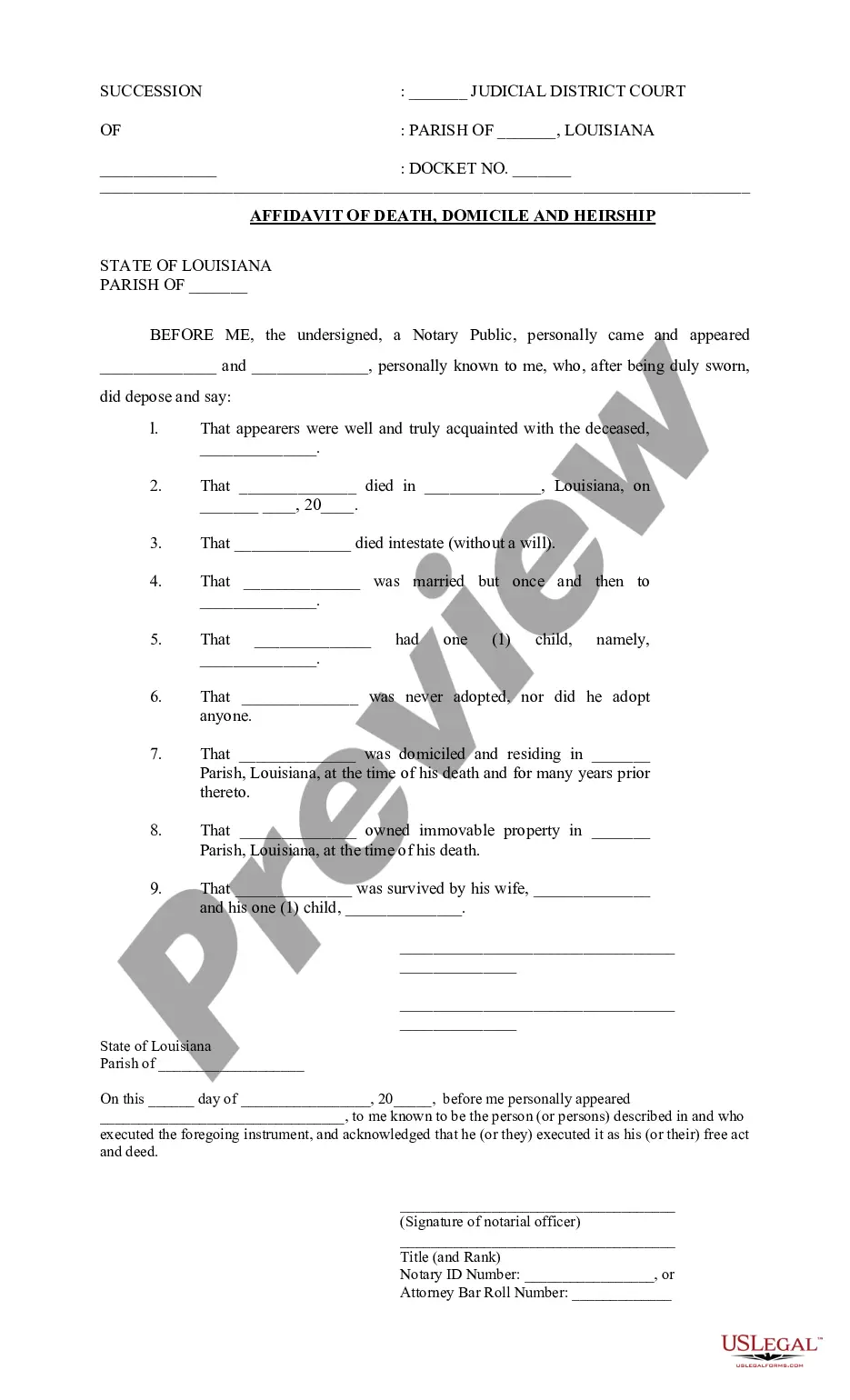

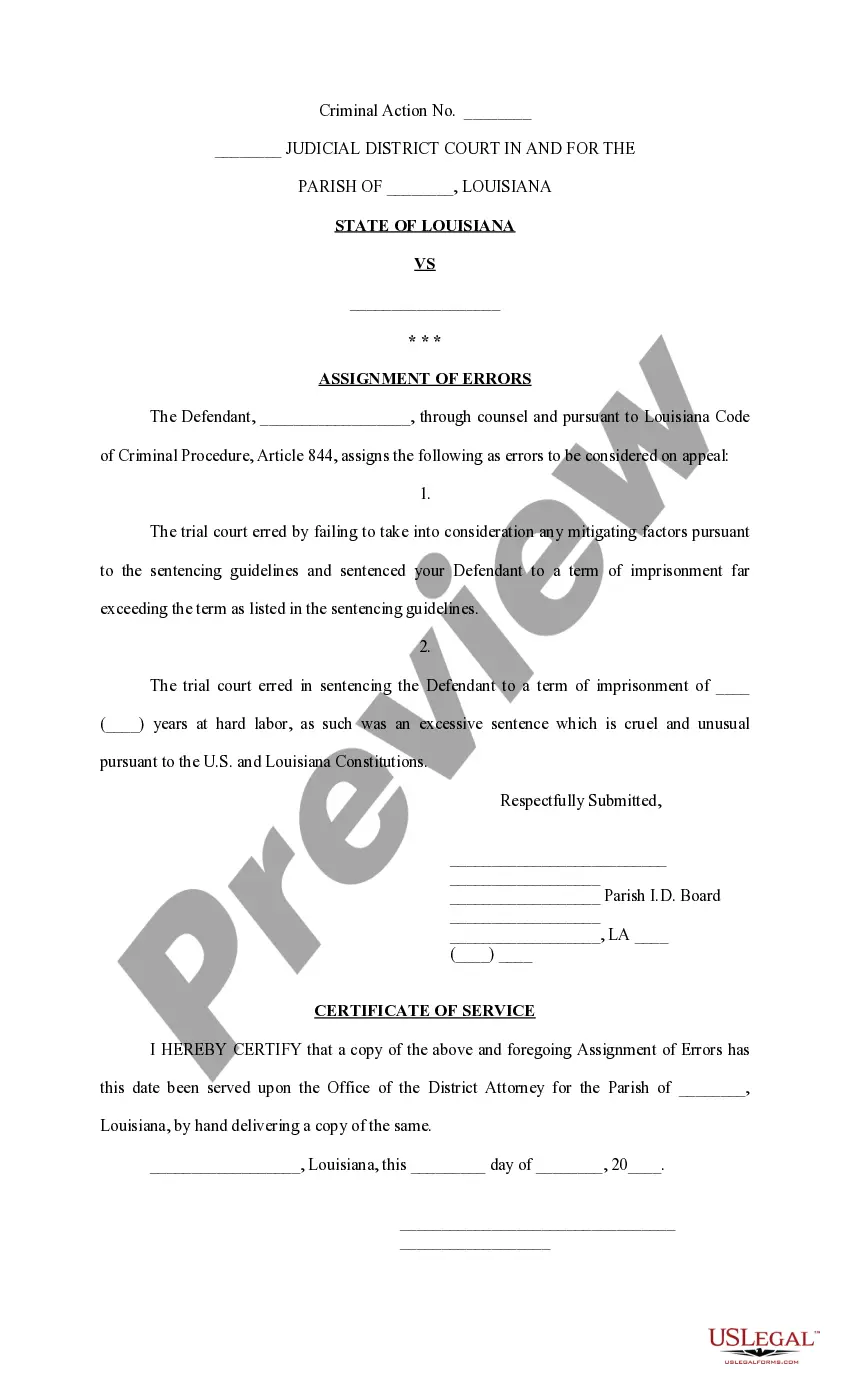

Commission Sample Statement With Text

Description

How to fill out Sales Commission Policy?

Legal administration can be overwhelming, even for the most seasoned professionals.

If you require a Commission Sample Statement With Text and lack the time to search for the appropriate and current version, the process can be anxiety-inducing.

US Legal Forms addresses all your requirements, from personal documents to business-related paperwork, all housed in one location.

Utilize cutting-edge tools to complete and oversee your Commission Sample Statement With Text.

Here are the steps to follow after accessing the form you require: Confirm this is the correct form by previewing it and reviewing its description.

- Gain access to a repository of articles, guides, and materials related to your case and requirements.

- Conserve time and energy searching for the necessary documents, making use of US Legal Forms’ advanced search and Review tool to find and retrieve the Commission Sample Statement With Text.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to see the documents you've downloaded previously and manage your folders as desired.

- If you are new to US Legal Forms, set up an account and acquire unlimited access to all platform benefits.

- A comprehensive online form directory could be a transformative solution for anyone aiming to navigate these challenges effectively.

- US Legal Forms is a prominent provider of digital legal documents, offering over 85,000 state-specific legal forms available to you whenever you need them.

- With US Legal Forms, you have access to legal and business forms tailored to your state or county needs.

Form popularity

FAQ

Rhode Island is a tax lien state. In a tax lien state, a priority lien against the property is sold to an investor giving the investor the right to collection the back due taxes and earn interest. In the event this lien does not get paid, the investor could foreclose it to gain ownership of the property.

How to file a mechanics lien in Rhode Island Prepare your Rhode Island Notice of Intention form. ... Serve the Rhode Island Notice of Intention as a preliminary notice. ... Record the Rhode Island Notice of Intention as a mechanics lien. ... File Notice of Lis Pendens and enforce the mechanics lien.

A judgment lien in Rhode Island will remain attached to the debtor's property (even if the property changes hands) for 20 years.

This form advises the party that a lien will be filed if payment is not received within 10 days. Since this is a non required document, you can deliver it electronically, or via mail. Sendinging documents via certified mail always adds another layer of professionalism to your payment practices.

If a municipality does not have land records available online, the tax assessor's or revaluation website is available for the ability to see some information relating to a property. If you'd like to see your municipality's land records online, we encourage you to speak directly to that municipality.

RHODE ISLAND A lien executed against real property is deemed discharged after twenty years from the date of the judgment. R.I. Gen. Laws § 9-26-33.

If commissions are accrued but not yet paid, the business will record a liability called ?Commissions Payable? on its balance sheet. When the commissions are eventually paid, the liability is reduced, and the cash account is debited.

Commission Statement means a monthly written statement that sets forth any Commission that becomes due and payable to You pursuant to the Commission Plan and this Agreement.