Artist Invoice Format

Description

How to fill out Invoice Template For Artist?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Finding the right legal documents needs accuracy and attention to detail, which explains why it is important to take samples of Artist Invoice Format only from trustworthy sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and see all the details concerning the document’s use and relevance for your situation and in your state or county.

Take the following steps to complete your Artist Invoice Format:

- Use the library navigation or search field to locate your template.

- View the form’s description to see if it fits the requirements of your state and area.

- View the form preview, if available, to make sure the form is the one you are interested in.

- Resume the search and look for the proper document if the Artist Invoice Format does not match your requirements.

- When you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that fits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by selecting a payment method (bank card or PayPal).

- Select the document format for downloading Artist Invoice Format.

- When you have the form on your device, you may modify it using the editor or print it and complete it manually.

Get rid of the inconvenience that comes with your legal documentation. Check out the extensive US Legal Forms collection to find legal templates, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

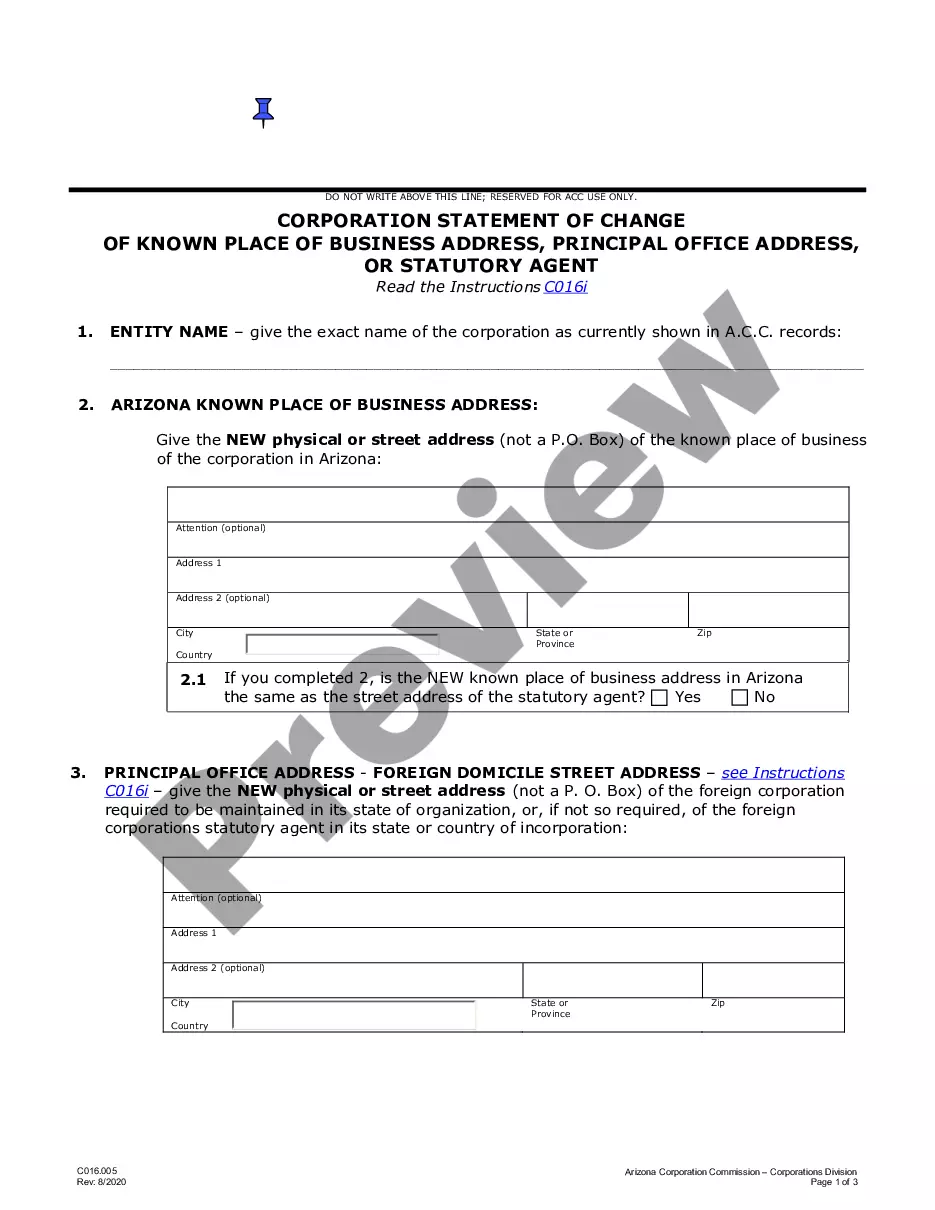

Invoices should contain information about: you the artist. your billing address. your client or customer. ?their taxable address. your tax reference code (UTR - unique tax reference code if in the UK) the tax date for the product or service rendered. description of the artwork provided or artistic service rendered.

Invoice must-haves for artists Your invoices should include the following elements that address all of the essential details of your transaction. The ?whos?: Your invoices should have your name, address, and contact details as well as any type of LLC designation or company registration number.

An Invoice Number: You must legally include the word "invoice" along with a unique invoice number for your own records. Artwork Details: Include the title, a thumbnail of the work, creation date, medium, dimensions, and any other important information about the work. Price of individual works and totals.

4. Artist invoice templates help be detailed Artist's name. Artist's billing address. Client's name. Client's taxable address. Tax date for work or service rendered. Full description of the artistic work rendered. The amount due. Terms of payment.

How to fill out an invoice. The name and contact information of the vendor and customer. An invoice number for payment tracking. The date of the transaction and date of invoice. The payment due date. A list of sold products or services with prices. Any pre-payments or discounts.