Loan Business Form Template With Interest

Description

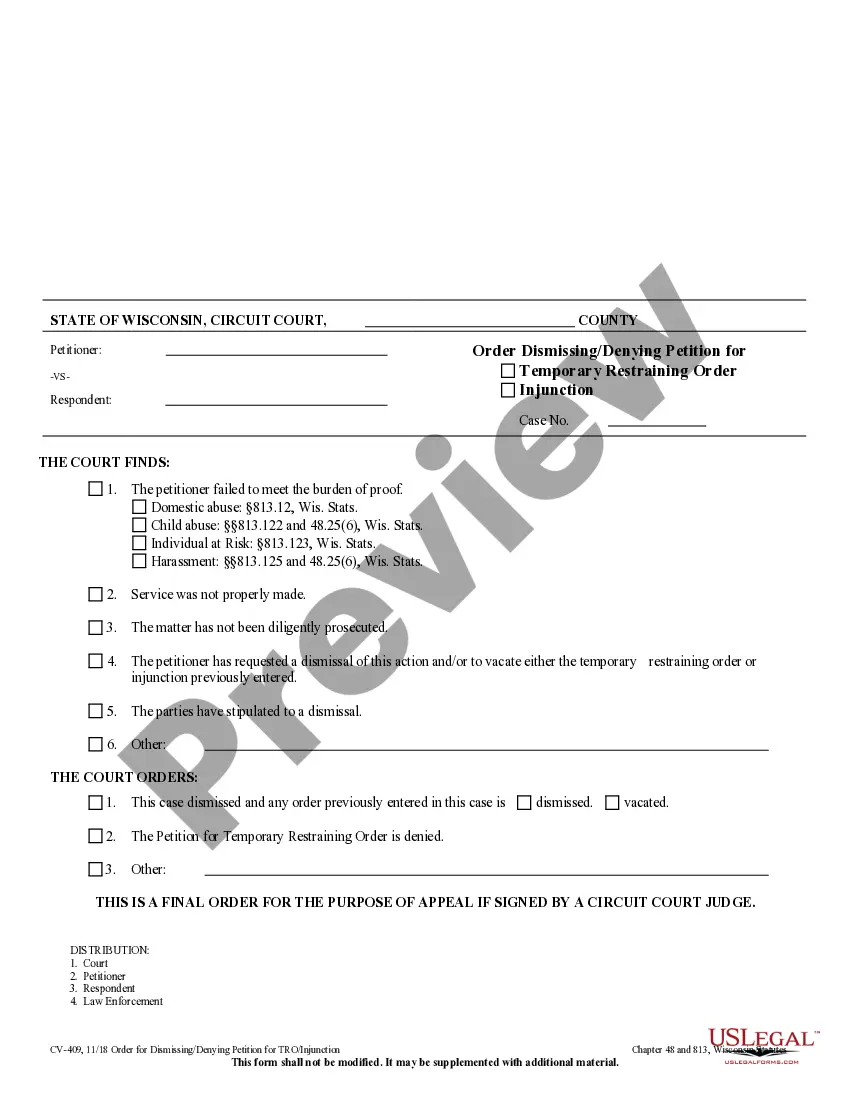

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Finding a go-to place to take the most recent and relevant legal samples is half the struggle of working with bureaucracy. Finding the right legal documents calls for accuracy and attention to detail, which is why it is vital to take samples of Loan Business Form Template With Interest only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and check all the information regarding the document’s use and relevance for your circumstances and in your state or region.

Take the following steps to complete your Loan Business Form Template With Interest:

- Make use of the catalog navigation or search field to find your template.

- Open the form’s information to see if it matches the requirements of your state and county.

- Open the form preview, if there is one, to make sure the form is the one you are looking for.

- Return to the search and find the appropriate document if the Loan Business Form Template With Interest does not suit your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Complete your purchase by picking a payment method (bank card or PayPal).

- Select the document format for downloading Loan Business Form Template With Interest.

- When you have the form on your device, you may modify it with the editor or print it and complete it manually.

Remove the hassle that comes with your legal paperwork. Explore the comprehensive US Legal Forms library where you can find legal samples, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Loan Application Form Personal details and contact information. Employment status and history. Current income and outgoings (especially related to dependents, child support, alimony, etc.) Recent tax returns. Liabilities, debts, and existing loans.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

How To Write A Loan Request Letter Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. ... Mention the purpose of the loan. ... Assure the lender of repayment. ... Closing the business loan request letter.

How to apply for a business loan in 7 steps Prepare documentation. ... Review your credit score. ... Gather financial documents. ... Create a business plan. ... Consider your collateral. ... Consider which loan to apply for. ... Assemble and submit your application.

How to Write a Business Loan Agreement Step 1 ? Set an Effective Date. ... Step 2 ? Identify the Parties. ... Step 3 ? Include the Loan Amount. ... Step 4 ? Create a Repayment Schedule. ... Step 5 ? Define Security Interests or Collateral. ... Step 6 ? Set an Interest Rate. ... Step 7 ? Late Payment Fees. ... Step 8 ? Determine Prepayment Options.