Loan Agreement Form Draft With Payment

Description

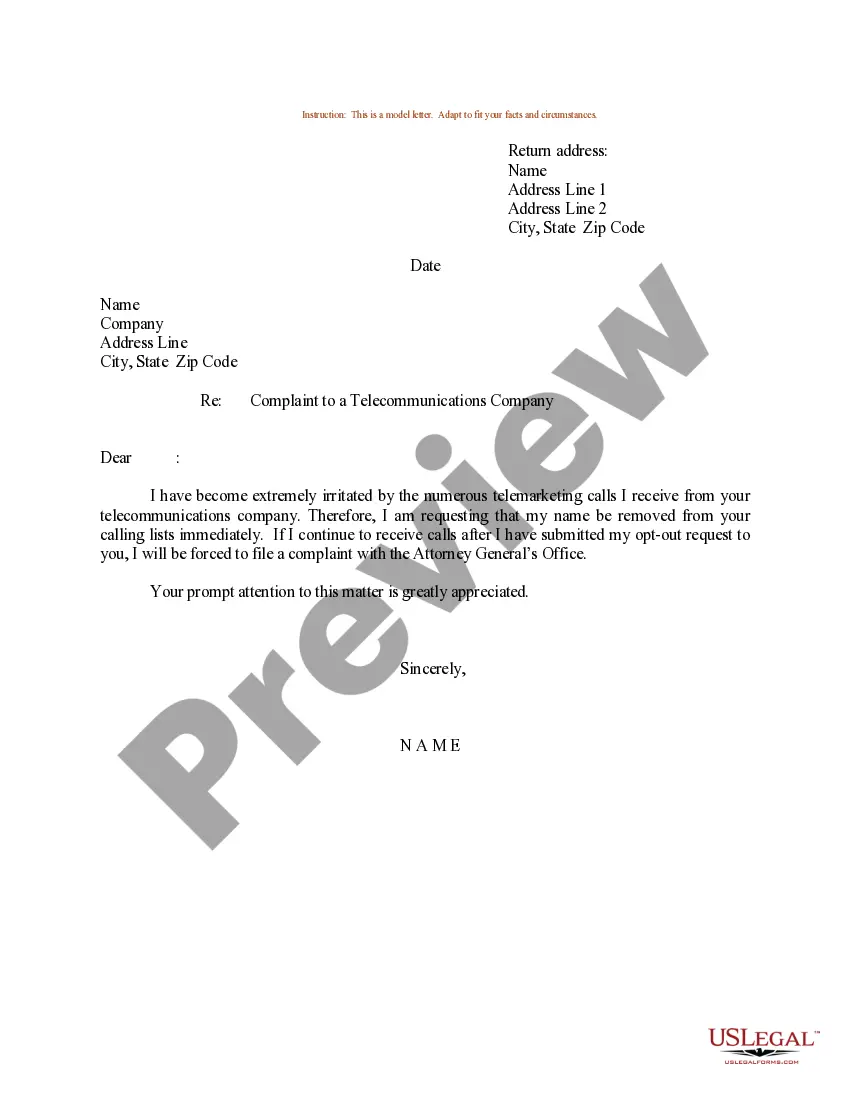

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Managing legal documents and processes can be a lengthy addition to your entire day.

Loan Agreement Form Draft With Payment and similar documents typically necessitate you to look for them and navigate the best approach to fill them out accurately.

As a result, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms at your disposal will significantly help.

US Legal Forms is the leading online platform of legal templates, providing over 85,000 state-specific documents and a variety of tools to help you complete your paperwork swiftly.

Is it your first experience with US Legal Forms? Register and establish your account in a few minutes, and you’ll gain access to the form directory and Loan Agreement Form Draft With Payment. Then, follow the steps outlined below to complete your form: Ensure you have located the correct form using the Review option and examining the form details. Select Buy Now when prepared, and choose the monthly subscription plan that suits your requirements. Click Download, then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience helping clients manage their legal documents. Locate the form you need today and streamline any process effortlessly.

- Browse the directory of pertinent documents available to you with just one click.

- US Legal Forms offers state- and county-specific forms accessible at any time for downloading.

- Safeguard your document management processes with a high-quality service that enables you to prepare any form in minutes without extra or hidden fees.

- Simply Log In to your account, search for Loan Agreement Form Draft With Payment, and obtain it instantly within the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

Repayment Clause: It is the major element in the loan agreement. This clause specifies how and when the loan is to be repaid by the borrower to the lender. The repayment can be a lump sum or on a periodical basis.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

Method of Payment This can be through: One lump sum paid on a certain date at the end of the contract's term. Regular payments made over a specified amount of time. Regular payments made specifically toward the interest.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).