Agreement Borrower Form With 2 Points

Description

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Whether for commercial reasons or for personal affairs, everyone must confront legal matters at some stage in their life.

Filling out legal documents requires meticulous attention, starting with choosing the correct form template.

Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

- For example, if you select an incorrect version of the Agreement Borrower Form With 2 Points, it will be declined upon submission.

- It is, therefore, essential to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire an Agreement Borrower Form With 2 Points template, follow these straightforward steps.

- Obtain the template you require using the search field or catalog browsing.

- Review the form’s details to ensure it fits your situation, state, and county.

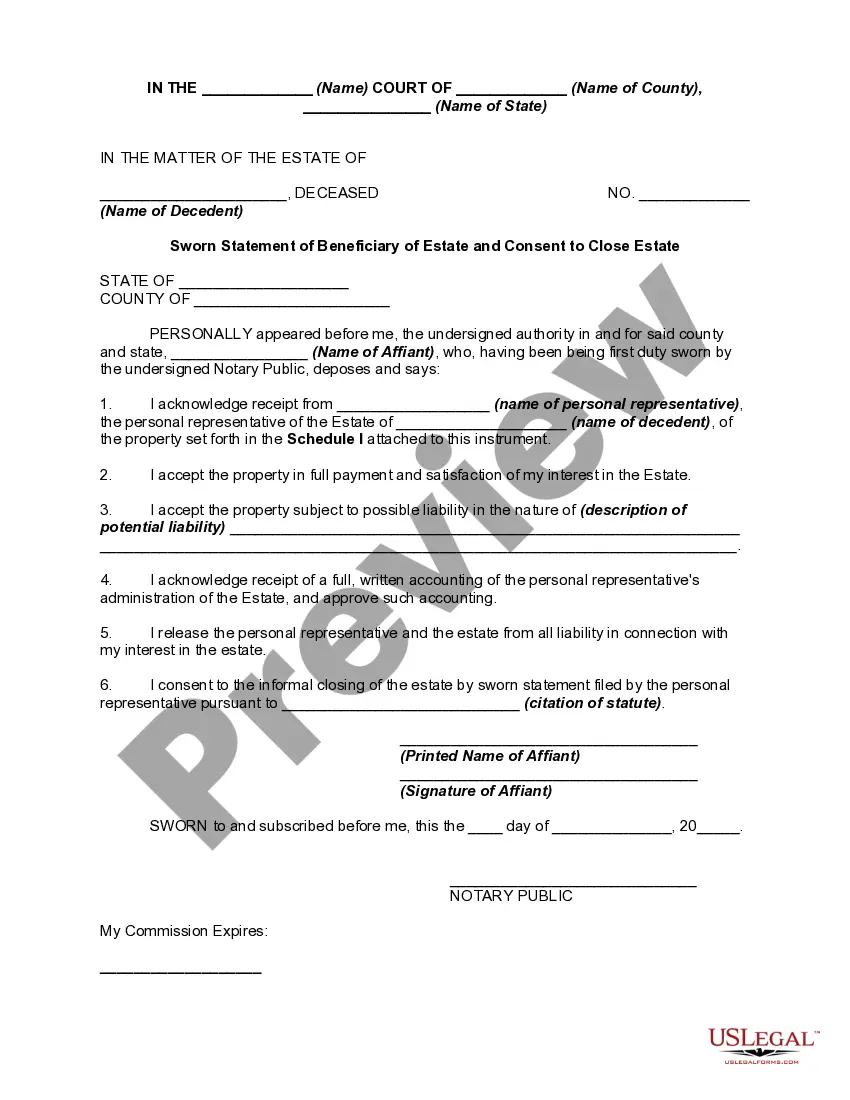

- Click on the form’s preview to inspect it.

- If it is not the correct document, return to the search function to find the Agreement Borrower Form With 2 Points sample you require.

- Download the file if it meets your stipulations.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- In case you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Select the file format you wish and download the Agreement Borrower Form With 2 Points.

Form popularity

FAQ

To write a borrowing agreement, start by clearly stating the names of the borrower and lender, along with their contact information. Next, specify the amount being borrowed, the interest rate, and the repayment terms, including due dates and any penalties for late payments. Additionally, include any collateral involved in the agreement and ensure both parties sign and date the document. Using an Agreement borrower form can simplify this process, providing a structured template to ensure all important aspects are covered.

To write a simple agreement, begin by identifying the parties involved and the purpose of the agreement. Clearly state the terms and conditions in easy-to-understand language. Include a section for signatures to confirm acceptance. Using an Agreement borrower form can help streamline this process and ensure all essential elements are included.

To fill an agreement form, start by reading all instructions carefully. Enter the required information, such as names, addresses, and relevant dates, ensuring accuracy. Follow the format provided to maintain consistency and clarity. Finally, review the completed form before submission to avoid errors.

An example of a written agreement is a rental contract between a landlord and a tenant. This document outlines the terms of the lease, including the rental amount, duration, and responsibilities of each party. By using a standardized Agreement borrower form, you can ensure all necessary details are included for clarity and protection.

To write an agreement in short form, start by clearly stating the purpose of the agreement. Include the names of the parties involved, the date, and the terms of the agreement. Use straightforward language to outline each party's responsibilities. Finally, ensure both parties sign the agreement to validate it.

Creating a simple legally binding contract involves several key components, such as the offer, acceptance, and consideration. Clearly define the obligations of each party and ensure all terms are specific and comprehensible. It’s important to have both parties sign the Agreement borrower form to solidify their commitment to the terms. A well-structured agreement can prevent future conflicts and promote a positive experience for all involved.

Filling out an agreement borrower form is straightforward. Start by entering your personal information, such as your name and contact details. Next, clearly specify the terms and conditions that both parties have agreed upon. Lastly, review the document for accuracy before signing to ensure that everything reflects your understanding.

To fill an agreement borrower form, start by gathering all necessary information about the borrower, including their full name, address, and contact details. Next, refer to each section of the form and provide accurate and complete information as required. It is vital to review the terms and conditions included in the agreement carefully before signing. By using USLegalForms, you can access easy-to-follow templates that guide you on how to properly complete the agreement borrower form.