Account Terms Conditions With Withdrawal From Empower Retirement

Description

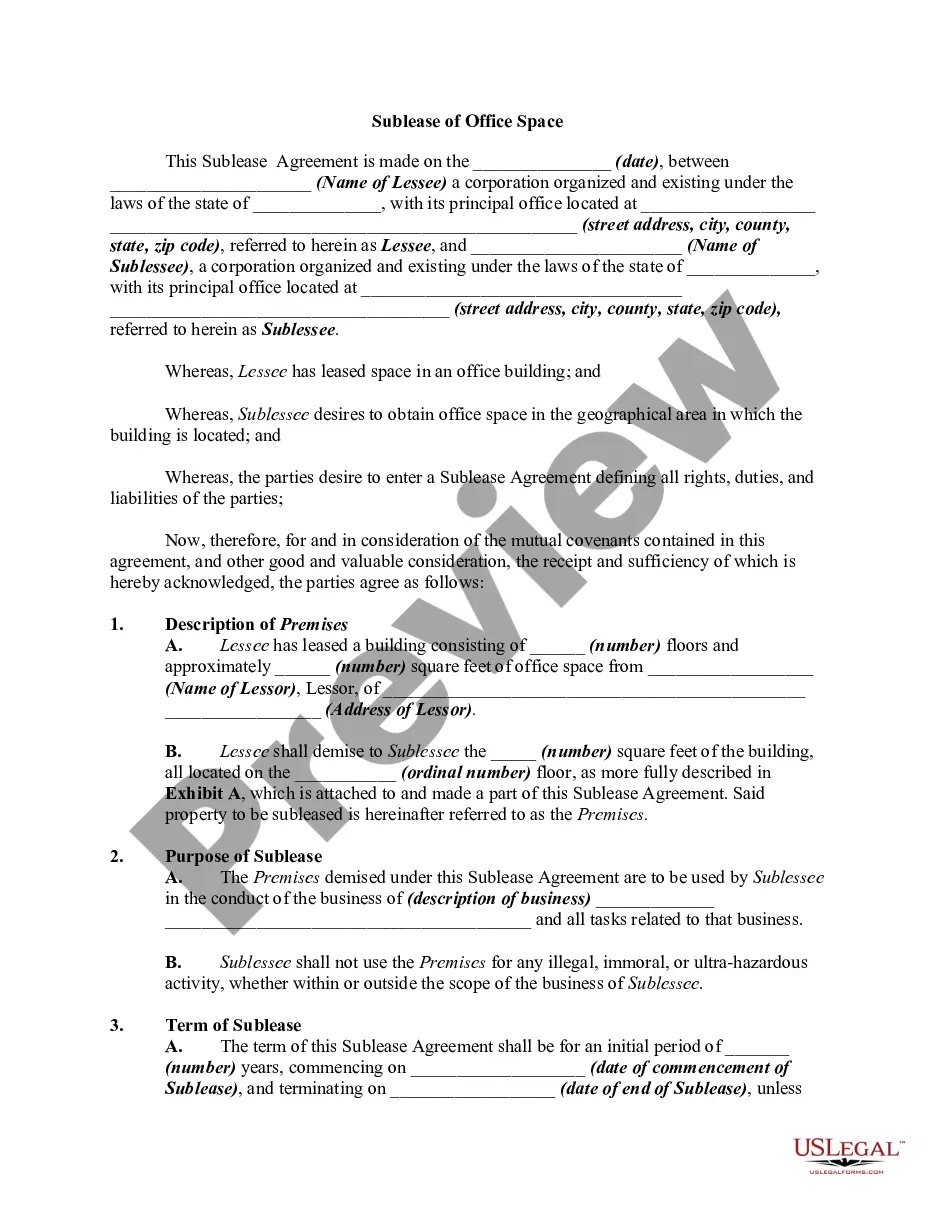

How to fill out Charge Account Terms And Conditions?

Properly composed official paperwork is one of the essential assurances for preventing problems and legal disputes, but obtaining it without a lawyer's guidance may require time.

Whether you need to swiftly locate an updated Account Terms Conditions With Withdrawal From Empower Retirement or any other forms for employment, family, or business purposes, US Legal Forms is always available to assist.

The process is even easier for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and hit the Download button next to the chosen document. Additionally, you can retrieve the Account Terms Conditions With Withdrawal From Empower Retirement at any time, as all documents ever obtained on the platform are kept accessible within the My documents section of your profile. Save time and money on preparing official documents. Try US Legal Forms today!

- Ensure that the document is appropriate for your situation and locale by reviewing the description and preview.

- Search for another example (if needed) using the Search bar located in the page header.

- Click Buy Now when you find the correct template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Account Terms Conditions With Withdrawal From Empower Retirement.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

You may make withdrawals without penalty from your traditional IRA after you reach age 59½. Your taxable distribution is subject to ordinary income tax, including applicable federal, state and local tax, in the year you take the withdrawal(s).

In most circumstances, taking an early withdrawal from your 401(k) or IRA will result in an additional 10 percent penalty on top of income taxes. There are instances where the penalty is waived, but you'll still pay regular income tax on the withdrawal.

In general, you can't take a withdrawal from your 401(k) account until one of the following events occurs: You die, become disabled, or otherwise terminate employment. Your employer terminates your 401(k) plan.

The daily ATM withdrawal limit is $500, and the daily debit card purchase limit is $2,000. Your daily transfer limit is $2500, and it will increase to $5000 31 days after your first transaction.

You may make withdrawals without penalty from your traditional IRA after you reach age 59½. Your taxable distribution is subject to ordinary income tax, including applicable federal, state and local tax, in the year you take the withdrawal(s).