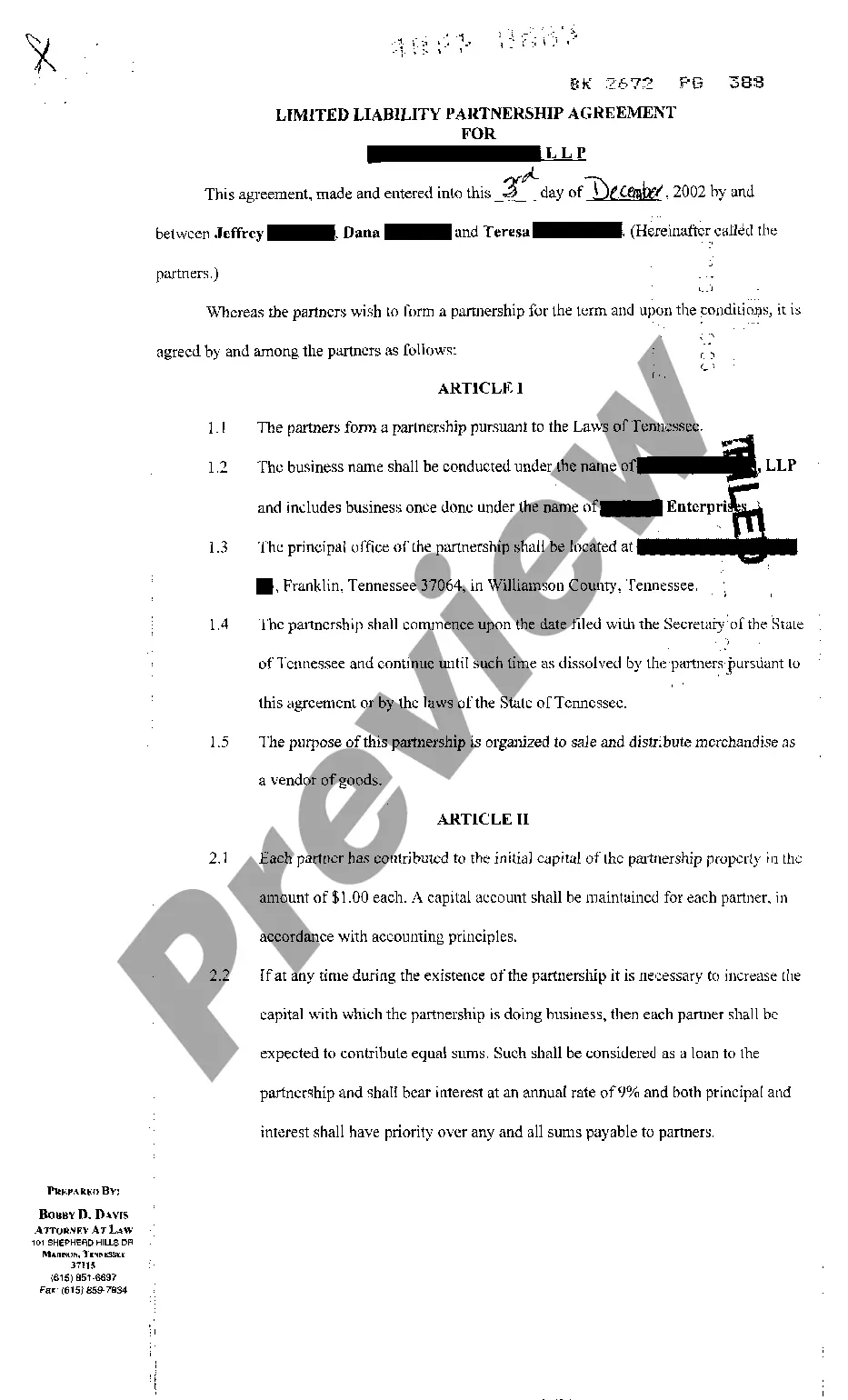

Credit Agreement Example

Description

How to fill out Credit Agreement?

Managing legal documents and processes can be a lengthy addition to your schedule.

Credit Agreement Sample and similar forms generally necessitate that you search for them and find the optimal way to fill them out accurately.

Therefore, whether you are addressing financial, legal, or personal issues, having a thorough and accessible online collection of forms readily available will be immensely beneficial.

US Legal Forms is the leading online resource for legal templates, boasting over 85,000 state-specific forms along with various tools to help you complete your documentation seamlessly.

Is this your first experience with US Legal Forms? Sign up and create an account in just a few minutes to access the form library and Credit Agreement Sample. Then, follow the steps below to fill out your form: Please ensure you have the correct form by using the Preview function and reviewing the form details. Click Buy Now when ready, and choose the monthly subscription plan that aligns with your requirements. Select Download, then fill out, eSign, and print the form. US Legal Forms has twenty-five years of expertise in assisting users with their legal documentation. Locate the form you need today and enhance any process without difficulty.

- Explore the collection of relevant documents accessible to you with a single click.

- US Legal Forms provides you state- and county-specific forms available at any time for download.

- Protect your document management processes by employing a high-quality service that enables you to prepare any form in minutes without extra or hidden fees.

- Simply Log In to your account, locate Credit Agreement Sample, and download it directly from the My documents section.

- You can also retrieve previously stored forms.

Form popularity

FAQ

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

Credit cards are one example, as are lines of credit, including home equity lines of credit (HELOCs). Non-revolving loans, such as mortgages and auto loans, have a fixed end date and a prescribed repayment schedule.

The Lender agrees to loan _________ (total amount of the credit) to the Borrower. The Borrower agrees to repay the total amount in full before _________ , along with any interest incurred on the unpaid monies at the rate of ____% per year, beginning on _________ (date).

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.