Lien Made Property For Foreclosed

Description

How to fill out Assignment Of Lien By General Contractor?

It’s well known that becoming a legal authority takes time, and one cannot easily learn how to swiftly prepare Lien Made Property For Foreclosure without a dedicated knowledge base.

Assembling legal paperwork is a lengthy process that necessitates specialized training and expertise. So why not leave the preparation of the Lien Made Property For Foreclosure to the experts.

With US Legal Forms, one of the most extensive collections of legal documents, you can find anything from court filings to templates for internal communication.

You can regain access to your documents from the My documents section at any time.

If you are an existing customer, you can simply Log In, and locate and download the template from the same section.

- Begin by using the search bar located at the top of the page to find the document you need.

- If available, preview it and read the supporting details to determine if Lien Made Property For Foreclosure matches your needs.

- If you require a different template, start your search anew.

- Create a complimentary account and select a subscription plan to acquire the template.

- Click Buy now. After the transaction is completed, you can download the Lien Made Property For Foreclosure, complete it, print it, and send or mail it to the necessary parties or institutions.

Form popularity

FAQ

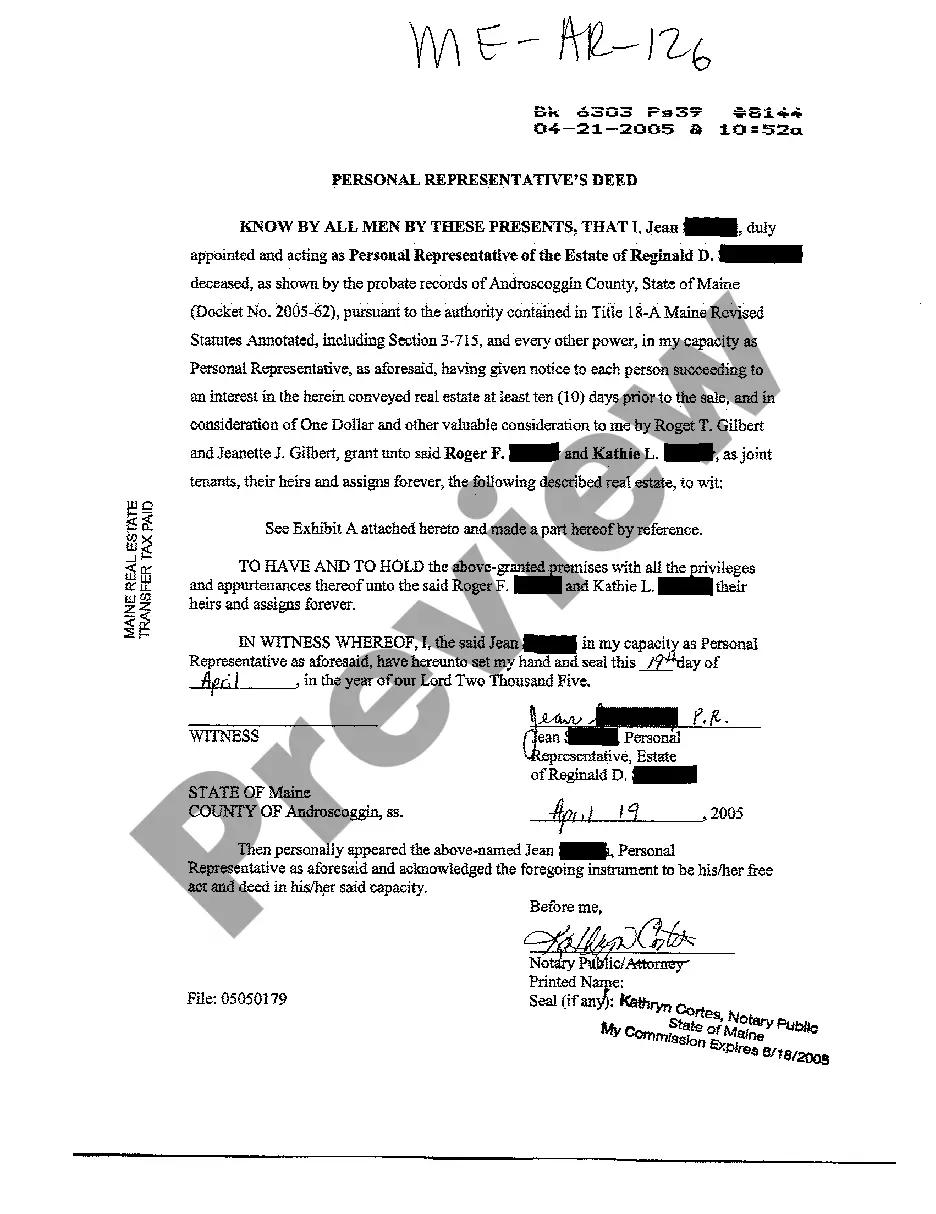

A lien foreclosure action is a lawsuit to foreclose the mechanics lien. The lien claimant must file a lien foreclosure action within 90 days of the date that he or she recorded the mechanics lien. Often a lien claimant with a valid claim will fail to follow through, making the lien invalid.

New York requires that a copy of the lien be served on the owner of the property, the prime contractor, and the hiring party (if the claimant didn't contract directly with the prime contractor). The copy of the lien must be served within 5 days before, or before 30 days after filing the notice of lien.

Foreclosures may be judicial (ordered by a court following a judgment in a lawsuit) or, most likely in Texas, non-judicial (?on the courthouse steps?). The effect of foreclosure is to cut off and eliminate junior liens, including mechanic's liens, except for any liens for unpaid taxes.

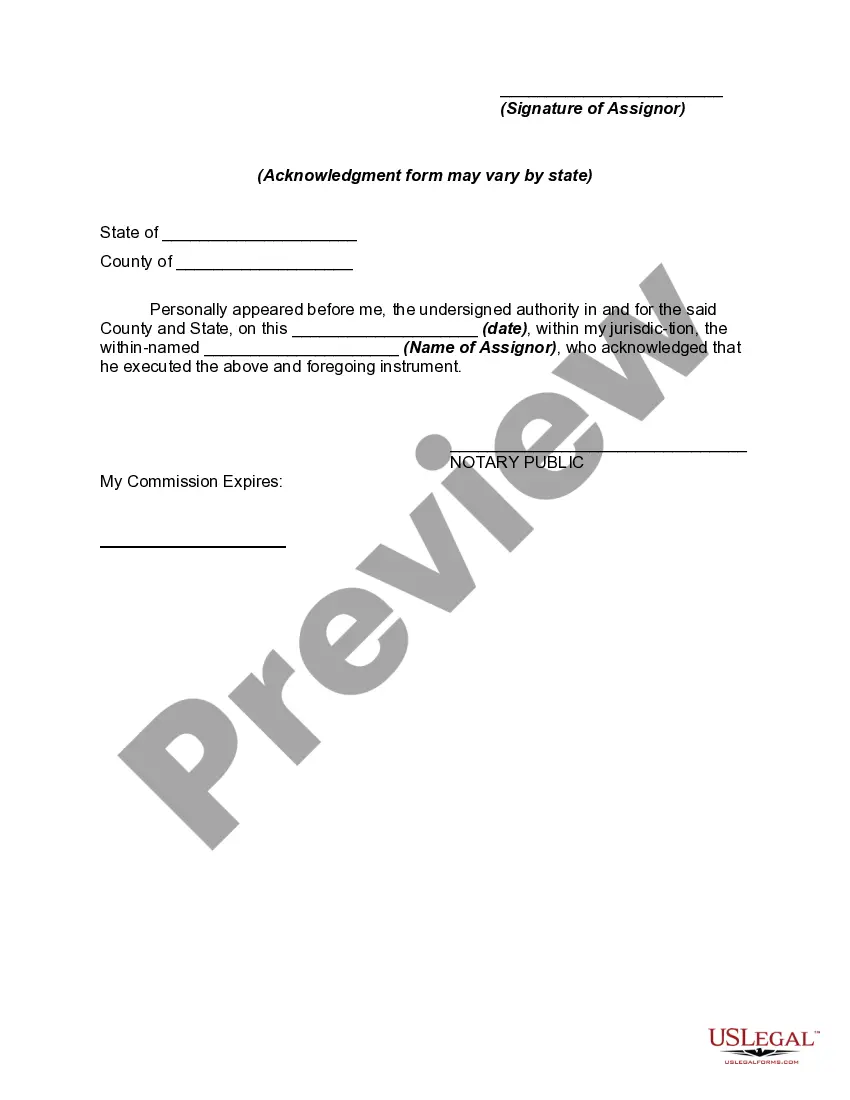

To file a notice of lien, you must complete the Public Improvement Lien Form. You must also sign and notarize both the Lien Form and the Affidavit of Service. You can submit everything to DOF by mail or in person.

Individuals or companies that borrow from a Financial Institution using their vehicle as collateral for a loan must submit their title and a completed Notice of Lien (PDF) (MV-900) to the Department of Motor Vehicles in order to file the lien.