Not Profit Organization File With Rent

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

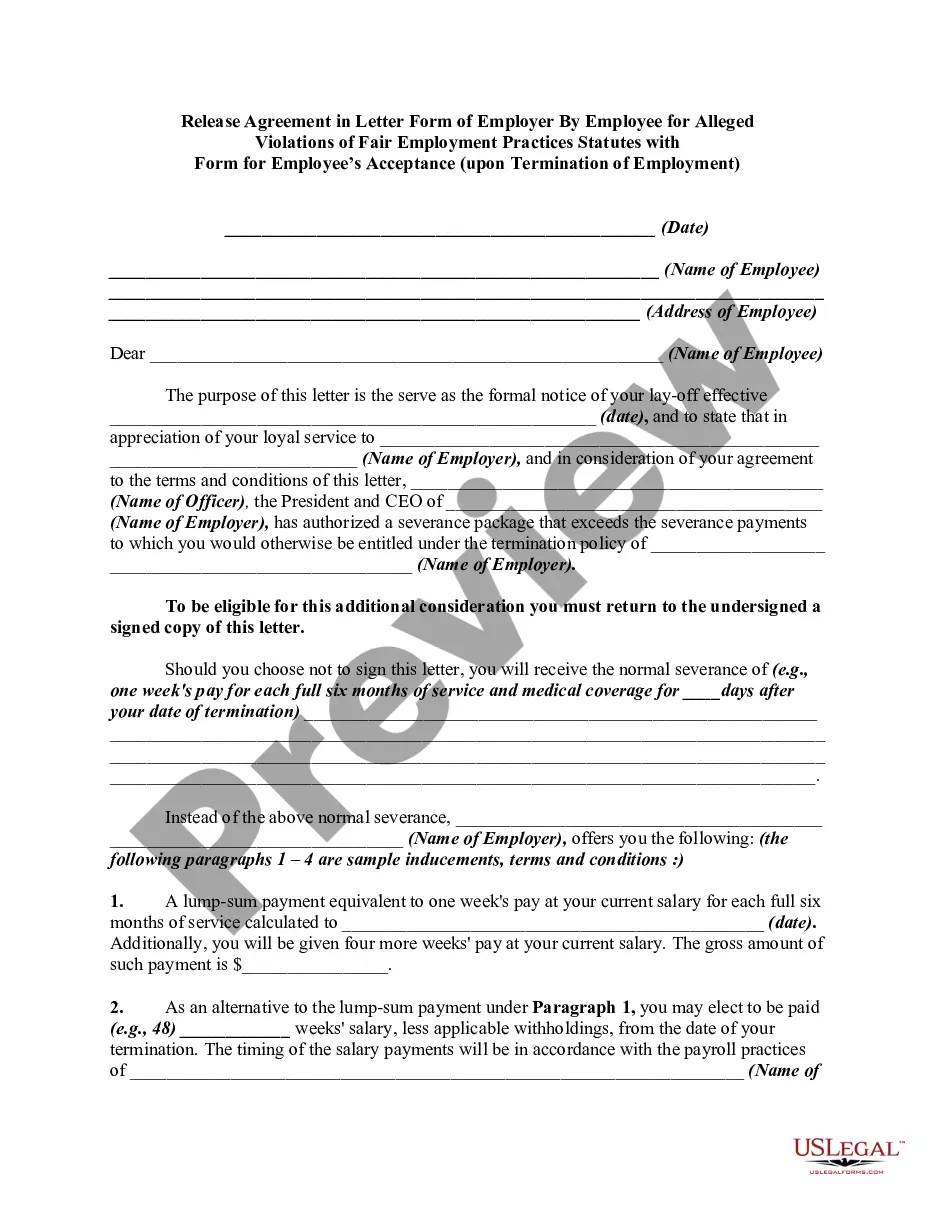

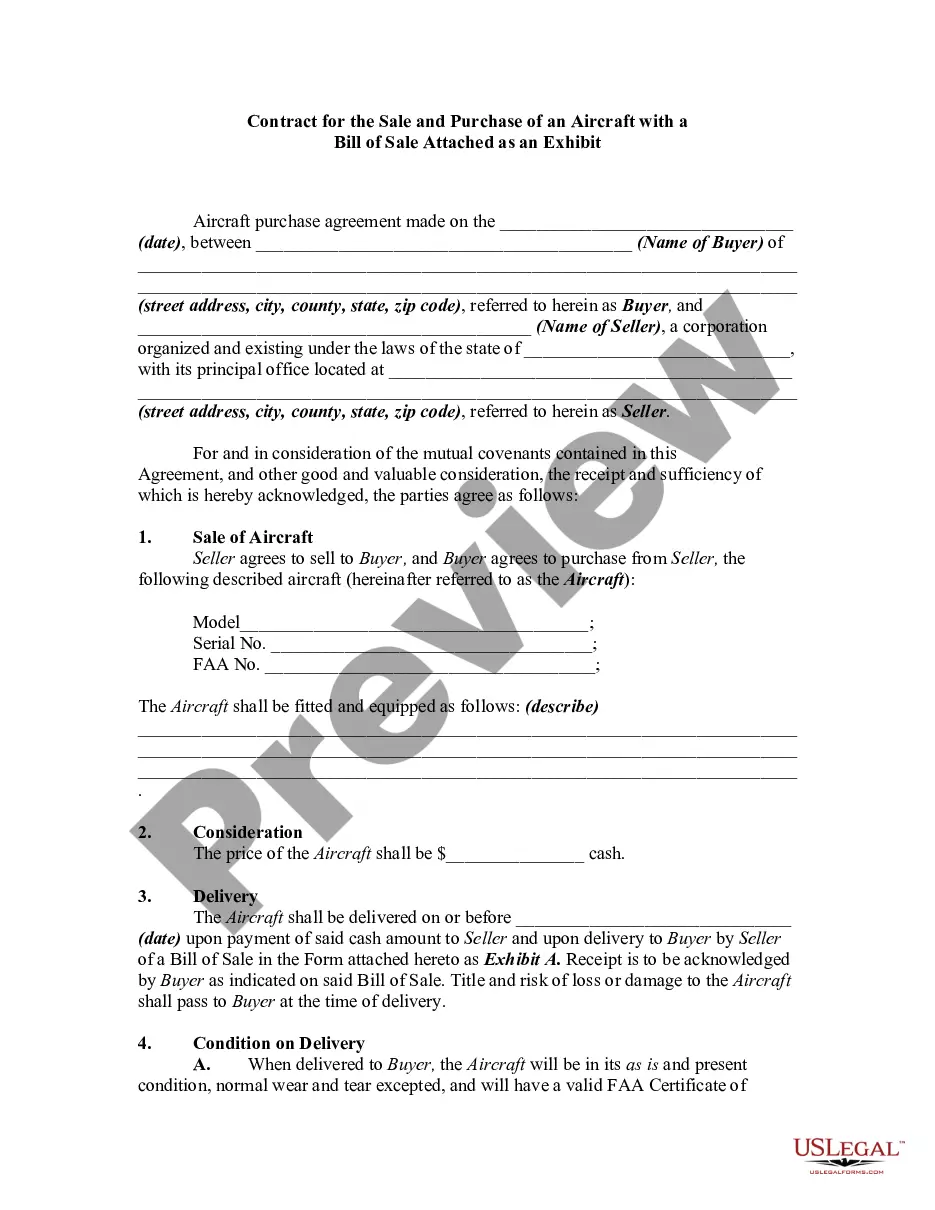

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Obtaining legal templates that meet the federal and local regulations is a matter of necessity, and the internet offers many options to choose from. But what’s the point in wasting time looking for the correctly drafted Not Profit Organization File With Rent sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are simple to browse with all documents collected by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when obtaining a Not Profit Organization File With Rent from our website.

Obtaining a Not Profit Organization File With Rent is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, adhere to the guidelines below:

- Examine the template using the Preview option or through the text outline to ensure it meets your needs.

- Locate a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Not Profit Organization File With Rent and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

How to Fill Out the Form W-9 for Nonprofits Step 1 ? Write your corporation name. ... Step 2 ? Enter your business name. ... Step 3 ? Know your entity type. ... Step 4 ? Your exempt payee code. ... Step 5 ? Give your street address. ... Step 6 ? Give your city, state, and zip code. ... Step 7 ? List account numbers.

Once the rent is received, the accrued rent receivable is reduced, and the cash account is credited. To record accrued rent income, a property owner would record a journal entry debiting the relevant asset account (e.g., ?Accrued Rent Receivable?) and crediting the corresponding income account (e.g., ?Rental Income?).

For example, rental income is a common type of nonbusiness income. However, if you're in the business of renting personal property, then rental income would be considered business income.

Accrued rent expense is recorded on the company's balance sheet as a current liability, often under the ?Accrued Rent? or a similar account. Once the rent is paid, the accrued rent liability is reduced, and the cash account is debited.

Form 990 requires filers to list their individual charitable programs by name or purpose, then describe in detail what was accomplished during the year. For example, you may need to include things like: A description of the program. The number of people served.