Articles Organization Form For Business

Description

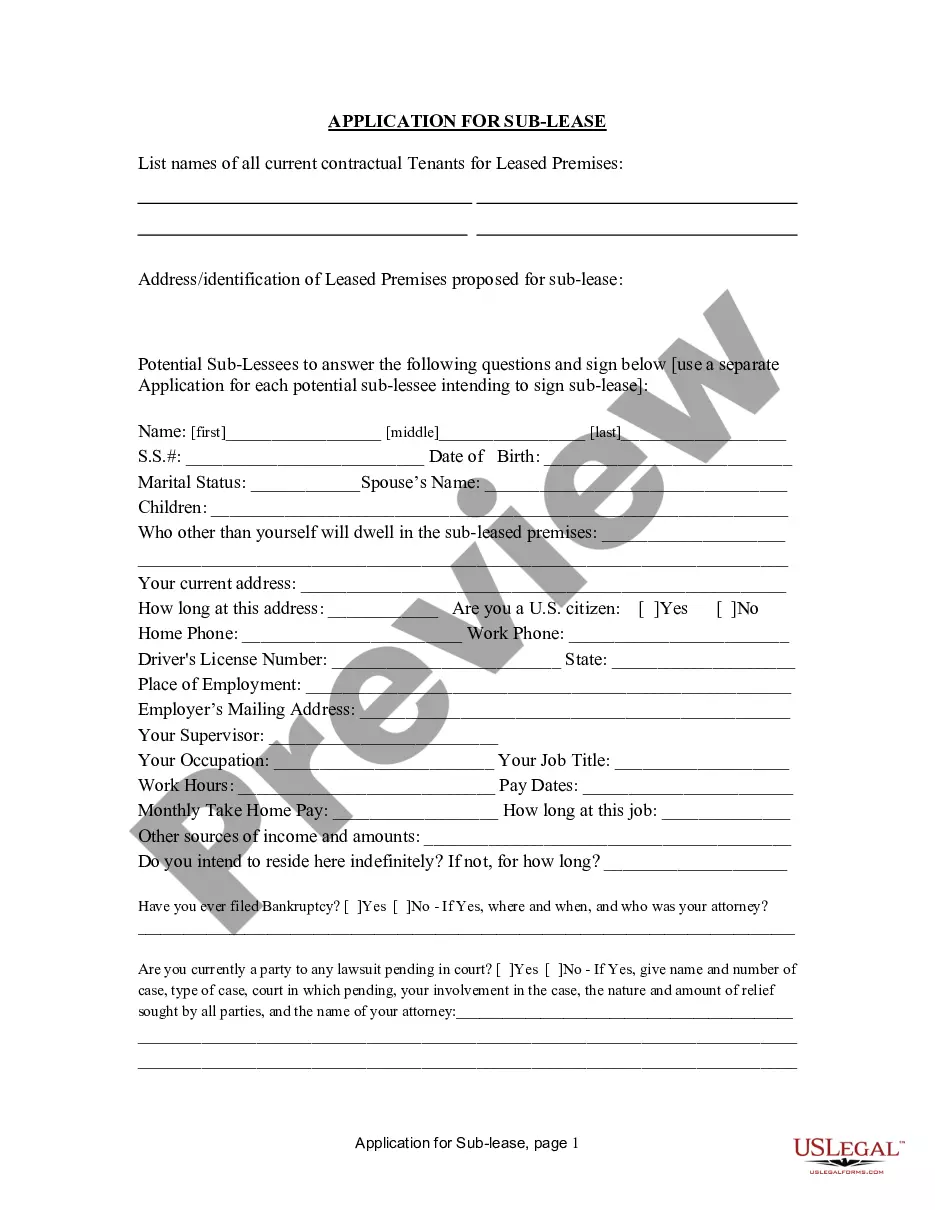

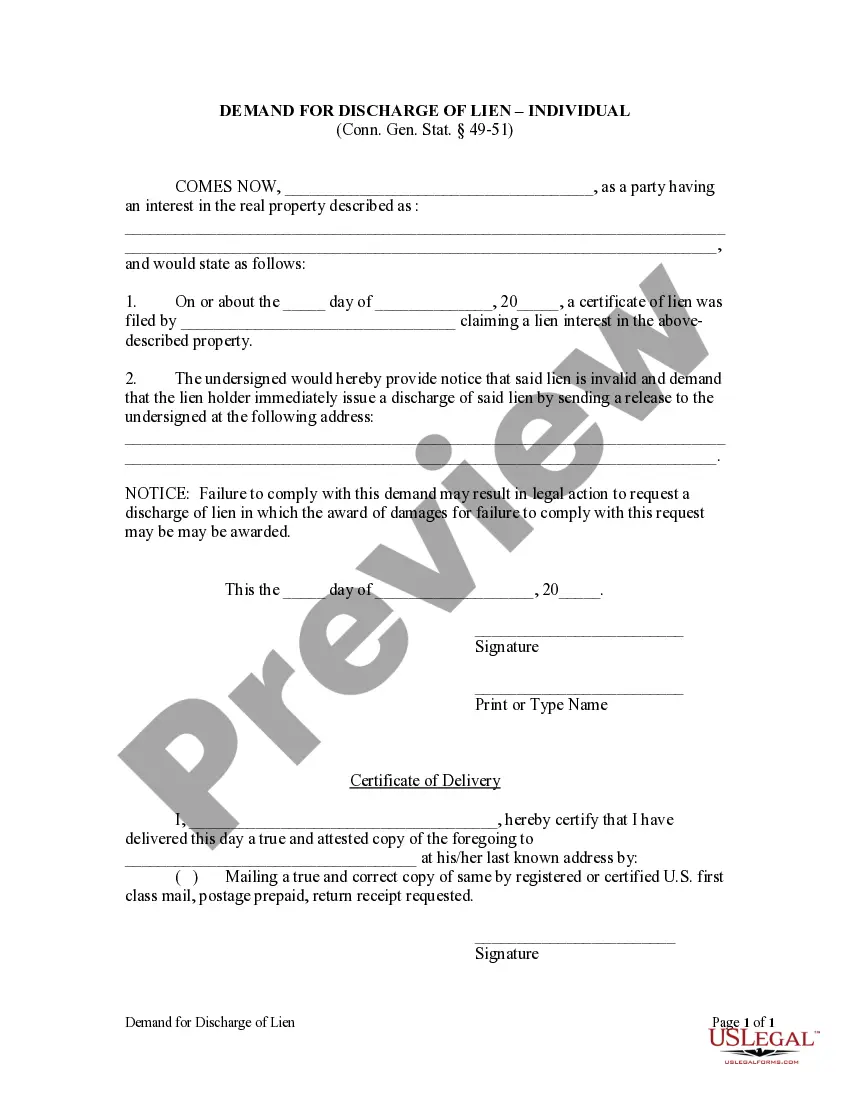

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Handling legal documents and operations can be a time-consuming addition to your entire day. Articles Organization Form For Business and forms like it usually need you to search for them and navigate the way to complete them correctly. Therefore, regardless if you are taking care of financial, legal, or individual matters, having a thorough and practical web catalogue of forms on hand will greatly assist.

US Legal Forms is the top web platform of legal templates, featuring more than 85,000 state-specific forms and a number of resources to assist you complete your documents easily. Explore the catalogue of appropriate papers accessible to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Shield your papers management processes having a top-notch services that lets you make any form within minutes without having additional or hidden charges. Simply log in in your profile, locate Articles Organization Form For Business and download it straight away within the My Forms tab. You may also access previously downloaded forms.

Would it be your first time making use of US Legal Forms? Register and set up your account in a few minutes and you’ll have access to the form catalogue and Articles Organization Form For Business. Then, stick to the steps below to complete your form:

- Be sure you have found the proper form using the Review option and reading the form description.

- Select Buy Now as soon as all set, and select the subscription plan that is right for you.

- Choose Download then complete, sign, and print the form.

US Legal Forms has twenty five years of experience supporting consumers deal with their legal documents. Discover the form you want right now and enhance any process without breaking a sweat.

Form popularity

FAQ

Virginia LLC Cost. Filing the registration paperwork to officially form your Virginia LLC will cost $100. You'll also need to pay a yearly $50 fee to file your Virginia Annual Registration.

Yes. California law requires LLCs to create an operating agreement during their initial registration process.

File Your Wisconsin LLC Articles of Organization Select Your LLC's Official Name. Provide the Name and Address of Your Registered Agent and Registered Office. Decide Who Will Manage the LLC. Provide the Names and Addresses of Your Organizers. List the LLC Articles of Organization Drafter. Choose a Filing Date.

Your Articles of Organization in California is the official document that registers your business with the state. It provides the state with important information about your business and is needed to comply with state business laws.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.