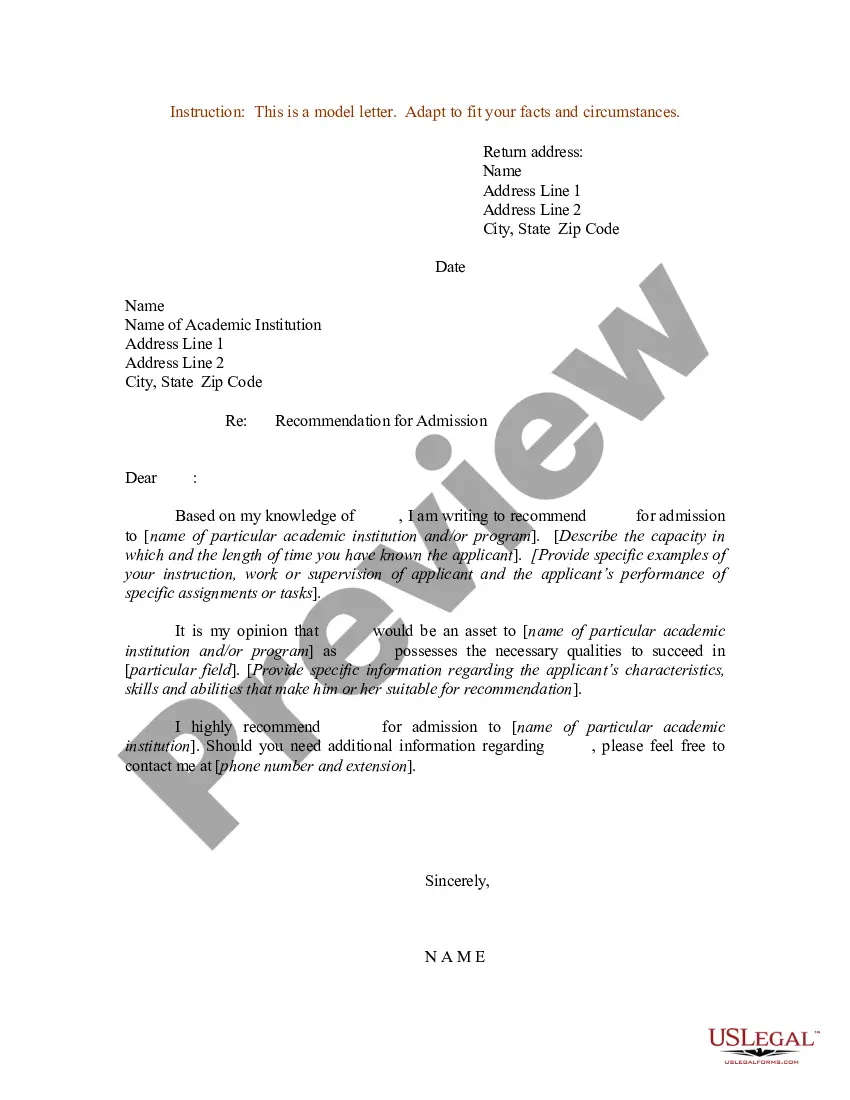

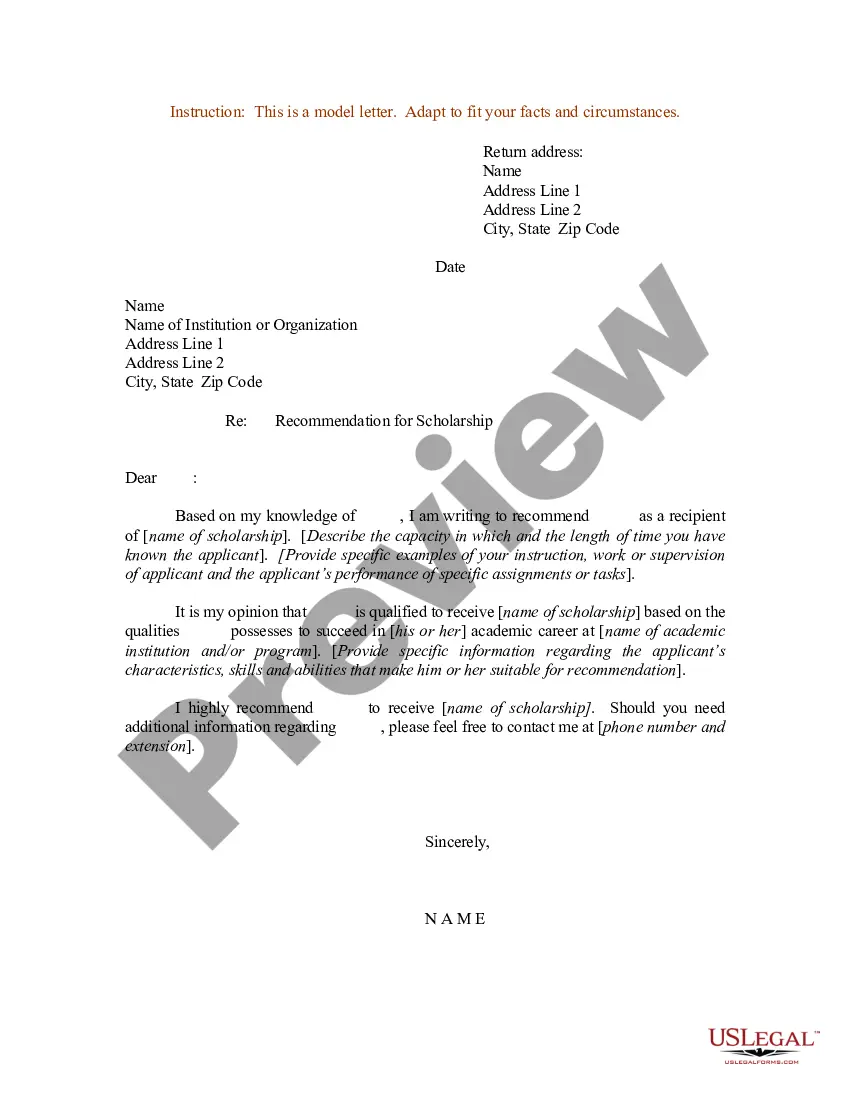

Teacher Reference For Student

Description

How to fill out Sample Letter For Reference Letter For School Or College Scholarship Applicant - From Professor - Teacher - Educator?

Dealing with legal documents can be exasperating, even for seasoned professionals.

If you're searching for a Teacher Reference For Student and can't find the time to seek out the correct and latest version, the process can become overwhelming.

Access a wealth of articles, guides, and materials that are pertinent to your circumstances and needs.

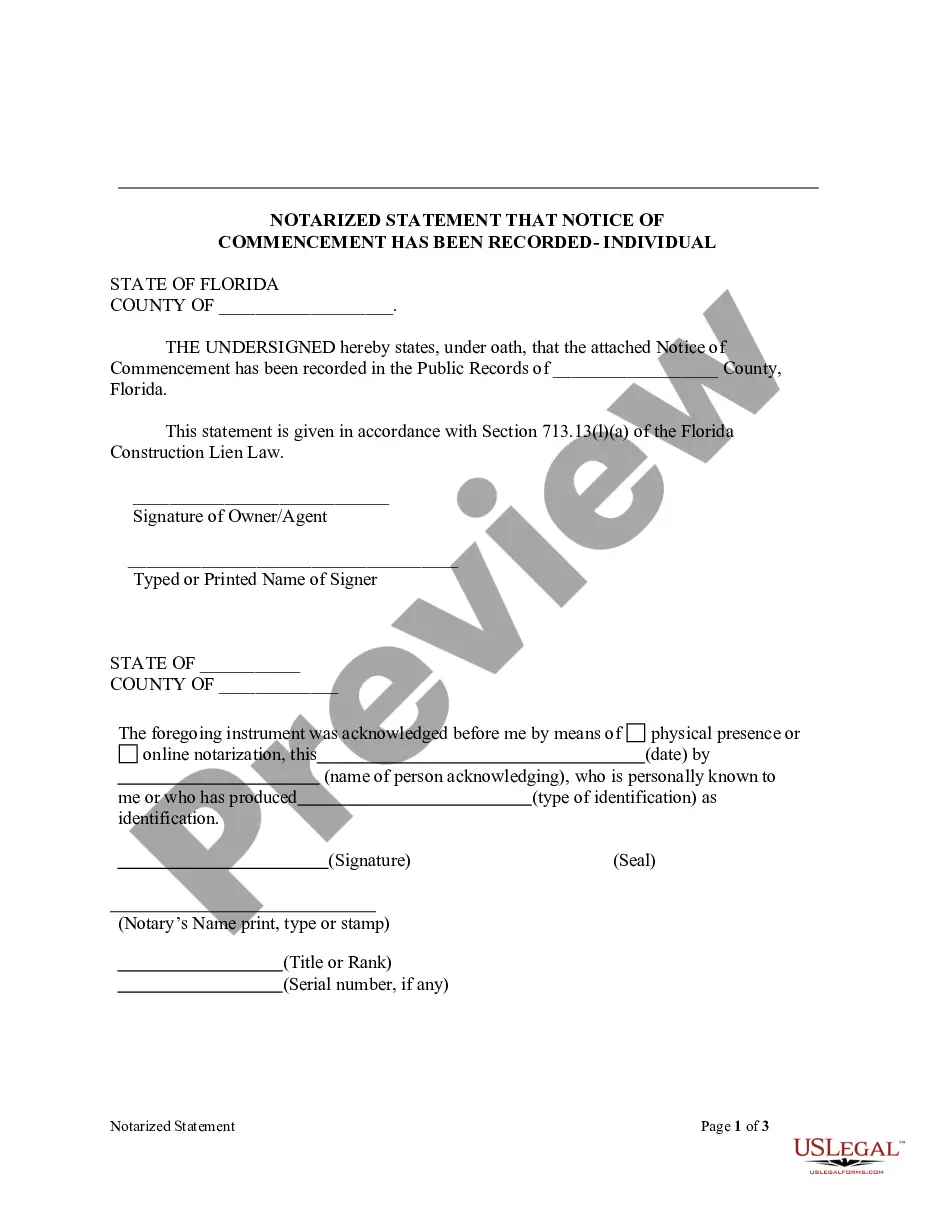

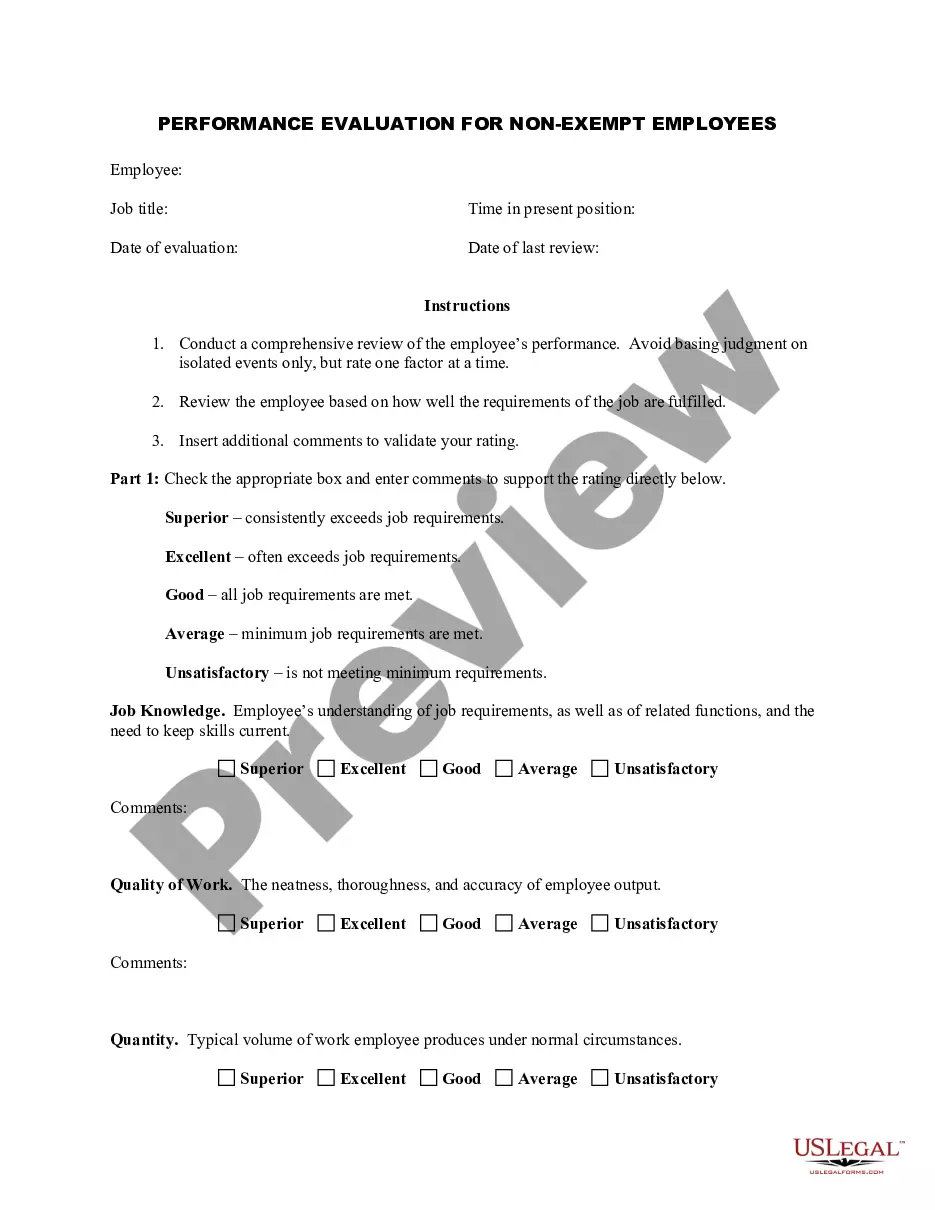

Conserve time and effort when searching for the documents you require, and utilize US Legal Forms' innovative search and Preview feature to find Teacher Reference For Student and obtain it.

Confirm that the sample is valid in your state or county. Select Buy Now when you are prepared. Choose a monthly subscription option. Select the format you require, and Download, complete, sign, print, and dispatch your document. Benefit from the US Legal Forms online library, supported by 25 years of expertise and reliability. Revamp your routine document management into a straightforward and user-friendly process today.

- If you're a member, Log In to your US Legal Forms account, search for the document, and download it.

- Visit the My documents section to review the documents you've saved and manage your folders as desired.

- If it's your first experience with US Legal Forms, create a complimentary account to gain unlimited access to all the benefits of the library.

- Here are the steps to follow after locating the document you need.

- Ensure this is the appropriate form by previewing it and reviewing its description.

- Leverage state- or county-specific legal and organizational documents.

- US Legal Forms accommodates any necessities you might have, from personal to commercial paperwork, all in one location.

- Employ sophisticated tools to finalize and oversee your Teacher Reference For Student.

Form popularity

FAQ

You will need to file a nonresident income tax return to Maryland, using Form 505 and Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.

You must register with the Department of Assessments & Taxation in order to receive an SDAT number. If you are a Sole Proprietor (work for yourself, pay no wages to staff, and are solely liable for any damages), you can register, and get a FEIN, without cost.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland. The deadline to file is April 15th.

All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply)

Personal Property Tax Returns are due to the SDAT by April 15th each year. Extensions of the filing deadline up to 60 days can be granted if the requests are made on or before April 15th. Visit SDAT to file an extension.

Do I have to file a Maryland income tax return? Generally, you must file a return if you are required to file a federal return with the IRS.

Maryland is known for fishing, and it produces the most blue crabs in the United States. The state is also known for mining coal, clays, natural gas, and limestone.

We offer several ways for you to obtain Maryland tax forms, booklets and instructions: Download them. You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.