Discharge Mortgage To

Description

Form popularity

FAQ

Yes, clearing your mortgage is often a prudent financial move. It provides relief from monthly payment obligations and frees you from long-term debt. Additionally, a discharged mortgage can enhance your creditworthiness and offer peace of mind. If you decide to discharge a mortgage, uslegalforms can simplify your tasks with easy-to-use legal forms.

When you discharge your mortgage, you eliminate the debt attached to your property, which means you own it outright. This process provides you with greater financial flexibility, allowing you to make future investments or enhance your lifestyle. Therefore, when you discharge your mortgage to the lender, you not only relieve yourself of monthly payments but also enjoy enhanced personal equity.

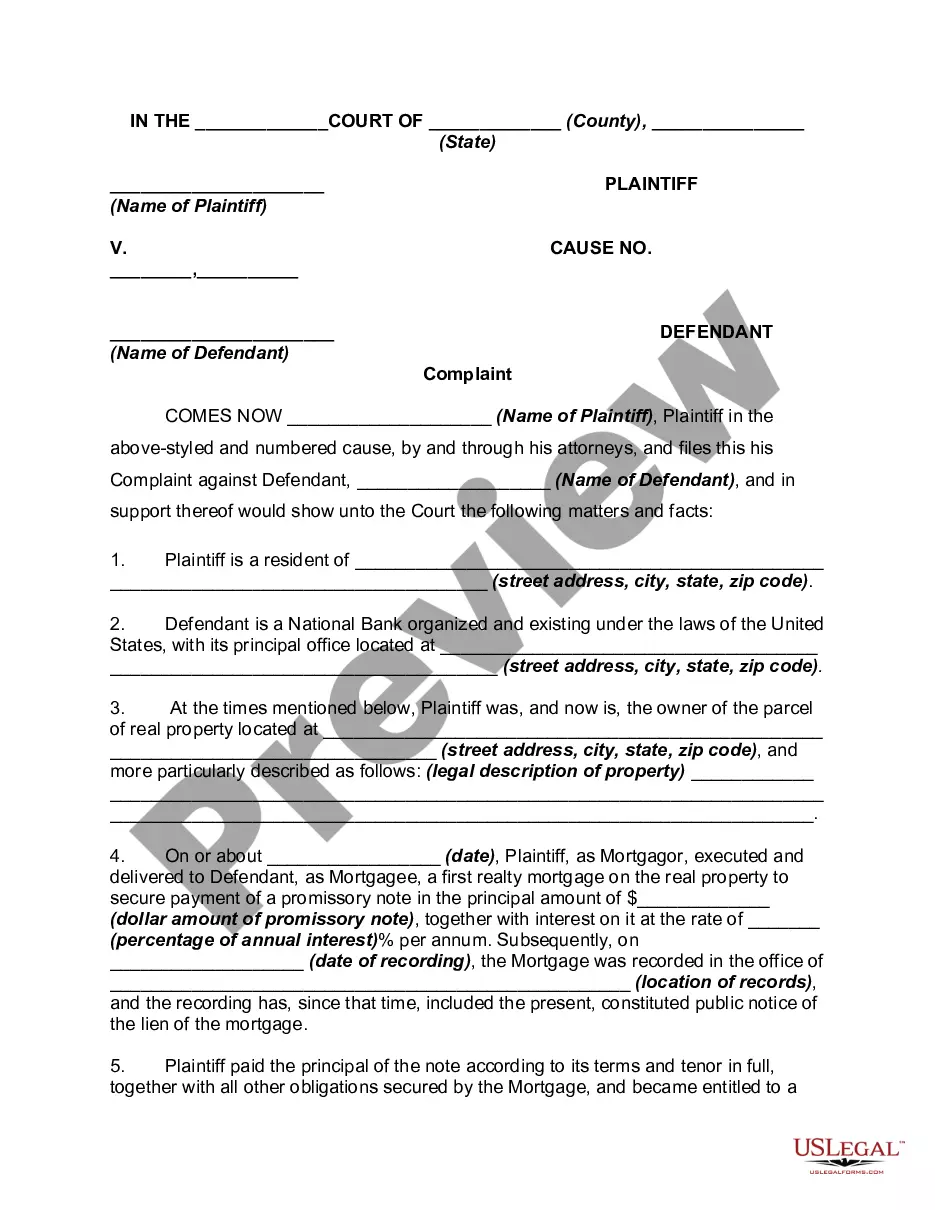

Discharging your mortgage involves paying off the full amount owed to your lender. After the payment is made, it's crucial to file the appropriate documents with your local government to ensure that the mortgage is officially released from your property records. When you discharge your mortgage to the lender, you embark on a new chapter of financial freedom.

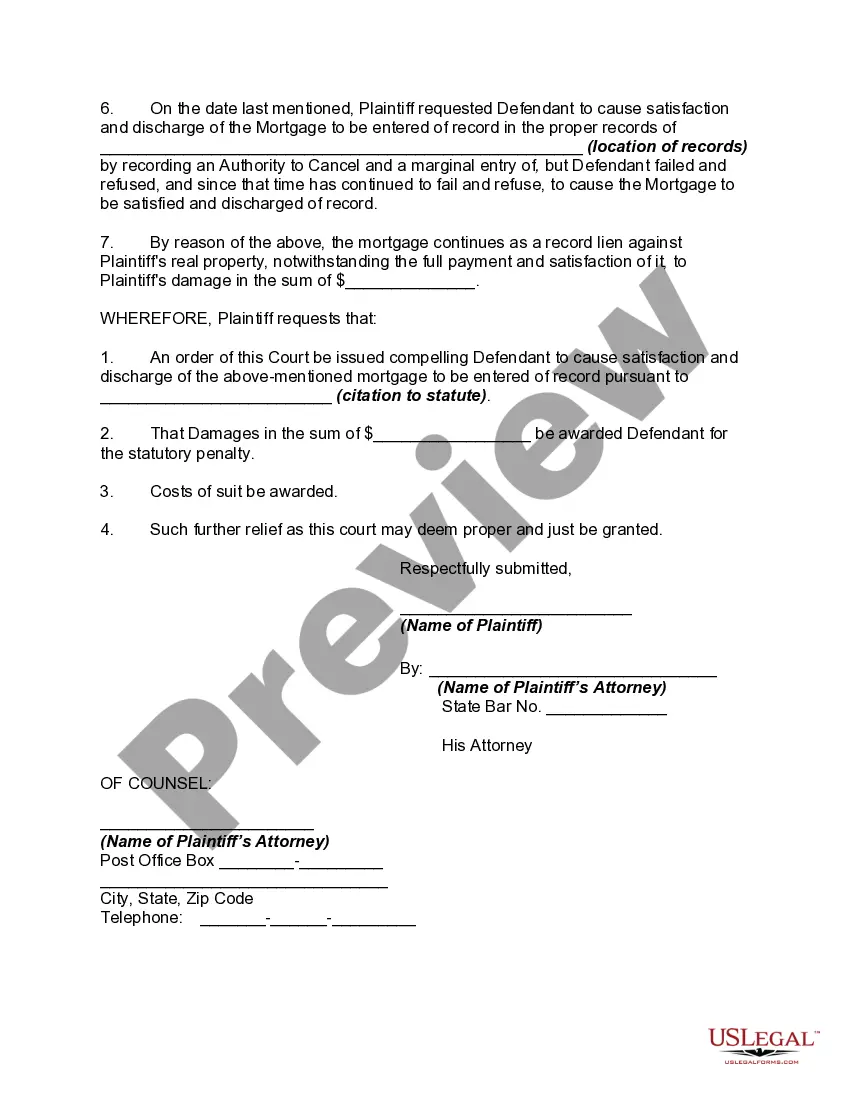

To release a mortgage, you need to complete a mortgage discharge application and submit it to your lender. Once they approve your request, they will process the discharge, allowing you to discharge mortgage to the next property or to eliminate it entirely. It’s essential to check whether any fees apply and to confirm that all payments are settled. Using US Legal Forms can help you ensure you have the correct forms and instructions.

The time it takes to release mortgage funds typically varies based on several factors, such as lender processes and local regulations. Generally, it can take anywhere from a few days to a few weeks after submitting your request to discharge the mortgage to receive the funds. To speed up the process, make sure all documentation is complete and accurate. US Legal Forms can assist in preparing the necessary paperwork efficiently.

To fill out the ANZ discharge and variation authority, begin by gathering your mortgage details and personal information. Ensure you clearly indicate your intent to discharge the mortgage to avoid any confusion. You can complete this form online or download it for manual submission. Utilizing US Legal Forms can simplify this process by providing templates and guidance tailored to your needs.

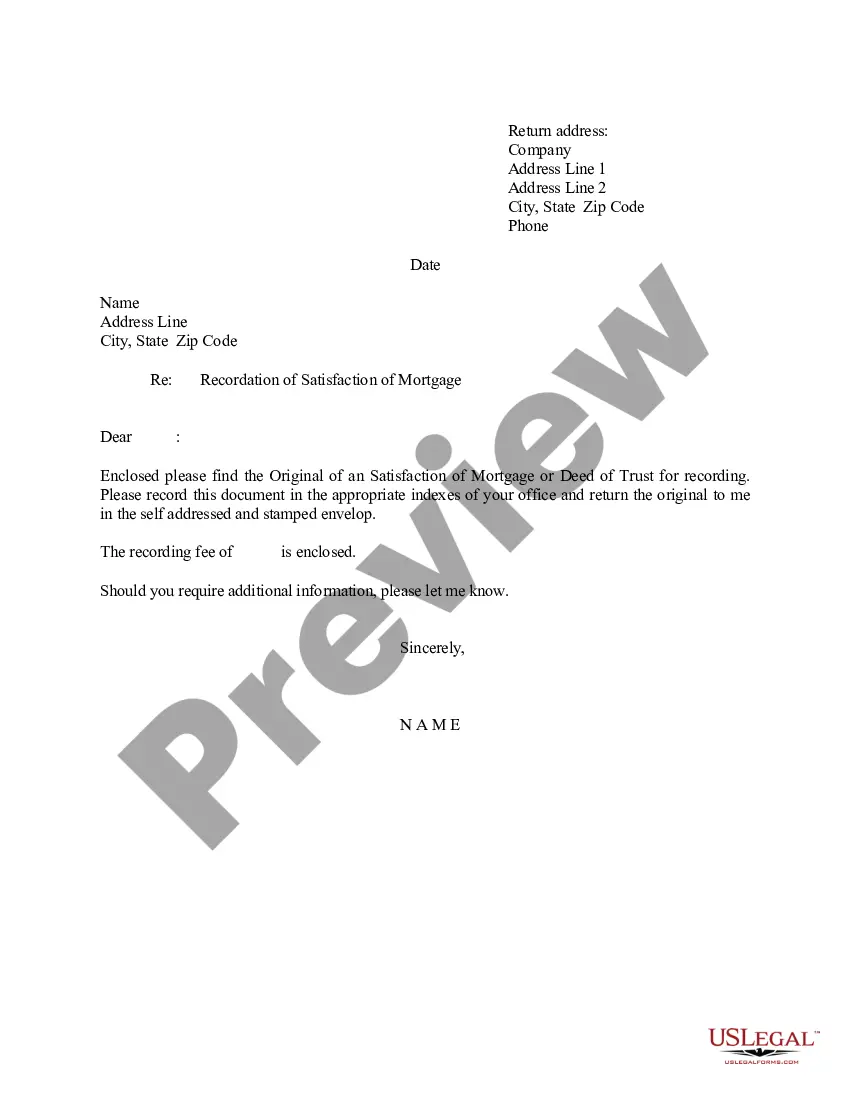

Recording a release of your mortgage involves submitting the appropriate discharge documents to the local county recorder’s office. Typically, you will need to include a completed discharge form along with any applicable fees. Properly recording this release is vital to maintaining an accurate public record of your ownership.