Sample Offer In Compromise Letter To Irs Without Appointment

Description

How to fill out Sample Letter For Application For Approval Of Compromise Settlement?

There’s no longer a requirement to squander hours searching for legal documents to satisfy your local state obligations.

US Legal Forms has compiled them all in one location and streamlined their availability.

Our platform offers over 85,000 templates for various business and personal legal situations organized by state and area of use.

Utilize the search bar above to find another template if the prior one wasn’t suitable. Click Buy Now next to the template name once you identify the correct one. Select your preferred pricing plan and create an account or Log In. Complete your subscription payment with a credit card or via PayPal to proceed. Choose the file format for your Sample Offer In Compromise Letter To Irs Without Appointment and download it to your device. Print your form to fill it out manually or upload the sample if you wish to use an online editor. Preparing official paperwork under federal and state laws is fast and straightforward with our platform. Try US Legal Forms today to keep your documents organized!

- All forms are correctly drafted and verified for authenticity, so you can be confident in obtaining an updated Sample Offer In Compromise Letter To Irs Without Appointment.

- If you are acquainted with our service and already possess an account, ensure your subscription is current before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation whenever needed by accessing the My documents tab in your profile.

- If you haven’t previously utilized our service, the process will require a few additional steps to complete.

- Here’s how new users can find the Sample Offer In Compromise Letter To Irs Without Appointment in our database.

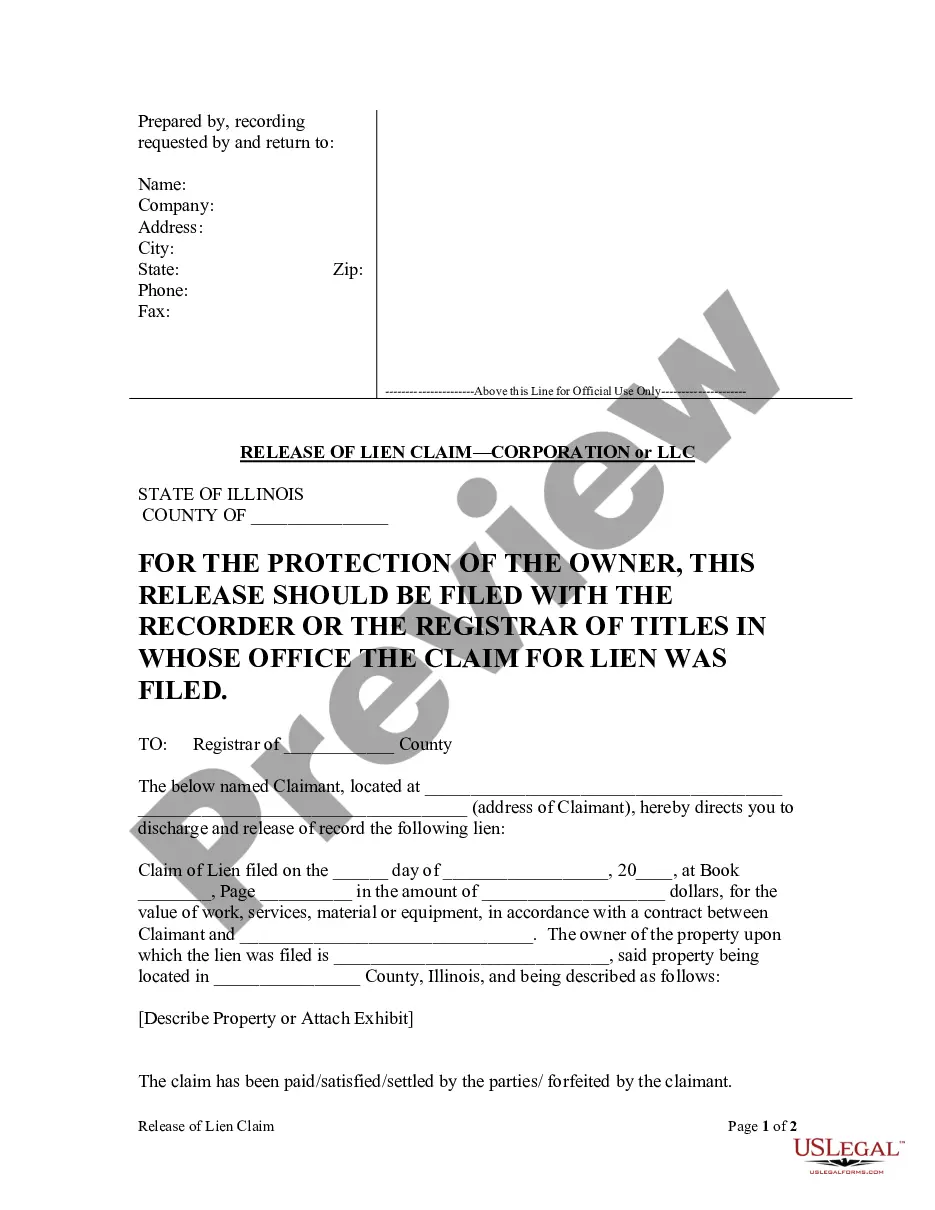

- Examine the page content thoroughly to confirm it includes the sample you require.

- To do this, make use of the form description and preview options if available.

Form popularity

FAQ

To submit an offer in compromise to the IRS, you should begin by completing IRS Form 656. You can find helpful templates and tools, such as a sample offer in compromise letter to irs without appointment, on platforms like USLegalForms. Make sure to include all required financial information to support your offer. Once completed, send the form and payment to the address specified in the instructions.

To make an offer of compromise with the IRS, you must complete Form 656 and provide financial documentation that supports your claim. A well-crafted sample offer in compromise letter to IRS without appointment can enhance your submission's clarity and persuasiveness. After submitting your offer, the IRS will review your case, so ensure that all details are accurate and complete. Consider turning to uslegalforms for guidance on preparing your documents and staying organized throughout this process.

You can contact the IRS by phone or through their official website for inquiries about an offer in compromise. If you want to avoid long wait times, consider preparing a sample offer in compromise letter to IRS without appointment to expedite the process. Make sure to have your tax information ready when you call, as this will help the IRS assist you more efficiently. Utilizing uslegalforms can also streamline your communication with the IRS, ensuring you present everything correctly.

Yes, you can file your own offer in compromise without legal representation. Many individuals handle their submissions independently by following IRS guidelines and using available templates. Using a sample offer in compromise letter to IRS without appointment can provide you with the structure needed to draft your proposal effectively.

While you do not need a lawyer to negotiate with the IRS, having one can provide substantial advantages. Lawyers can often navigate complex situations and advocate on your behalf more effectively. If you feel confident, you can negotiate on your own, especially with resources like a sample offer in compromise letter to IRS without appointment available from US Legal Forms.

The acceptance process for an offer in compromise can take several months. Once you submit, the IRS will review your offer, which can take anywhere from six months to a year or longer, depending on the complexity of your case. Staying patient and providing accurate information is key during this time. To accelerate your process, consider utilizing a sample offer in compromise letter to IRS without appointment.

To submit an offer in compromise to the IRS, collect the necessary forms and documentation that support your financial situation. You will typically need to complete Form 656 and Form 433-A or 433-B. It is essential to state your offer clearly in your letter, so having a sample offer in compromise letter to IRS without appointment can help in crafting a precise submission.

You do not necessarily need an attorney for an offer in compromise with the IRS. Many taxpayers successfully navigate the process on their own. However, having professional guidance can be beneficial, especially if you are unfamiliar with tax processes. Using US Legal Forms can give you access to templates, including a sample offer in compromise letter to IRS without appointment, that make this process easier.

Choosing the best company to help with IRS debt takes some research. Look for companies that have a solid track record in handling IRS negotiations. US Legal Forms offers resources and templates, including a sample offer in compromise letter to IRS without appointment, which can simplify the process for you.

When preparing an offer in compromise, you typically need several documents, including financial statements and tax returns. A well-structured sample offer in compromise letter to IRS without appointment should detail your income, expenses, and assets. Gathering these documents beforehand enhances clarity and supports your request.