What Is A Time Share Resort

Description

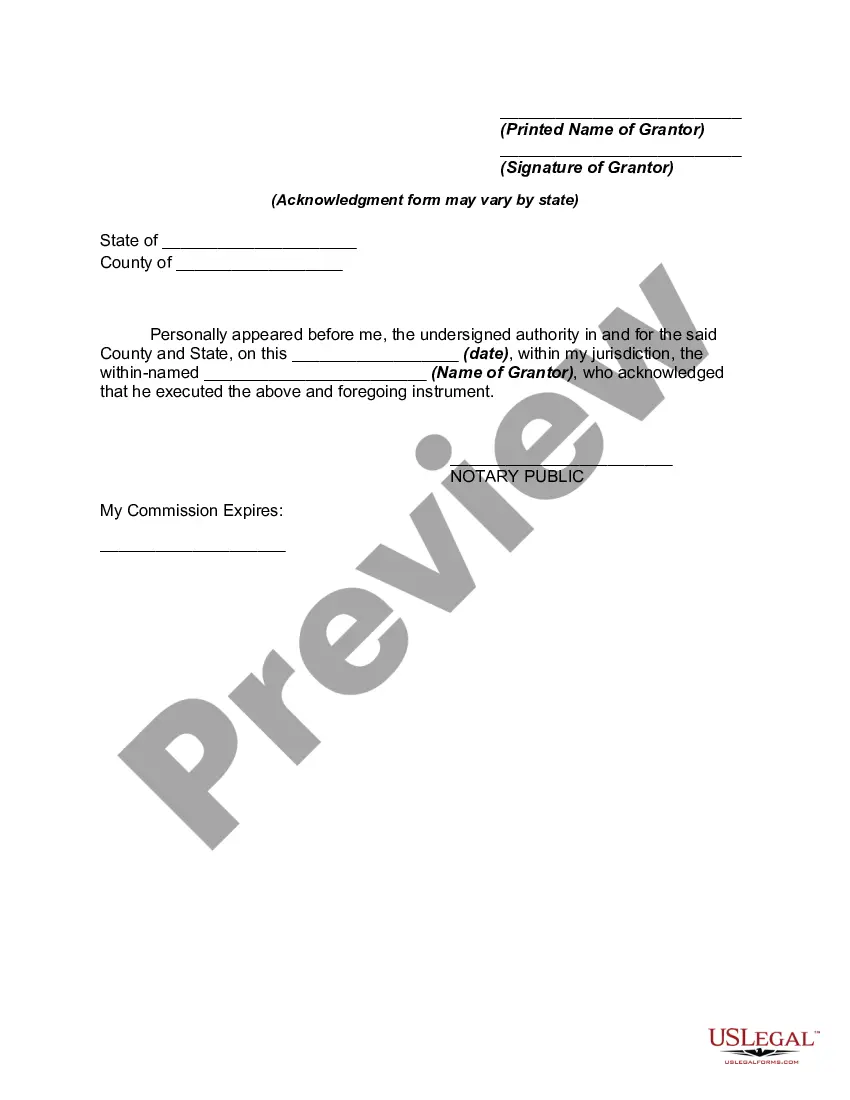

How to fill out Deed To Time Share Condominium With Covenants Of Title?

- If you're a returning user, simply log in to your account and download the necessary form by clicking the Download button. Confirm that your subscription is active; if it's expired, renew according to your payment plan.

- For first-time users, start by checking the Preview mode and form description. Make sure you select the correct document that meets your local jurisdiction requirements.

- If there are any discrepancies, utilize the Search tab to find another template that aligns with your needs. Once satisfied, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You'll need to create an account to access the full library.

- Complete your purchase by entering your credit card details or opting for PayPal to finalize the subscription.

- Download the form to your device for easy completion, and access it anytime in the My Forms section of your profile.

With US Legal Forms, you gain access to a vast collection of over 85,000 editable legal documents, empowering both individuals and attorneys to efficiently manage their legal needs.

Ready to get started? Explore US Legal Forms today and take control of your legal documents with confidence!

Form popularity

FAQ

Yes, you can file your timeshare on your taxes by reporting any income earned from it and deducting qualifying expenses. Make sure to list your timeshare correctly in the appropriate tax forms. Knowing how to navigate this filing process helps to manage your obligations related to what is a time share resort.

Timeshares affect taxes because they can generate both income and deductions. It's important to report any rental income, and you may also deduct related costs, such as maintenance fees. Understanding these tax implications helps clarify the financial landscape around what is a time share resort.

A timeshare can be considered a second home for tax purposes if you meet specific criteria, such as using it for personal enjoyment. This classification can allow you to deduct mortgage interest and property taxes. Understanding this aspect can clarify financial responsibilities associated with what is a time share resort.

You may write off certain fees related to your timeshare, especially if it is rented out. Deductible expenses could include maintenance fees and property taxes. Keep detailed records to maximize your deductions and navigate the nuances of what is a time share resort.

When reporting a timeshare on your tax return, you should generally include it under the section for personal property. This property can be reported in Schedule A if you itemize your deductions. It is essential to track any income generated from your timeshare rentals, as this can also affect how you report it.

The concept behind timeshares revolves around shared ownership of a vacation property. When you ask, 'What is a time share resort?' you uncover the idea of having guaranteed access to a vacation home at different times of the year. This setup allows families and friends to create lasting memories without the burden of full ownership. Additionally, timeshares can provide a sense of community, as owners often share experiences and recommendations.

Many people wonder, 'What is a time share resort?' to evaluate if it's worth their investment. Timeshares can be beneficial for those who enjoy regular vacations at a specific location, as they often offer significant savings over traditional hotel rates. However, commitment is essential; you need to be certain that you will utilize the time allotted. So, while timeshares do have their advantages, it's wise to weigh the costs and benefits before making a decision.

The 1 in 4 rule for timeshares states that owners can only use their timeshare for residency in a property once every four years, in most cases. This rule is essential for maintaining access to a timeshare resort while allowing other owners to enjoy their allocated time. If you are considering a timeshare, understanding this rule can help you grasp the usage patterns associated with what is a time share resort. Knowing the limitations can help you make informed decisions about your investment.