Seller Financing Vs Contract For Deed

Description

How to fill out Contract For The Sale Of Motor Vehicle - Owner Financed With Provisions For Note And Security Agreement?

Legal administration can be daunting, even for the most experienced experts.

When you are looking for a Seller Financing Vs Contract For Deed and lack the time to invest in finding the correct and current version, the process can be taxing.

US Legal Forms caters to any needs you may have, from personal to business documents, all in one location.

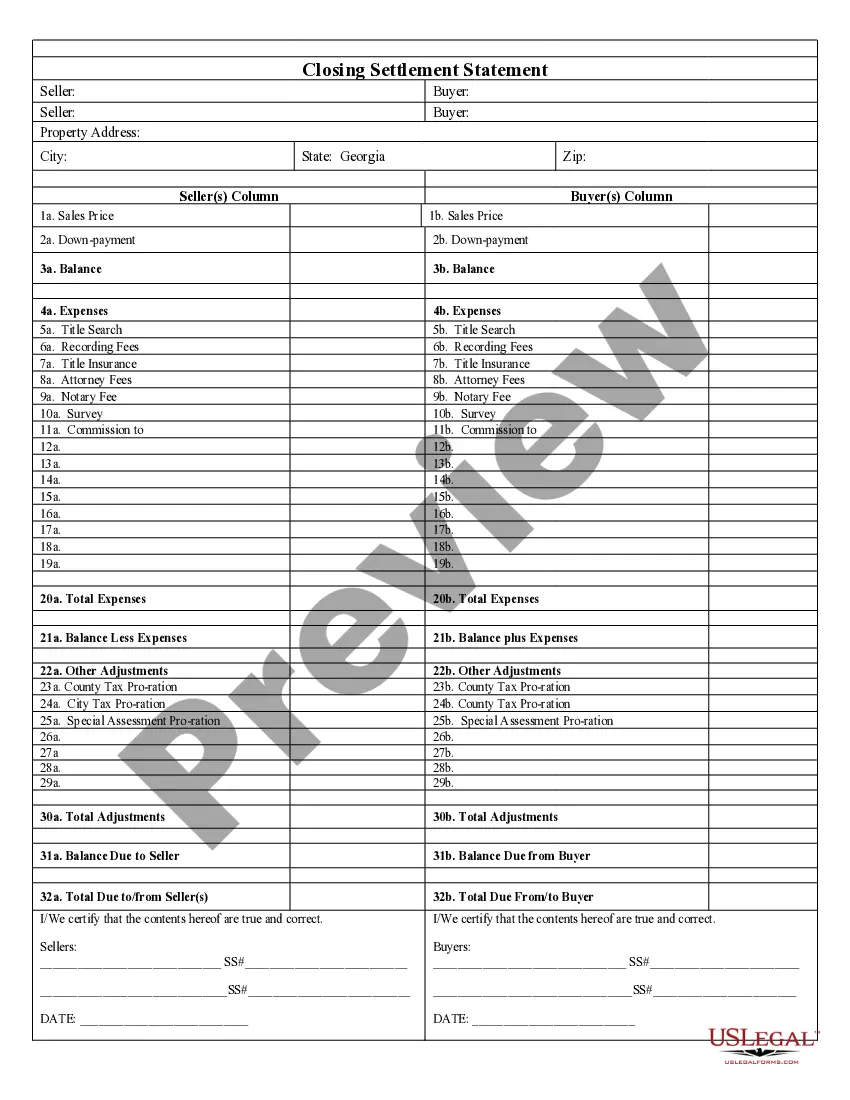

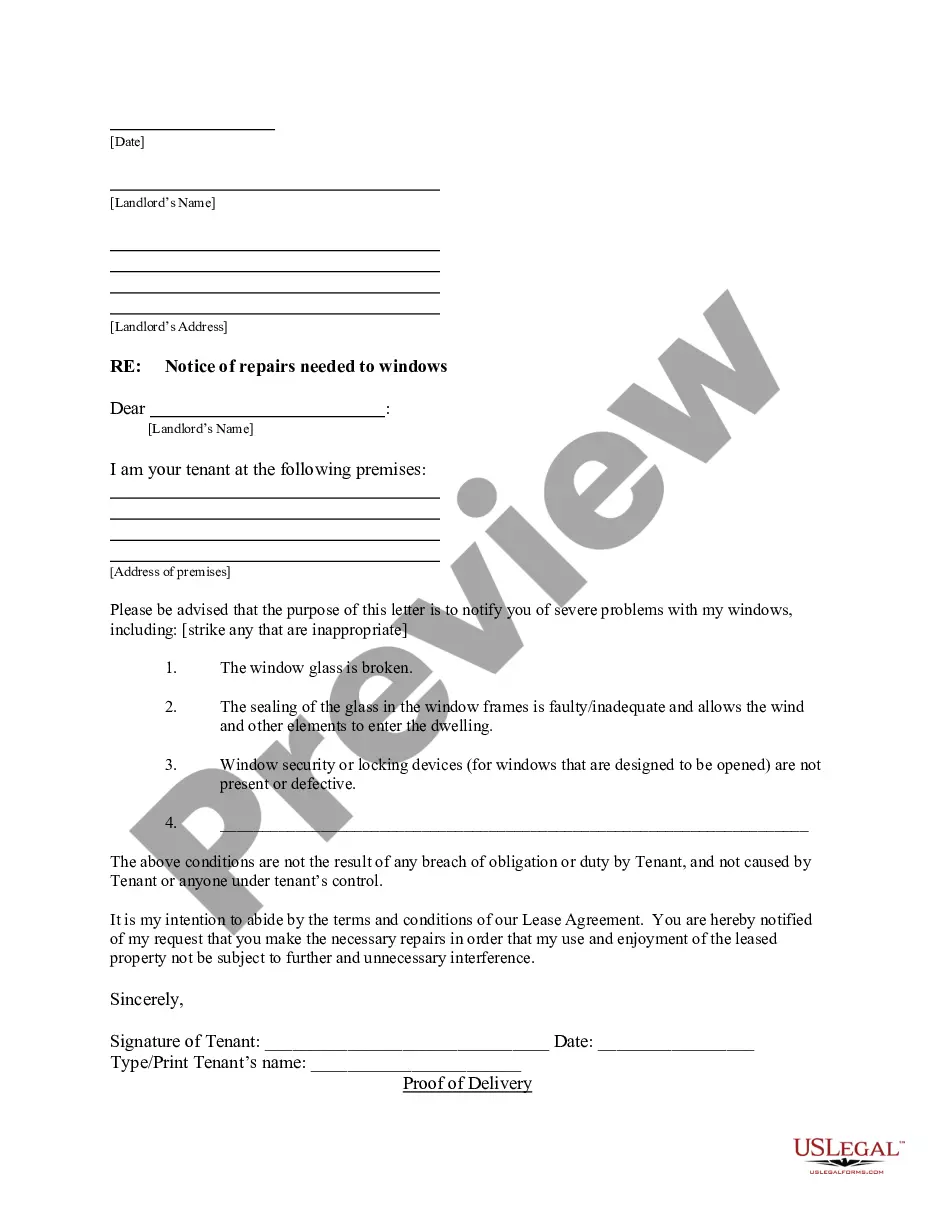

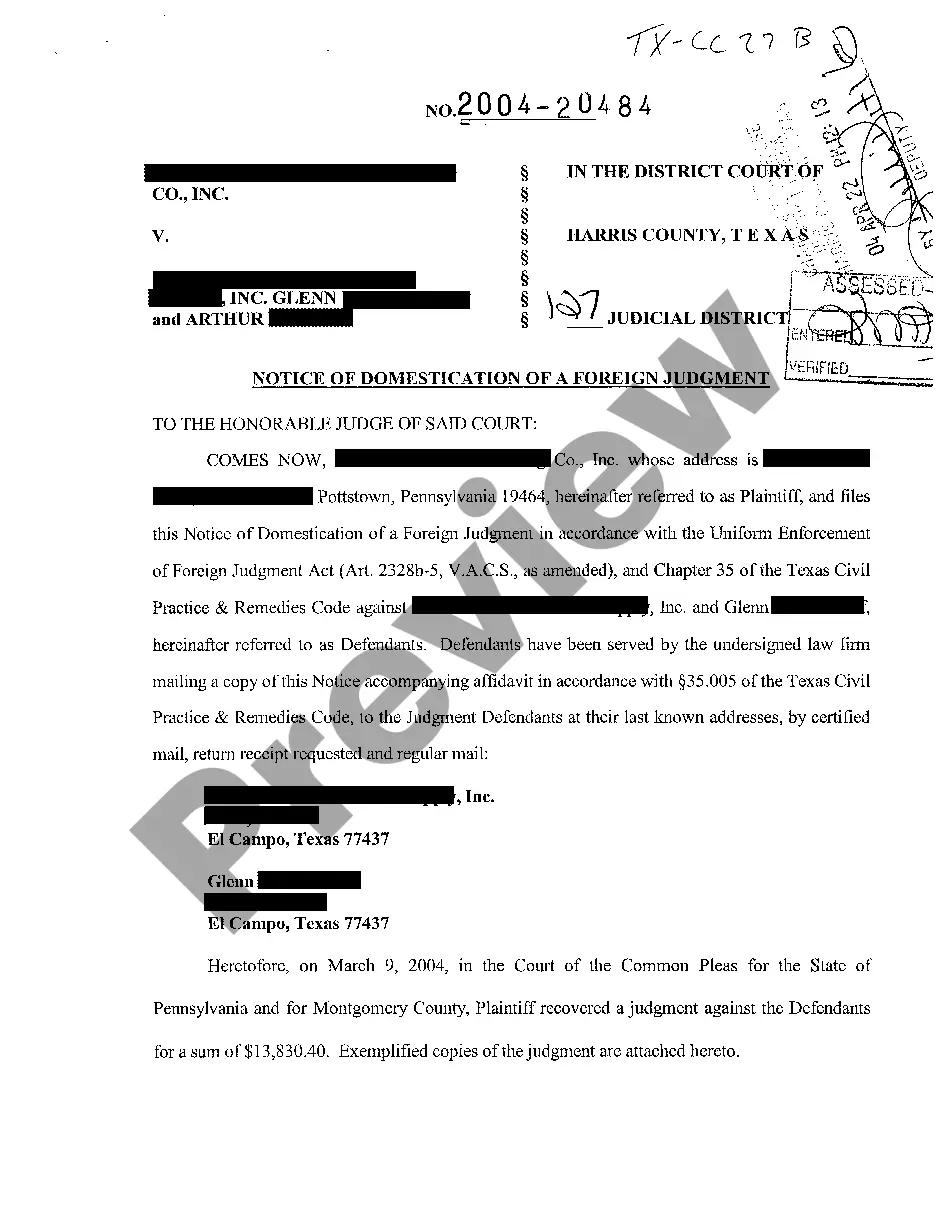

Utilize advanced tools to fill out and manage your Seller Financing Vs Contract For Deed.

Here are the steps to follow after obtaining the form you need: Verify that this is the correct form by previewing it and reviewing its details. Ensure that the sample is accepted in your state or county. Click Buy Now when you are ready. Choose a monthly subscription plan. Select the format you need, and Download, complete, sign, print, and submit your document. Enjoy the US Legal Forms online library, backed by 25 years of expertise and reliability. Streamline your daily document management into a seamless and user-friendly experience today.

- Access a library of articles, guides, and materials related to your situation and needs.

- Save time and effort in finding the documents you require, and use US Legal Forms’ advanced search and Review feature to locate Seller Financing Vs Contract For Deed and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check the My documents tab to discover the documents you have previously saved and manage your folders as you wish.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the platform's benefits.

- An extensive online form repository could transform the way anyone handles these situations efficiently.

- US Legal Forms is a leader in the online legal forms sector, offering over 85,000 state-specific legal forms at any time.

- With US Legal Forms, you can access a range of state or county-specific legal and organizational forms.

Form popularity

FAQ

Owner financing involves greater risk for sellers compared to traditional lenders. This means that buyers often have to pay higher interest rates and make higher loan payments over the life of the loan. Owner Financing: Definition, Example, Advantages, and Risks investopedia.com ? terms ? owner-financing investopedia.com ? terms ? owner-financing

Risks of a Contract for Deed Even one late payment can result in much higher penalties and fees, not to mention possible legal action from the seller (including kicking the homebuyer out of the home without recouping any money they have paid while living there).

A contract for deed is a type of seller financing, where the seller agrees to give possession of the property to the buyer immediately. The buyer makes payments directly to the seller, usually monthly, over a period of time agreed upon by both parties and established within the contract. A Guide to Contract for Deed - ? blog ? guide-to-contract-... ? blog ? guide-to-contract-...

Here's a quick look at some of the most common types of seller financing. All-inclusive mortgage. In an all-inclusive mortgage or all-inclusive trust deed (AITD), the seller carries the promissory note and mortgage for the entire balance of the home price, less any down payment. Junior mortgage. Seller Financing: How It Works in Home Sales | Nolo nolo.com ? legal-encyclopedia ? seller-finan... nolo.com ? legal-encyclopedia ? seller-finan...

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate. Contract For Deed ? Advantages and Disadvantages - Maitin Law Firm maitinlaw.com ? 2020/02/21 ? contract-for-... maitinlaw.com ? 2020/02/21 ? contract-for-...