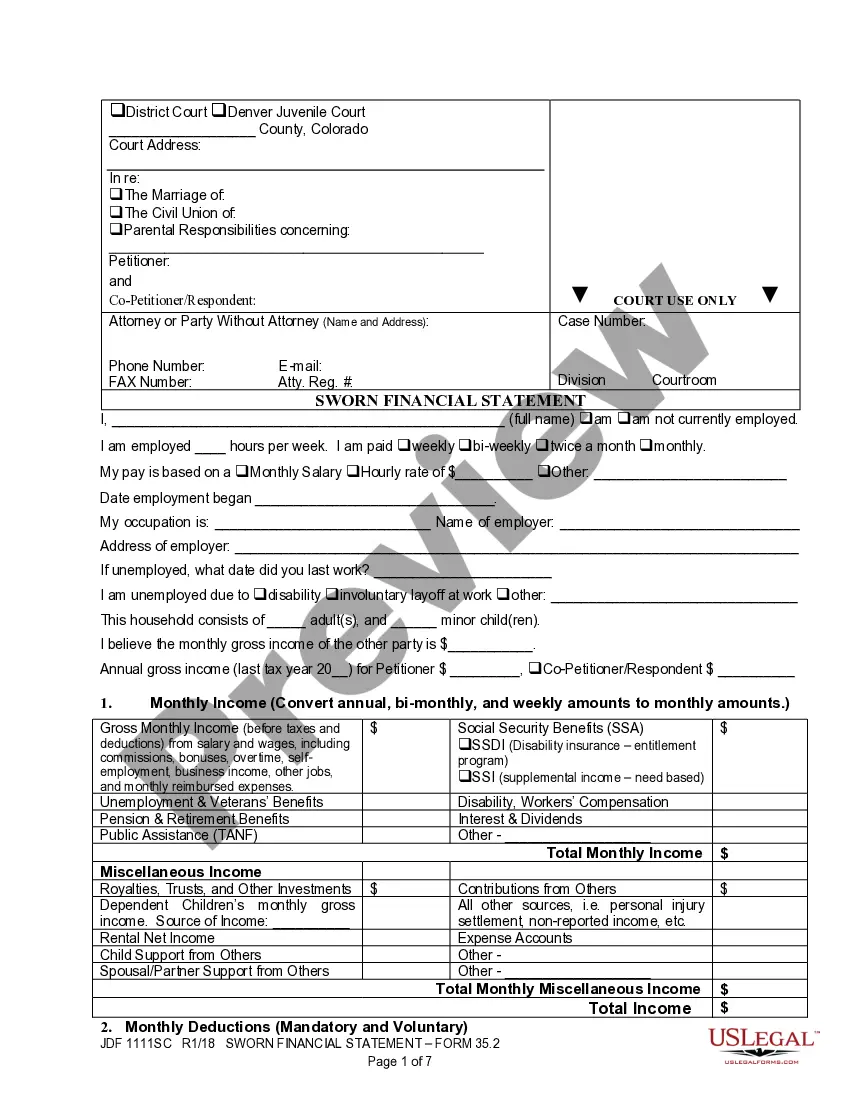

Whats A Garnishment Order

Description

How to fill out Motion To Discharge Or Quash Writ Of Garnishment?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and a significant financial commitment.

If you're in search of a simpler and more economical method for generating Whats A Garnishment Order or any other documents without the hassle, US Legal Forms is always readily available.

Our online collection of more than 85,000 current legal templates addresses nearly every facet of your financial, legal, and personal matters.

Before proceeding to download Whats A Garnishment Order, consider these suggestions: Review the document preview and descriptions to confirm you are selecting the correct form. Ensure the template you select adheres to the laws and regulations of your state and county. Choose the most appropriate subscription option for purchasing the Whats A Garnishment Order. Download the document, then complete, verify, and print it out. US Legal Forms is proud of its impeccable reputation and more than 25 years of experience. Join us today and make document preparation a straightforward and efficient process!

- With just a handful of clicks, you can quickly obtain state- and county-compliant forms meticulously prepared for you by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can effortlessly locate and download the Whats A Garnishment Order.

- If you're a returning user and have previously set up an account with us, simply Log In to your account, locate the form, and download it or access it later in the My documents section.

- Don't have an account? No problem. It requires minimal time to register and browse the catalog.

Form popularity

FAQ

Georgia Wage Garnishment Laws The amount by which your disposable earnings per week exceeds 30 times the federal minimum wage. If your disposable income is less than the federal minimum wage, it cannot be garnished. In other words, if your disposable income for a week exceeds $217.50, that amount can be garnished.

812.33 Garnishee fees. (1) The creditor shall pay a $15 fee to the garnishee for each earnings garnishment or each stipulated extension of that earnings garnishment. This fee shall be included as a cost in the creditor's claim in the earnings garnishment. (2) In addition to the $15 garnishee fee under sub.

Ordinary garnishments Under Title III, the amount that an employer may garnish from an employee in any workweek or pay period is the lesser of: 25% of disposable earnings -or- The amount by which disposable earnings are 30 times greater than the federal minimum wage.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673.)

By law, you are entitled to an exemption of not less than 80% of your disposable earnings. Your "disposable earnings" are those remaining after social security and federal and state income taxes are withheld.