Garnishment Form With Bank

Description

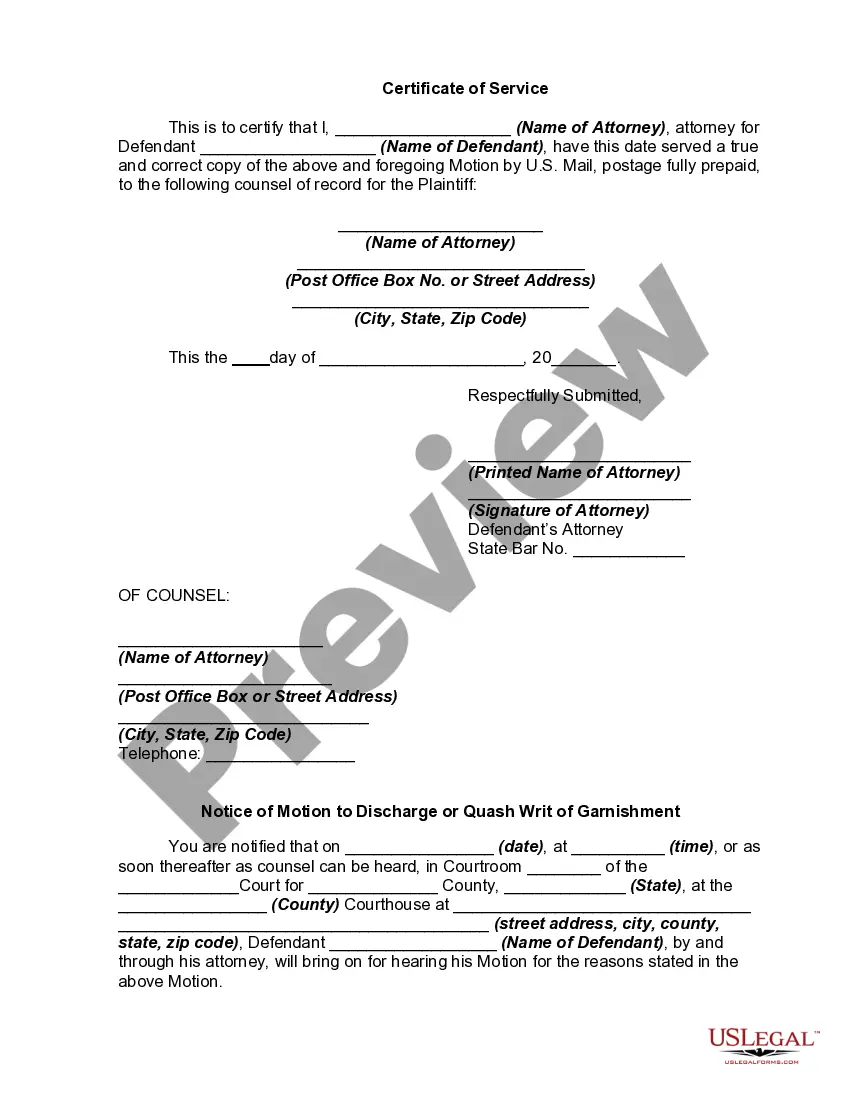

How to fill out Motion To Discharge Or Quash Writ Of Garnishment?

Managing legal documents can be exasperating, even for the most seasoned experts.

If you require a Garnishment Form With Bank and do not have the opportunity to spend time looking for the proper and current version, the process can be stressful.

US Legal Forms accommodates any requirements you may have, from personal to business documentation, all consolidated in one location.

Utilize advanced tools to fill out and manage your Garnishment Form With Bank.

Here are the steps to follow after obtaining the form you desire: Verify that this is the correct document by previewing it and reviewing its description.

- Access a comprehensive library of articles, guides, manuals, and resources pertinent to your situation and requirements.

- Conserve time and energy searching for the documents you need, and leverage US Legal Forms’ sophisticated search and Review tool to locate and download your Garnishment Form With Bank.

- If you possess a subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Check your My documents section to view the documents you have previously saved and organize your folders as needed.

- If this is your first time using US Legal Forms, establish a complimentary account to gain unlimited access to all platform benefits.

- A robust online form repository can be transformative for anyone who wishes to handle these matters effectively.

- US Legal Forms is a pioneer in digital legal documents, offering over 85,000 state-specific forms readily available to you at any time.

- With US Legal Forms, you can access relevant legal and business documents specific to your state or county.

Form popularity

FAQ

Creating a living trust in Indiana is simple. There is no specific form required and your trust document must simply be clear in its terms. You sign the document in front of a notary and then fund the trust by placing ownership of assets in its name.

A trust established under this chapter must be an irrevocable trust and may not be revoked or terminated by the authority or any other person, nor may it be amended or altered by the authority or any other person. However, the terms of the trust must provide that the trust terminates when no funds remain in the trust.

How to Write ( Fill Out ) a Living Trust Form Step 1: Fill out the grantor information. ... Step 2: Indicate the purpose of the trust. ... Step 3: Include trustee information. ... Step 4: List beneficiaries and make specific gifts. ... Step 5: Sign and notarize the completed document.

In Indiana, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more. Online platforms like Snug provide more affordable options for creating wills and trusts, offering transparent pricing and quality estate planning services.

Indiana law does not explicitly require a trust to be notarized; however, notarizing a trust provides extra protection for the signor if the signature is ever contested. To read and review the requirements of a Trust, you can visit Indiana Code § 30-4-2-1.

A living trust Indiana is a private contract that is not filed with a court or made part of the public record. This is often considered one of the most important benefits of a trust. The assets in the trust, terms of the trust, and beneficiaries remain secret.

The certification of trust must contain the following information: (1) That the trust exists and the date the trust instrument was executed. (2) The identity of the settlor. (3) The identity and address of the currently acting trustee.

In order to establish a trust, Indiana law requires that a person be over the age of 18 and be of sound mind. A person must describe the trust in writing.