Trainer Fitness Form Without Training

Description

How to fill out Personal Training Or Trainer And Fitness Center Membership Application And Agreement Including Waiver And Indemnification Agreement?

Regardless of whether it's for professional reasons or personal affairs, everyone must confront legal matters at some point in their lifetime.

Filling out legal documents requires meticulous care, beginning with selecting the correct template.

Fill out the account registration form, select your payment method (bank card or PayPal), choose the desired document format, and download the Trainer Fitness Form Without Training. Once saved, you can either complete the form using editing software or print it out and fill it in manually. With a vast collection from US Legal Forms available, you won't waste time searching for the correct template online. Utilize the library's easy navigation to find the right document for any occasion.

- For example, selecting an incorrect version of a Trainer Fitness Form Without Training will lead to its rejection upon submission.

- It is crucial to find a trustworthy source for legal documents like US Legal Forms.

- If you need a Trainer Fitness Form Without Training template, follow these straightforward instructions.

- Obtain the required sample using the search bar or catalog navigation.

- Review the description of the form to confirm that it suits your situation, state, and locale.

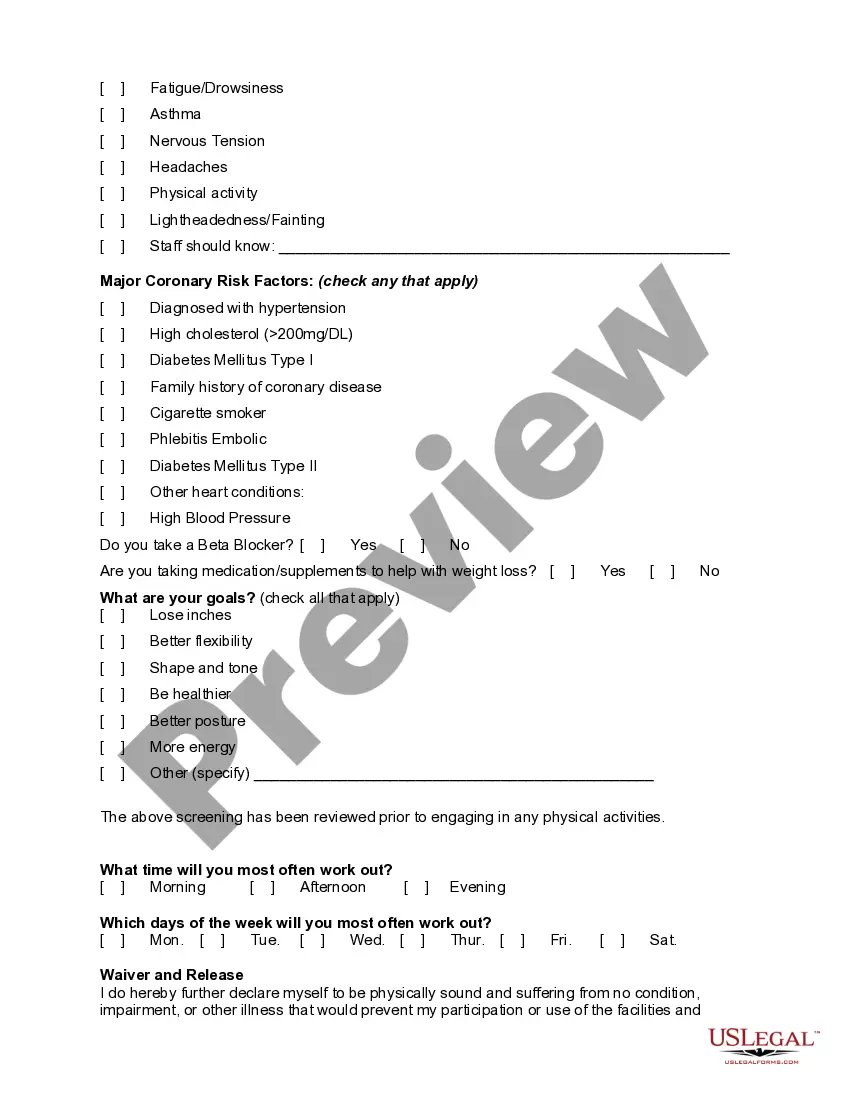

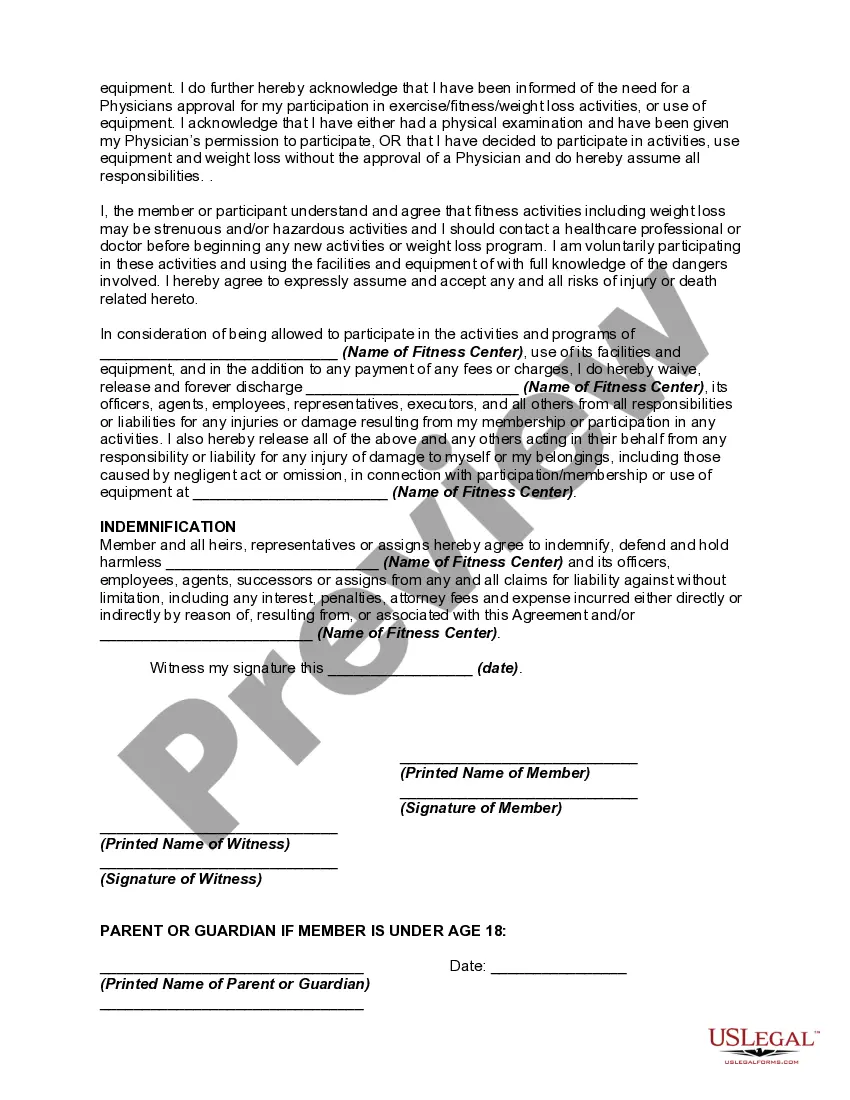

- Click on the preview of the form to examine it.

- If it's the incorrect document, return to the search option to find the Trainer Fitness Form Without Training template you require.

- Download the file when it fulfills your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access pre-saved documents in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the appropriate pricing choice.

Form popularity

FAQ

Learning proper form at the gym is essential for safety and effectiveness. You can watch tutorial videos, seek feedback from gym staff, or work with a trainer. Focusing on the trainer fitness form without training can improve your workouts and help prevent injuries.

The 3/2/1 rule in the gym refers to a structured approach to balancing different types of workouts. It suggests performing three cardio sessions, two strength training sessions, and one flexibility-focused session each week. This approach promotes overall fitness while preventing burnout. Consider maintaining a trainer fitness form without training to track your progress against this rule.

How can I check my CIBIL Report? You can request for your CIBIL report by visiting the cibil website. You will need to enter personal details such as name, PAN card number, date of birth, gender, etc., clear the personal verification process, and make a fee payment in order to access your credit report.

Through net banking Most of the banks under its net banking facility provides the 'loan' section through which a customer can view the details of loans availed by them. Click on 'loan' and you can download the e-statement on your computer or simply view your personal loan statement online.

Secured loans tend to have less stringent requirements and more favorable terms because the lender can take your collateral if you miss your loan payments. Some of the easiest loans to get in this category include auto title loans and pawnshop loans, but these also tend to be relatively expensive loans.

You can find your federal student loan balances by logging into your account at StudentAid.gov. For private student loan balances, you can contact your loan servicer or check your credit report. Experian, TransUnion and Equifax now offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com.

Your income will determine the loan amount you are eligible for. Lenders will consider your take-home salary, minus certain common deductions such as gratuity, PF, ESI, etc. The take-home salary will determine the EMI amount you can afford and thus the total loan amount you can borrow.

A hardship loan is a loan to cover an unexpected financial shortfall, either because your expenses went up or your income went down. Hardship loans are not like other loans that are designed to meet an expected or planned need (like a car loan or a business expansion loan).

Loan Term: The amount of time that the borrower has to repay the loan. Interest Rate: The rate at which the amount of money owed increases, usually expressed in terms of an annual percentage rate (APR). Loan Payments: The amount of money that must be paid every month or week in order to satisfy the terms of the loan.

In-person or phone interviews: Loan officers conduct in-person or phone interviews with customers and key the data into the internal systems. Paper forms: Customers fill out paper forms, which are then scanned and inputted into the system.