Proposed Probate Form With Decimals

Description

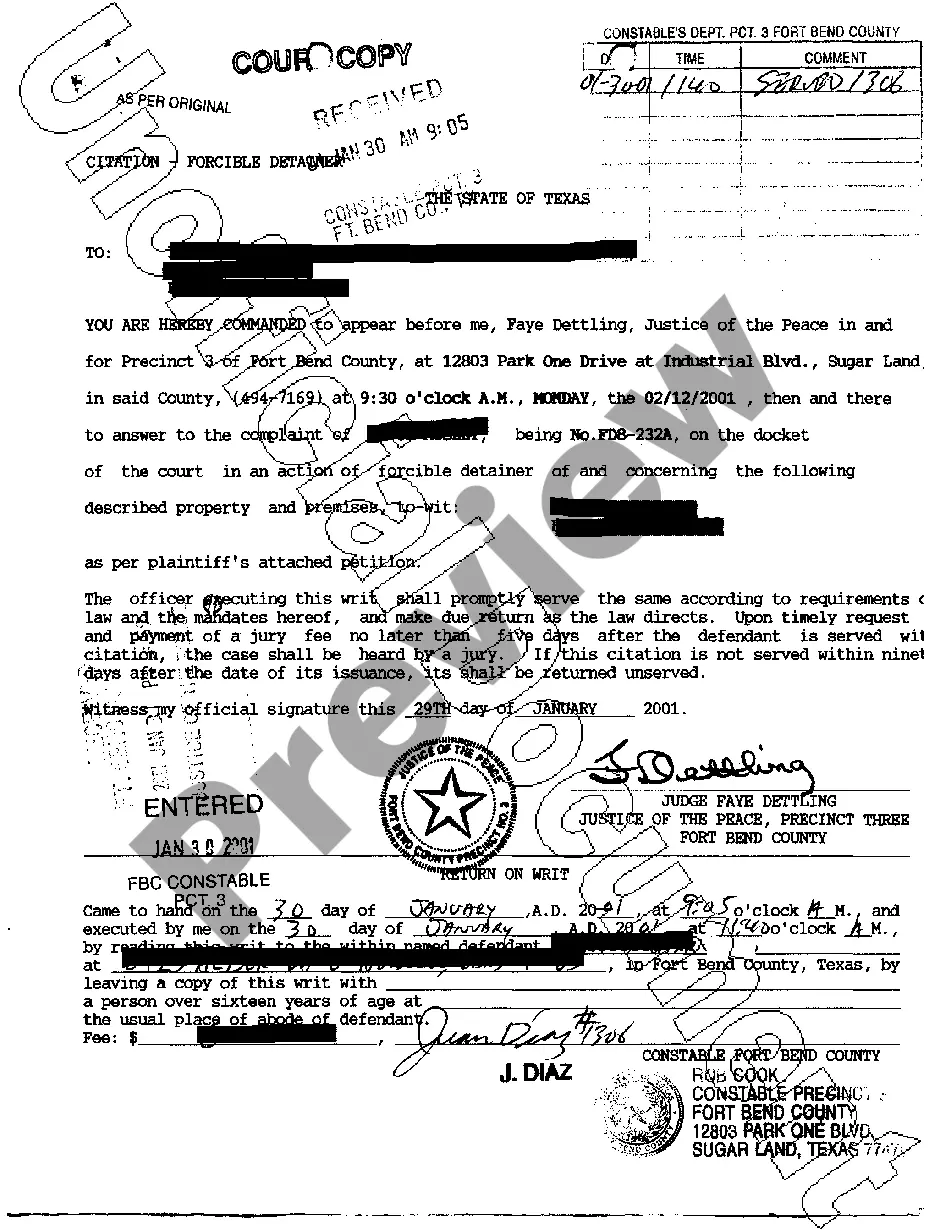

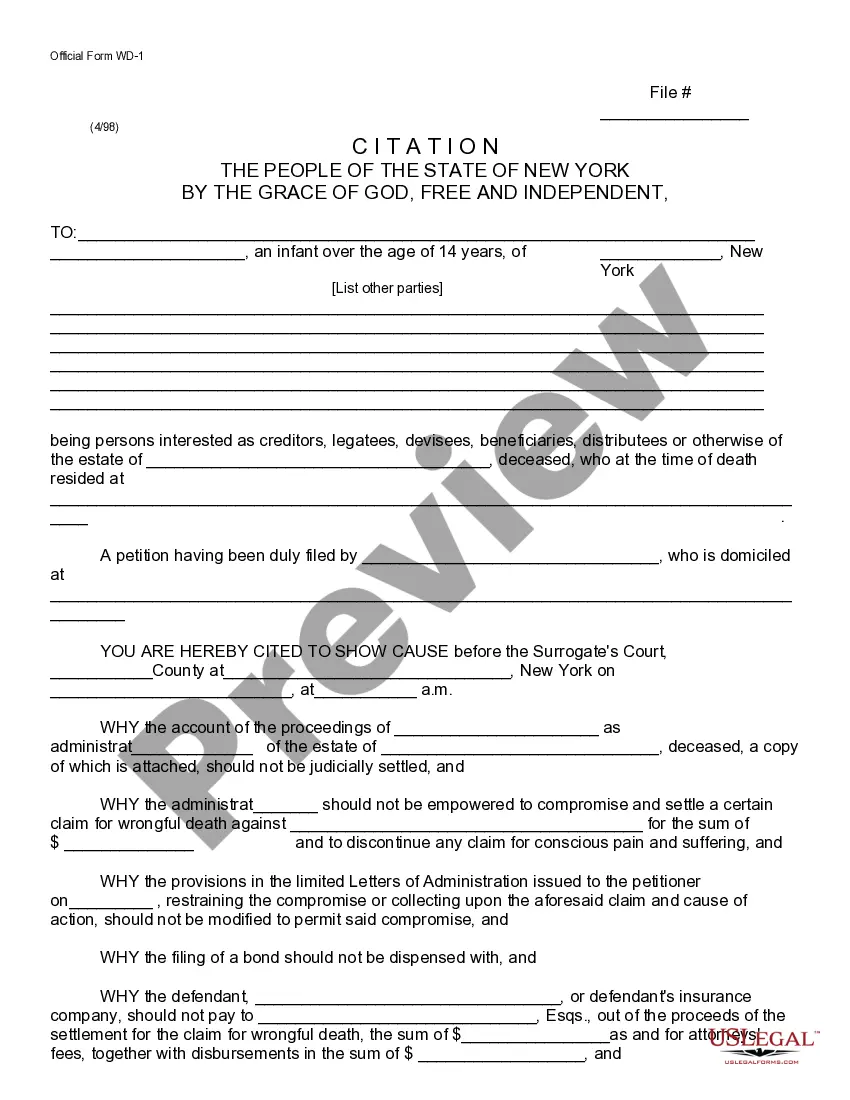

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Legal administration can be daunting, even for proficient professionals.

If you are looking for a Proposed Probate Form With Decimals and lack the opportunity to seek out the correct and current version, the process can be stressful.

US Legal Forms addresses all your needs, ranging from personal to commercial documentation, all in a single platform.

Utilize state-of-the-art tools to complete and manage your Proposed Probate Form With Decimals.

Here are the steps to follow after accessing the form you require: Verify its accuracy by previewing it and examining its details. Ensure that the sample is valid in your jurisdiction. Click Buy Now when you are ready. Choose a subscription plan. Select the file format you need, and Download, complete, sign, print, and send your documents. Experience the US Legal Forms online catalog, built on 25 years of expertise and reliability. Transform your routine document management into a seamless and user-friendly process today.

- Access a valuable knowledge base of articles, guides, handbooks, and resources pertinent to your situation and needs.

- Save time and effort in locating the required documents by using US Legal Forms' advanced search and Review tool to find your Proposed Probate Form With Decimals.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to review the documents you previously saved and manage your folders as desired.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to all the benefits of the library.

- A comprehensive online form archive can transform the way anyone manages these matters.

- US Legal Forms is a forefront provider in online legal documents, boasting over 85,000 state-specific legal forms available at your convenience.

- With US Legal Forms, you can access various legal and business forms tailored to your state or county.

Form popularity

FAQ

However, West Virginia does not have a central repository for court records, unlike other states. Instead, you will need to contact the court clerk in the county where the case was filed to obtain copies of court records.

Under federal law, all civil actions have a filing fee of $400.00. You can pay the filing fee by credit card or money order. Money orders must be payable to "Clerk, U.S. District Court".

In general, claims are limited to disputes up to $5,000. However, natural persons (individuals) can claim up to $10,000. Corporations, partnerships, unincorporated associations, governmental bodies, and other legal entities cannot claim more than $5,000.

Small claims rules and procedures are simpler than other courts. The hearing is informal. There is no jury. Parties represent themselves without lawyers.

In West Virginia, small claims court is called magistrate court. You may file in magistrate court on your own for anything that is $10,000 or less.

They hear misdemeanor cases, conduct preliminary examinations in felony cases and hear civil arguments with $10,000 or less in dispute. Cases lost in magistrate court can be appealed to circuit court.