Final Accounts Form With Adjustments Class 12

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

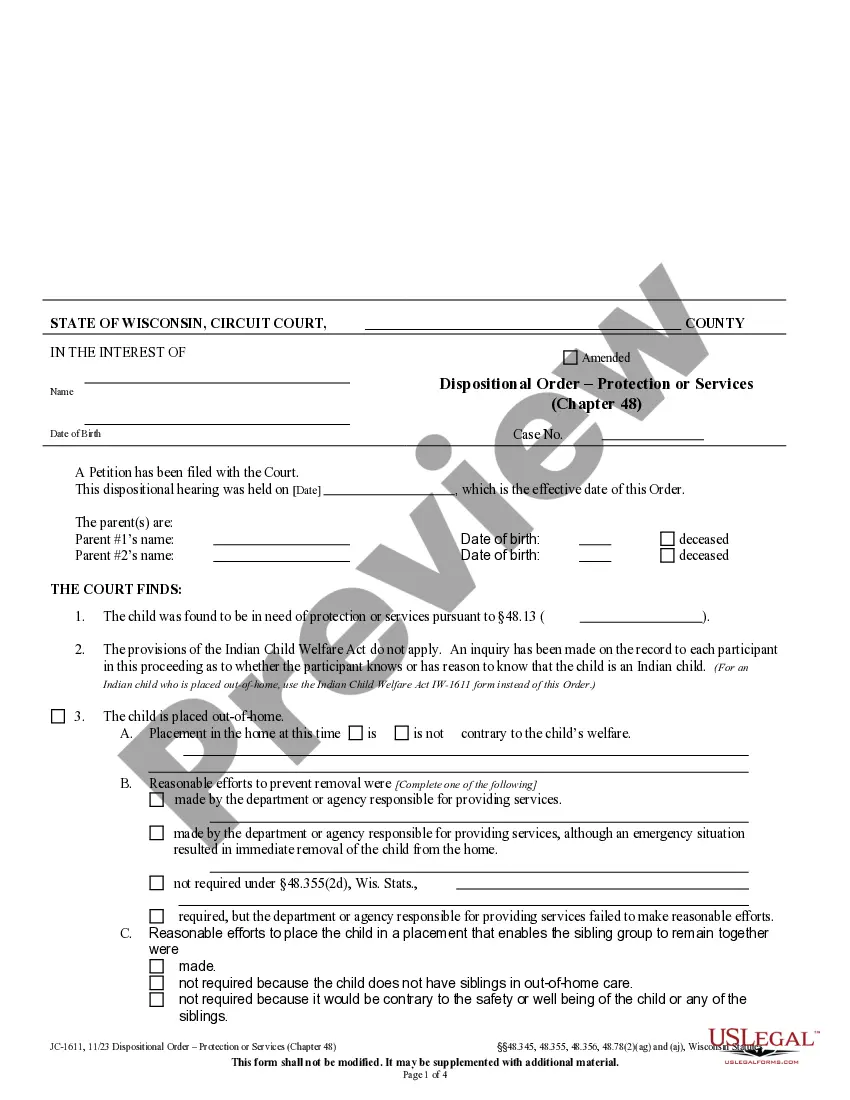

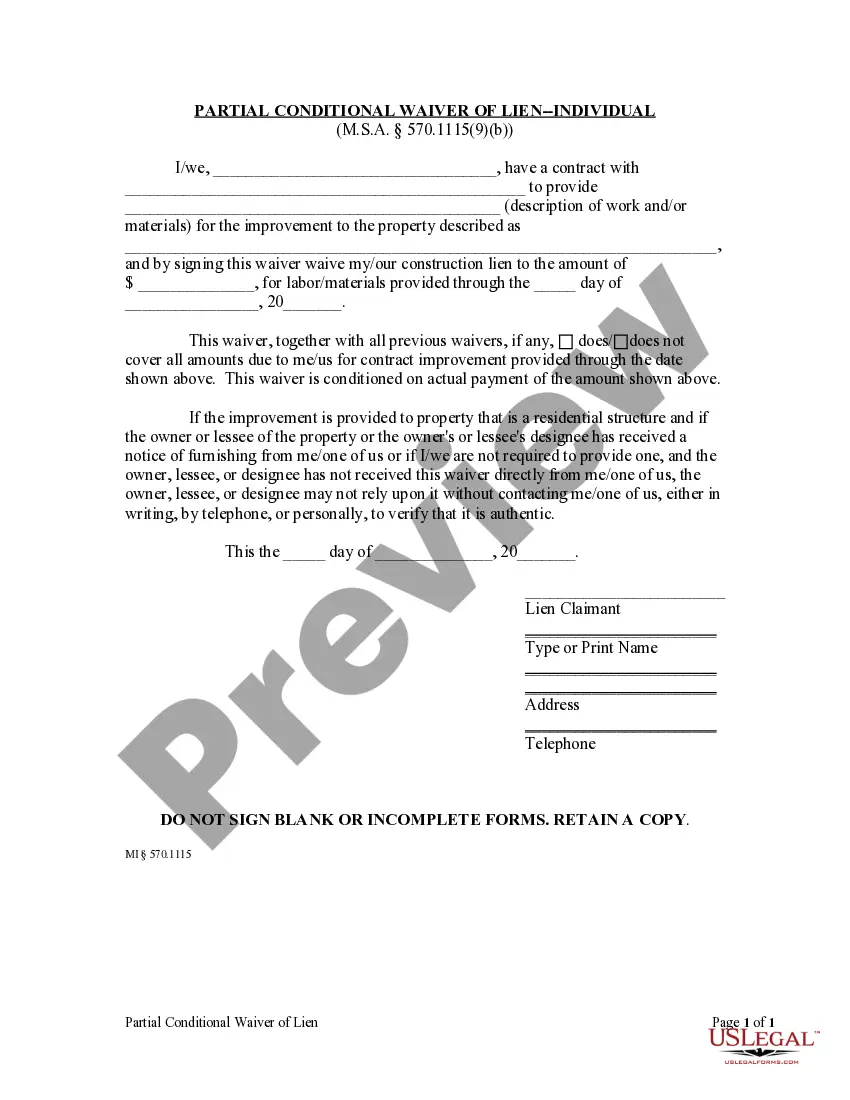

The Final Accounts Document With Alterations Class 12 you observe on this page is a versatile legal template created by qualified attorneys in accordance with federal and regional statutes and regulations.

For over 25 years, US Legal Forms has offered individuals, entities, and lawyers more than 85,000 validated, state-specific documents for any enterprise and personal circumstance. It’s the quickest, simplest, and most dependable means to procure the paperwork you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Pick the format you wish for your Final Accounts Document With Alterations Class 12 (PDF, Word, RTF) and save the sample on your device.

- Search for the document you require and examine it.

- Browse the file you sought and preview it or verify the form description to ensure it meets your needs. If it doesn’t, utilize the search bar to find the appropriate one. Click Buy Now when you have located the template you need.

- Choose and Log Into your account.

- Select the pricing plan that fits your needs and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and review your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

In the final accounts form with adjustments class 12, adjusted purchases are recorded in the trading account. This entry reflects the changes made to the purchases, ensuring that the final accounts accurately portray the financial position of the business. By including adjusted purchases, you can provide a clear picture of your expenses and profits. Using the US Legal Forms platform can simplify this process, allowing you to create and manage your final accounts efficiently.

To prepare a final account with adjustments, start by gathering your financial records, including income statements and balance sheets. Identify any adjustments needed, such as depreciation or accrued expenses, and record them in the appropriate accounts. Using a structured approach, like the final accounts form with adjustments class 12, simplifies this process and ensures that your financial statements are precise and compliant with accounting standards.

Creating a Profit and Loss adjustment account involves recording all income and expenses and making necessary adjustments for accuracy. You will start by listing all revenues, followed by expenses, and then apply adjustments such as accrued income and outstanding expenses. Utilizing the final accounts form with adjustments class 12 will guide you in structuring this account effectively, ensuring clarity in financial reporting.

Adjusting entries in final accounts are entries made at the end of an accounting period to account for income and expenses that have not yet been recorded. These entries ensure that the financial statements present a true and fair view of the company's financial position. For students learning about the final accounts form with adjustments class 12, mastering these entries is essential for accurate financial reporting.

The final account with adjustments is a crucial financial report that summarizes a company's performance over a specific period. It includes the Profit and Loss account, which reflects revenues and expenses, and the Balance Sheet, which shows the company's assets and liabilities. In the context of class 12 accounting, understanding this form helps students learn how to accurately present financial information while incorporating necessary adjustments.

The four types of adjusting entries include accruals, deferrals, estimates, and re-evaluations. Accruals account for revenues or expenses that have occurred but are not yet recorded, while deferrals involve payments received or made before the associated revenue or expense is recognized. Estimates are used for uncertain amounts, and re-evaluations adjust previous estimates based on new information. A final accounts form with adjustments class 12 can help you manage these entries effectively, ensuring your financial statements are precise.

Recording adjustments in accounting involves identifying the necessary changes to account balances and making appropriate journal entries. Adjustments may include accruals, deferrals, or estimates, which help align financial statements with actual performance. By using a final accounts form with adjustments class 12, you can efficiently track these changes and maintain accurate records.

To prepare final accounts with adjustments, start by gathering all relevant financial data, including trial balance and necessary adjustment details. Next, create an income statement to reflect revenues and expenses, followed by the balance sheet to present assets and liabilities. Utilizing a final accounts form with adjustments class 12 can simplify this process, ensuring accurate representation of your financial position.

Adjustment entries are essential for ensuring that your final accounts form with adjustments class 12 accurately reflects the financial position of a business. These entries include transactions that have occurred but have not yet been recorded in the financial statements, such as accrued expenses or prepaid income. By making these adjustments, you ensure that your income statement and balance sheet provide a true and fair view of your business’s performance for the accounting period.