Final Account Form Statement For Huf

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

It’s obvious that you can’t become a legal expert overnight, nor can you grasp how to quickly prepare Final Account Form Statement For Huf without the need of a specialized set of skills. Putting together legal forms is a time-consuming venture requiring a certain education and skills. So why not leave the preparation of the Final Account Form Statement For Huf to the pros?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court paperwork to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our website and obtain the document you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

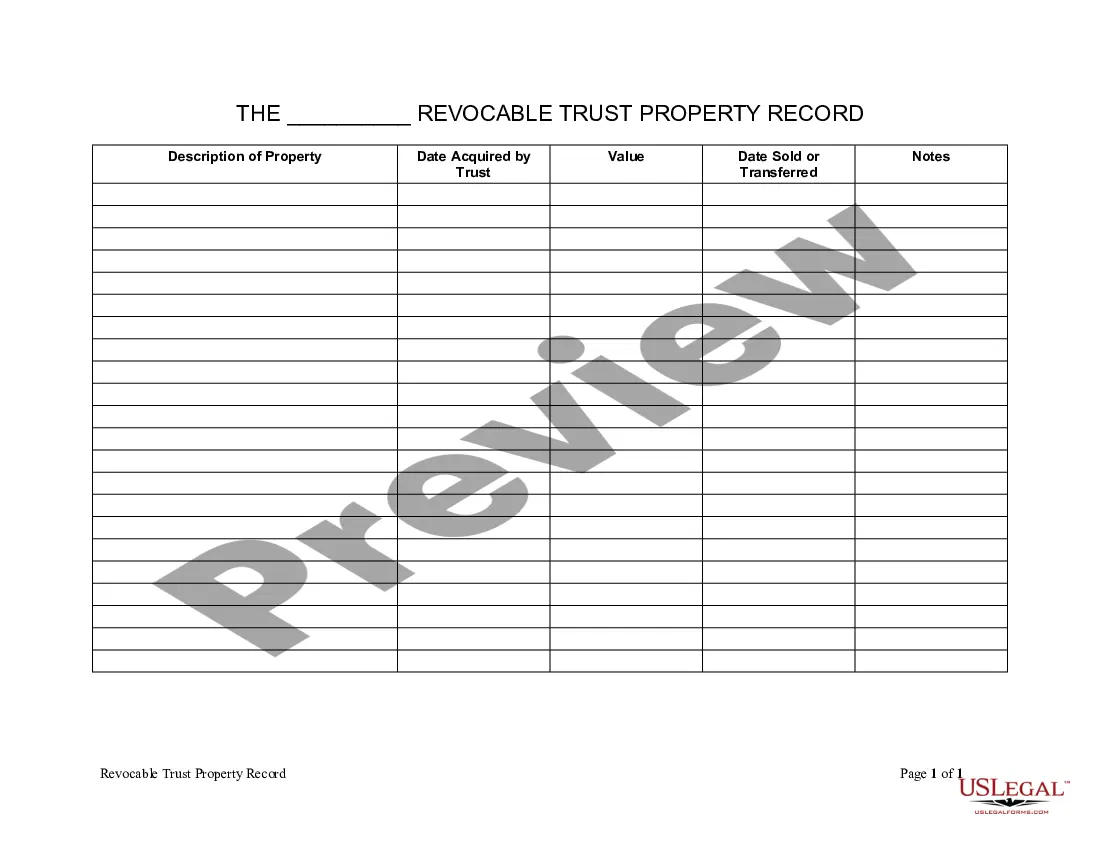

- Preview it (if this option provided) and read the supporting description to determine whether Final Account Form Statement For Huf is what you’re searching for.

- Begin your search over if you need a different template.

- Register for a free account and select a subscription option to buy the template.

- Choose Buy now. Once the payment is complete, you can download the Final Account Form Statement For Huf, complete it, print it, and send or send it by post to the necessary people or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

The executor statement of account should include: List of all debts and assets submitted with the application for probate. List of every cent that went out of and came into the estate, including the date. Reconciliation of current amount in bank account with everything that went out of and came into the estate.

This is a formal hearing in which the Court receives and reviews the executor's accounts to assess whether or not the disputed items are reasonable. If any beneficiary is requesting a passing of accounts, he/she can be proactive by filing a Petition with the Court.

Final accounts are those accounts that are prepared by a joint stock company at the end of a fiscal year. The purpose of creating final accounts is to provide a clear picture of the financial position of the organisation to its management, owners, or any other users of such accounting information.

If accounts have not been passed after two years, a beneficiary can again apply to the court to require passing of the executor's accounts. The executor will need to explain why the estate has not yet been settled.

After a death, the deceased's executor or administrator has the job of winding up the estate. Once this has been done, they are required to provide a final estate account. This details all of the assets, income, liabilities and expenses as well as the amount that is payable to the beneficiaries.