Final Account Estate Template With Trust

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Whether for business purposes or for personal affairs, everybody has to handle legal situations at some point in their life. Completing legal paperwork demands careful attention, starting with choosing the appropriate form sample. For instance, if you select a wrong edition of the Final Account Estate Template With Trust, it will be rejected when you send it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a Final Account Estate Template With Trust sample, follow these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Check out the form’s information to ensure it suits your situation, state, and county.

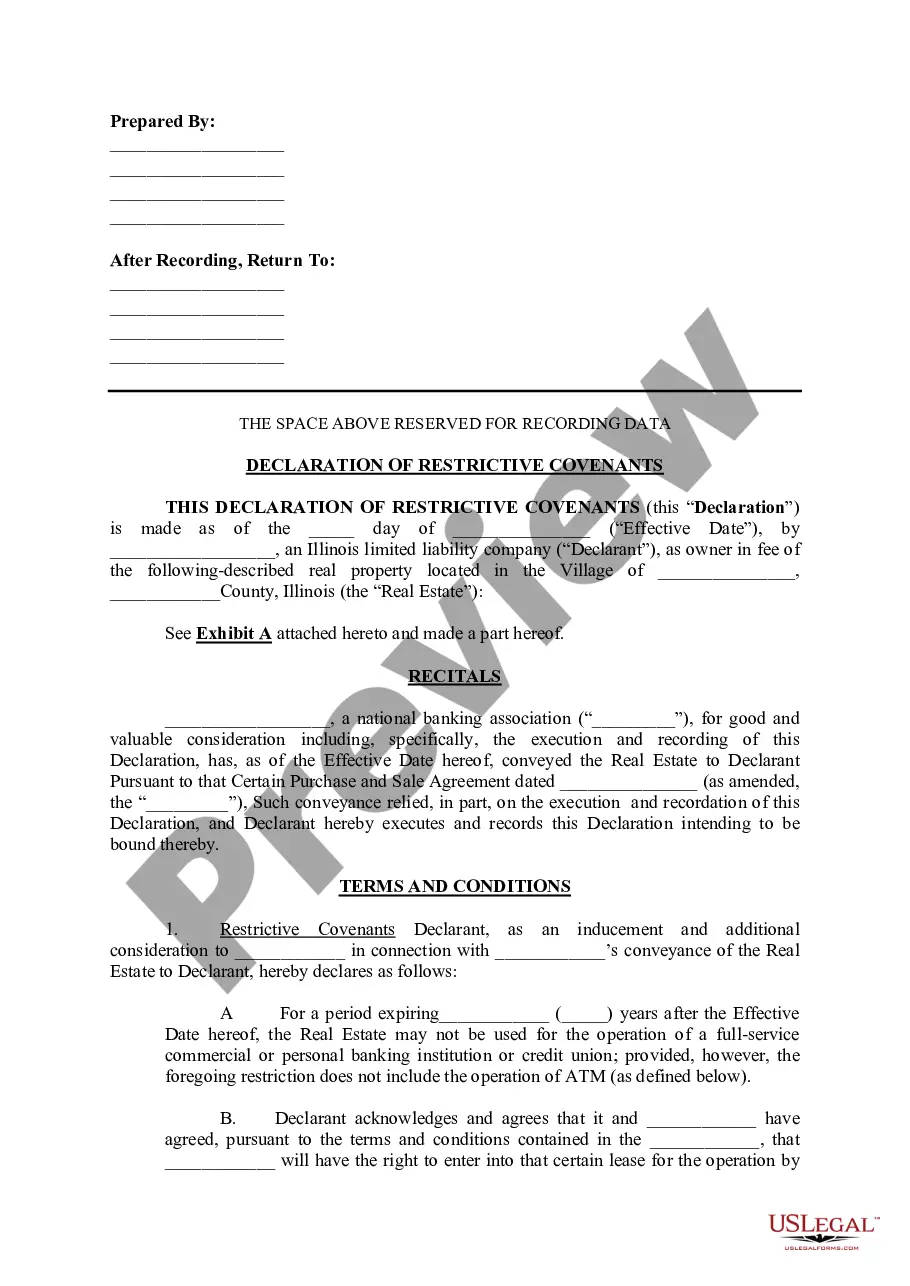

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search function to locate the Final Account Estate Template With Trust sample you need.

- Get the file if it matches your needs.

- If you already have a US Legal Forms account, simply click Log in to access previously saved files in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the proper pricing option.

- Complete the account registration form.

- Select your transaction method: use a bank card or PayPal account.

- Select the file format you want and download the Final Account Estate Template With Trust.

- After it is saved, you can fill out the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time searching for the appropriate sample across the web. Make use of the library’s simple navigation to get the right template for any occasion.

Form popularity

FAQ

An Executor or Administrator has a statutory duty to produce a final Estate Account which can be enforced by the Court. This account will illustrate what money has come in and out of the Estate, listing all assets, liabilities (debts), administration expenses and the final amount to be distributed to the Beneficiaries.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.

Typically, you need to make it known that you are the executor of the estate and are not taking responsibility for the transaction yourself. You can do this by simply signing your name and putting your title of executor of the estate afterward.

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of ...