Account State Estate Withdrawal

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Managing legal documents can be daunting, even for seasoned professionals.

When you're looking for an Account State Estate Withdrawal and lack the time to search for the correct and current version, the experience can be stressful.

US Legal Forms meets all your needs, from personal to business paperwork, all conveniently located in one spot.

Leverage advanced tools to complete and manage your Account State Estate Withdrawal.

Here are the steps to follow after finding the form you need: Validate it by previewing and reviewing its description, ensure the template is accepted in your state or county, select Buy Now when ready, choose a subscription plan, pick your desired file format, and Download, complete, eSign, print, and submit your document. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Streamline your daily document management into a simple and efficient process today.

- Access a valuable collection of articles, guides, and materials relevant to your situation and requirements.

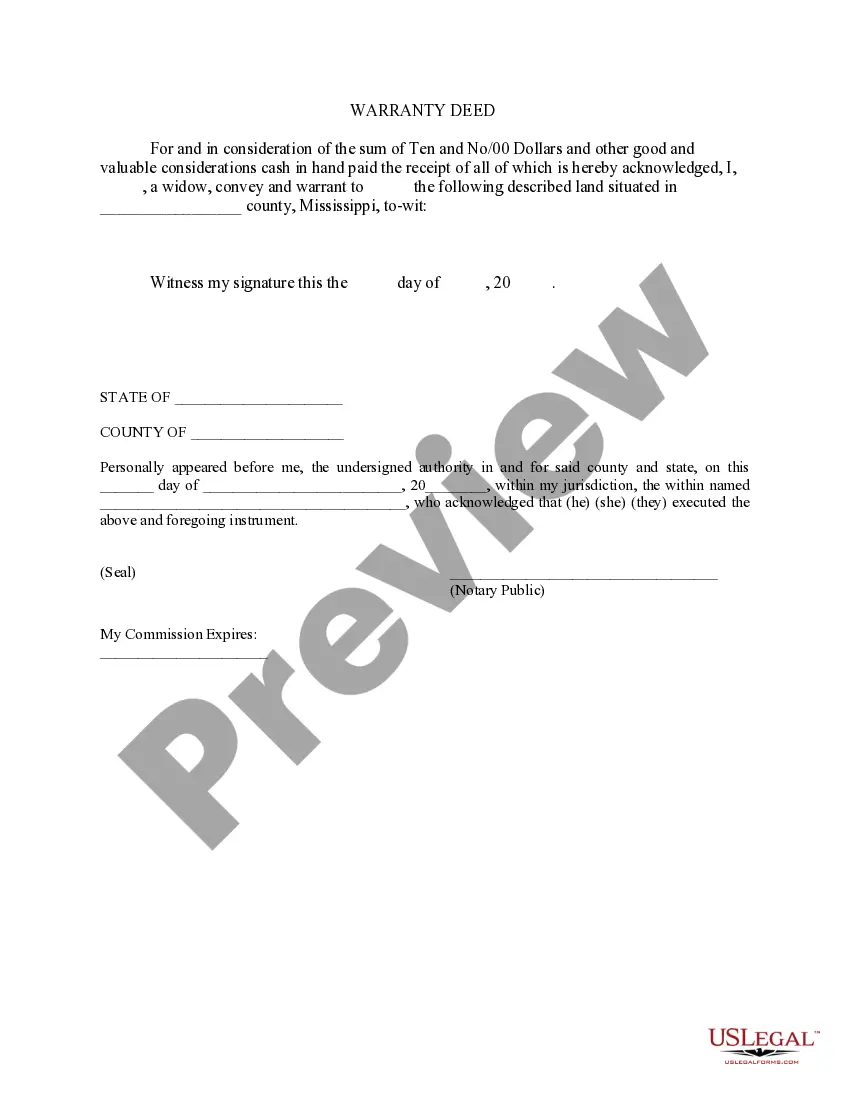

- Save time and effort searching for the documents you require, and utilize US Legal Forms’ enhanced search and Preview tool to find Account State Estate Withdrawal and obtain it.

- If you have a membership, Log In to your US Legal Forms account, look for the form, and retrieve it.

- Check your My documents tab to see the documents you've previously saved and organize your folders as needed.

- If it’s your first time using US Legal Forms, create a free account to enjoy unlimited access to all the features of the library.

- A comprehensive online form directory can significantly improve efficiency for anyone needing to handle these matters.

- US Legal Forms is a leading provider of digital legal documents, offering over 85,000 state-specific legal forms at your convenience.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

A death certificate, ID proof and account details must be provided to the bank to notify them of the death. Legal heirs will receive the proceeds from the deceased account if there are no debts owed to creditors. Furthermore, creditors would recover the account balance if there was an unpaid debt.

An executor can withdraw money from an estate account for the purpose of completing transactions related to the estate. That said, most banks will require an executor to provide supporting documentation for any withdrawals, including receipts, written explanations, or invoices.

?What that beneficiary has to do is just present a death certificate and ID to the bank. Then that asset will pass directly to who you want it to.? Banks typically don't ask account holders to designate a beneficiary.

'Estate of' accounts can be opened at any bank. All Executor(s)/Administrator(s)/next of kin must visit their chosen branch with the Death Certificate and Will (if applicable) and advise the staff that they wish to open an 'Estate of' account.

The best banks to open an estate account Schwab One Estate Account. Fidelity Estate Account. Bank of America Estate Services. USAA Survivor Relations.