Who Done That

Description

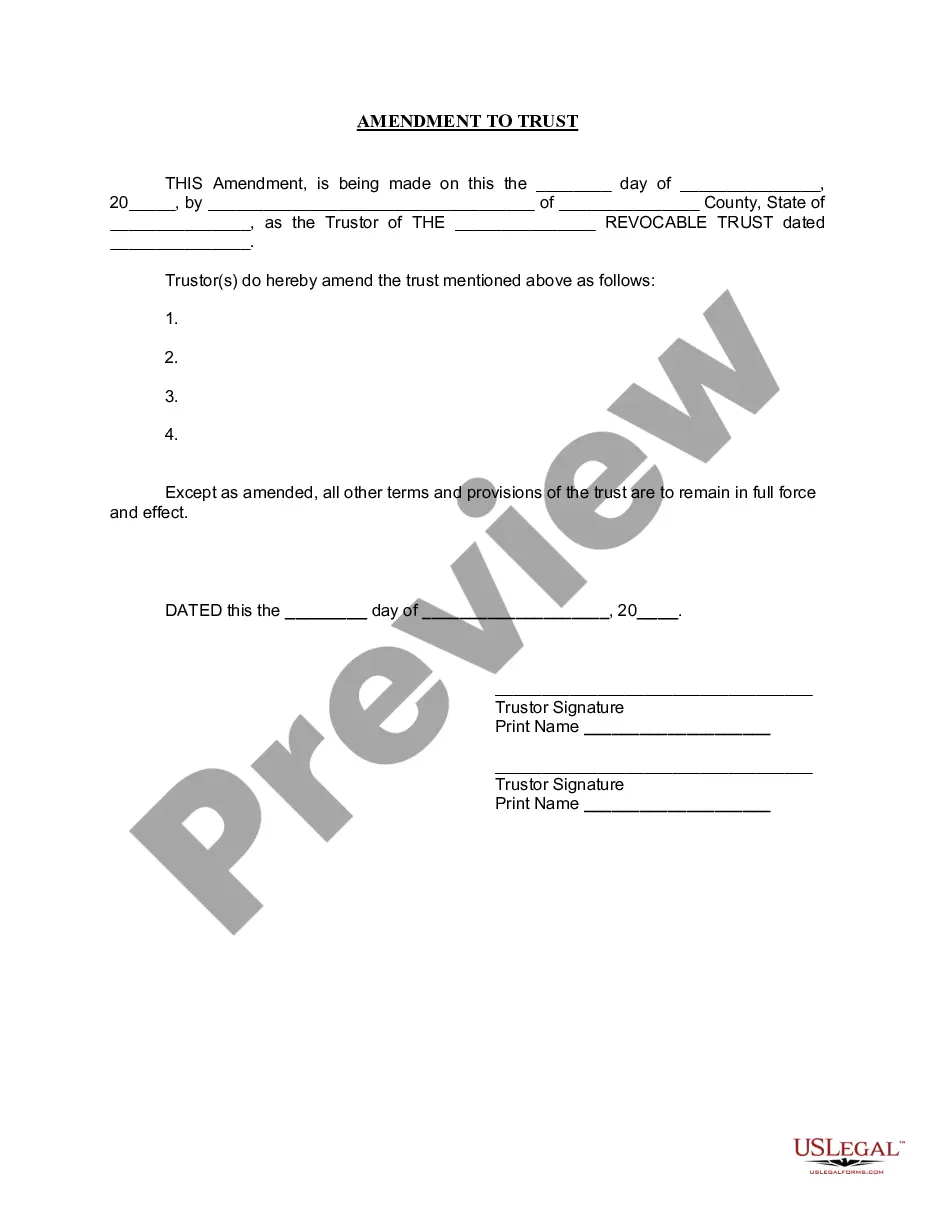

How to fill out Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death?

- If you’re a returning user, log in to your account and ensure your subscription is active before proceeding to download your desired form template by clicking the Download button.

- For new users, start by checking the Preview mode and description of the forms to confirm you've selected one that aligns with your needs and local regulations.

- If your initial form choice doesn’t meet your needs, utilize the Search tab to explore alternatives. Once you find the right form, proceed to the next step.

- To acquire the document, click the Buy Now button and select your preferred subscription plan, creating an account to gain full access.

- Finalize your purchase by entering your payment details via credit card or PayPal for the subscription plan.

- After the transaction, download your form to your device for completion. You can always retrieve it later from the My Forms section of your profile.

By following these straightforward steps, you can effortlessly tap into the power of US Legal Forms, which offers the most extensive online library of legal documents, exceeding 85,000 fillable and editable forms.

Don’t let legal paperwork overwhelm you. Start using US Legal Forms today and empower yourself with the right tools to tackle legal document needs efficiently!

Form popularity

FAQ

Line 16 on Form 1040 is where you report your qualified business income deduction. Ensure that you understand your business income and related deductions before filling this out. If your situation feels complicated, consider using a reliable online resource or services from uslegalforms to guide your completion. Understanding this line helps clarify tax responsibilities and confirms who done that when you file your return.

To fill out a withholding allowance form, begin with Form W-4 or a similar form required by your employer. Assess your financial situation and determine the number of allowances you can claim accurately. The goal is to balance your tax liability with your paycheck so that you don’t owe too much or get a huge refund. Resources like uslegalforms can help provide step-by-step instructions to guide you through the process effectively.

The IRS typically requires proof that the dependent resides with you for more than half of the year. This can include documents like birth certificates, social security cards, or school records showing your address. Documentation showing your financial support for the dependent, such as medical expenses, adds weight to your claim. Being thorough with your proof helps clarify who done that to safeguard your tax benefits.

To fill out Form 886 H DEP, start by clearly indicating your child's relationship to you and including their Social Security Number. This form requires documentation that affirms your claims about your dependents, so be prepared with necessary documents at hand. Familiarize yourself with each section to ensure accurate completion. Uslegalforms can be an excellent resource for templates and guidance on navigating this form efficiently, ensuring you know who done that.

To prove that your child lives with you, gather relevant documentation such as school records, medical records, or affidavits from neighbors. Having a child’s identification document with your address can also support your case. If your child resides with you, these forms of proof can effectively demonstrate to the IRS who done that regarding your dependent claims. It’s essential to have clear, organized documentation to back your assertions.

Filling out a withholding exemption form is simple. Begin with understanding your tax situation, including your total annual income and the number of dependents you have. The IRS offers Form W-4 to guide you in establishing how much tax should be withheld from your paycheck. Utilizing online platforms, like uslegalforms, can provide templates and instructions tailored to help you fill out the form correctly.

If you believe someone falsely claimed your dependents, it’s crucial to take action. You can report the issue to the IRS by using Form 3949-A, which allows you to disclose tax fraud. Additionally, you should file your tax return using the information that accurately represents your dependents. By doing so, you increase your chances of rectifying the situation and proving who done that.

To discover who claimed you as a dependent, start by reviewing your tax documents from the IRS. You can request a tax transcript that reflects the information the IRS holds regarding your tax filings. If you suspect someone wrongfully claimed you, consider consulting resources that can guide you on how to resolve this issue. Remember, it's essential to clarify who done that if you seek to get your rightful tax benefits.

Typically, the responsibility for filing taxes falls to the individual, their executor, or a designated representative. If you have appointed someone to manage your taxes, ensure they understand their role clearly. Utilizing services like USLegalForms can provide clarity and ease the process. Knowing 'who done that' can prevent future confusion and ensure compliance.

Yes, if you are filing a final tax return for a deceased person, you may need to include a copy of the death certificate. This document verifies the decedent's status and helps facilitate the filing process. For clarity on procedures, consider using resources like USLegalForms. This ensures you follow the necessary steps and clarifies 'who done that' regarding your responsibilities.