Any Trust May For You

Description

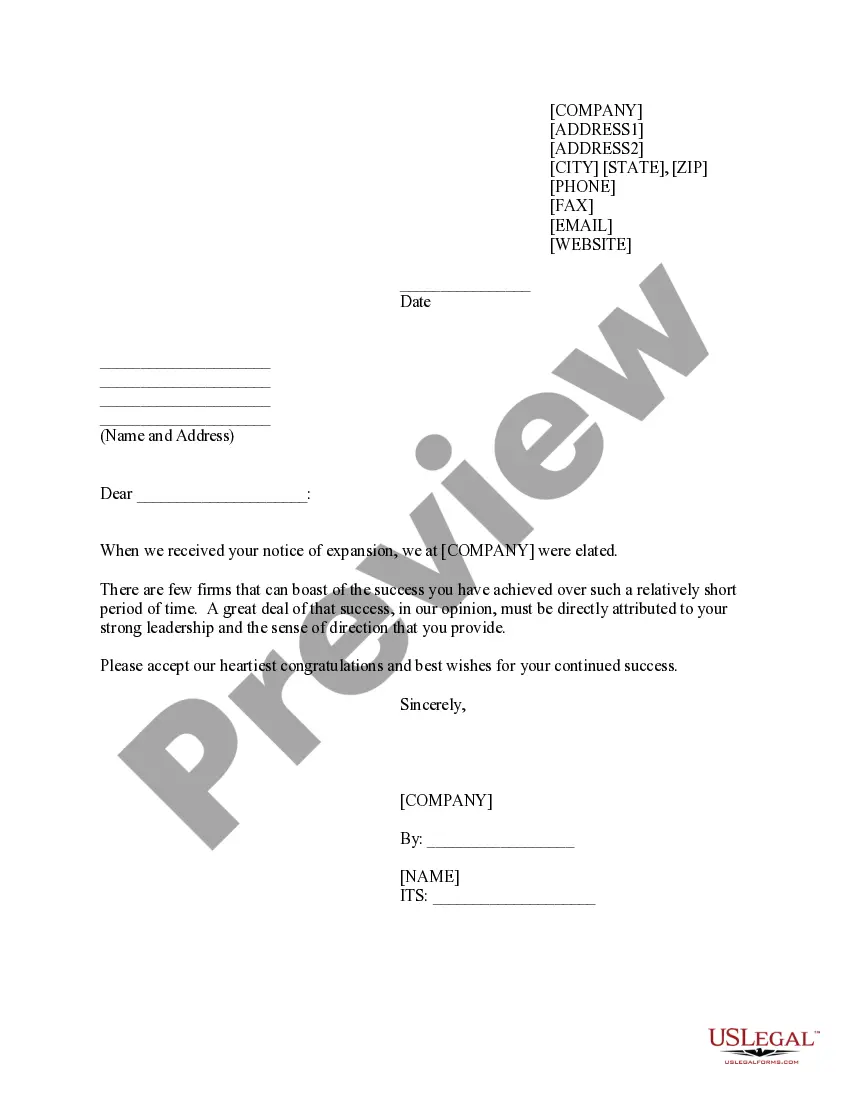

How to fill out Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death?

- If you’re a returning user, log in to your account and check your subscription status. Ensure it's active to download forms.

- For new users, start by exploring the Preview mode and reading the form descriptions to find the one that suits your needs and complies with local jurisdiction.

- If the desired template isn’t available, utilize the Search tab to find additional options that meet your requirements.

- Once you've selected a form, click on the Buy Now button and choose your preferred subscription plan. You'll need to create an account to access the library.

- Complete your purchase by entering your payment details via credit card or PayPal to secure your subscription.

- Download the selected form and save it on your device. You can also access it at any time through the My Forms section of your account.

With US Legal Forms, you gain access to a robust collection of legal forms that outmatch competitors, coupled with the assurance of precise guidance from premium experts. This combination not only saves time but also ensures legal compliance.

Empower yourself with the right legal documentation today! Get started with US Legal Forms and ensure that you have the documents you need.

Form popularity

FAQ

Yes, you can establish a trust even if you do not have assets to transfer into it at the moment. An empty trust serves as a legal framework and can hold assets in the future. It's a strategic move to prepare for upcoming inheritances or investments. Remember, any trust may for you, especially as your financial situation evolves.

Determining if a trust is right for you involves considering your financial situation and your future goals. A trust may provide benefits such as avoiding probate, managing your assets, and ensuring your wishes are carried out. Reflect on what you want to achieve for your family or beneficiaries. If you're unsure, consulting with a professional can help clarify how any trust may for you.

A special needs trust is a legal arrangement that allows individuals with disabilities to receive financial assistance without losing government benefits. This trust can provide funds for quality of life enhancements while preserving access to essential services. For families wanting the best for their loved ones, understanding how any trust may for you can offer support is vital. Legal professionals can help outline its structure and benefits.

While special needs trusts offer numerous benefits, they also come with disadvantages such as legal complexities and potential costs. Establishing and maintaining a trust requires ongoing supervision, which may be burdensome. However, careful planning can mitigate these issues, ensuring that any trust may for you ultimately serves your loved one well. Consulting with an attorney can help clarify the challenges and how to overcome them.

Filling out a trust fund involves completing formal documentation that specifies the trust's purpose and beneficiaries. You'll need to provide detailed information about the assets and how they will be managed. It may appear complex initially, but any trust may for you simplify this process. Using a reliable platform like US Legal Forms can guide you through the necessary paperwork effectively.

Creating a disability trust generally requires a clear understanding of the person's needs along with proper legal documentation. You must show how the trust can help manage the individual's assets while ensuring their eligibility for government benefits. This type of planning is essential, as any trust may for you play a significant role in securing financial support. Partnering with a legal service can clarify these requirements.

Not all assets should go into a trust; including retirement accounts or certain life insurance policies can complicate matters. Additionally, personal assets that require constant use, like vehicles, may be better off outside a trust. Understanding what to exclude is crucial for making any trust may for you effective and beneficial. It's advisable to seek expert advice on asset management in trusts.

Individuals with disabilities who require assistance to manage their financial resources are typically eligible for a special needs trust. This kind of trust allows them to benefit from assets without jeopardizing government assistance. If you are concerned about maintaining those benefits while providing for a loved one, any trust may for you serve as a valuable resource. Consult with a legal professional to understand the specifics of eligibility.

One common mistake parents make is failing to clearly identify the beneficiaries and their needs. It is crucial to ensure that the trust is structured in a way that truly benefits the intended recipients. Otherwise, any trust may for you can quickly become a source of confusion instead of assistance. Take the time to consult with an expert to create a trust that meets your family's requirements.

Typically, a trust is created by an individual known as the grantor or settlor, who decides to place assets into the trust for the benefit of others. You can also consult with an estate planning attorney or a financial advisor to ensure your trust meets legal requirements and aligns with your goals. Whether you want to protect your assets or provide for loved ones, any trust may for you, and expert guidance can make the process smoother. U.S. Legal Forms provides comprehensive tools to help you create your trust confidently.