Foreclosure With Usda Loan

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Obtaining a reliable source for the latest and pertinent legal templates is a significant part of dealing with bureaucracy.

Locating the appropriate legal documents requires accuracy and meticulousness, which is why it’s crucial to obtain Foreclosure With Usda Loan samples exclusively from trustworthy providers, like US Legal Forms.

After acquiring the form on your device, you can edit it using the editor or print it for manual completion. Alleviate the stress associated with legal paperwork. Explore the extensive collection of US Legal Forms where you can find legal templates, assess their suitability for your needs, and download them immediately.

- Utilize the catalog navigation or search functionality to locate your template.

- Examine the document’s description to verify if it meets your state and county's specifications.

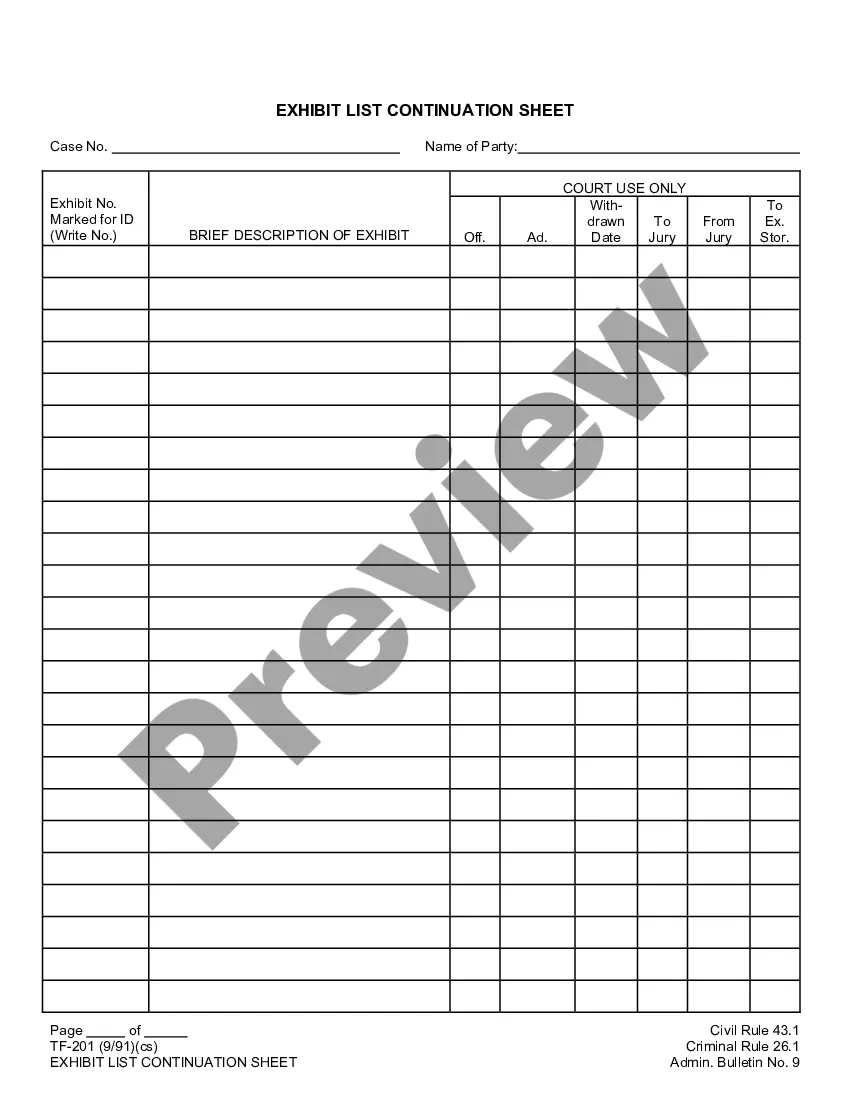

- Check the document preview, if available, to ensure it is the correct form you need.

- Return to the search if the Foreclosure With Usda Loan does not meet your specifications.

- Once you are certain about the form's applicability, download it.

- If you are an authorized user, click Log in to verify and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select the pricing option that suits your requirements.

- Continue with the registration process to complete your purchase.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading the Foreclosure With Usda Loan.

Form popularity

FAQ

To avoid USDA subsidy recapture, you should keep your mortgage payments up to date and ensure you comply with the USDA guidelines. Regularly review your financial situation and avoid selling your home within the recapture period, as it could lead to unexpected costs. Engaging with the USDA or consulting resources available on platforms like US Legal Forms can provide you clarity regarding your obligations and help you navigate this issue smoothly.

You dictate the actions you permit the person to take, and you can limit it to a single transaction or give the person general authority. You can revoke a power of attorney through a written revocation form, which must be given to your agent and to the individuals and businesses the agent deals with on your behalf.

Our call center number (which handles all initial intake) is 800-498-1804.

Steps for Making a Financial Power of Attorney in Mississippi Create the POA Using a Form, Software or an Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Chancery Clerk's Office.

Characteristics to Look For Someone Who Lives Nearby. Someone Who Is Trustworthy. Someone Who Can Be Assertive. Someone Who Has Some Understanding of Medical Processes. Someone Who Is Articulate. Someone Who Has a Willingness to Serve.

The requirements and restrictions vary in each state; however, in Mississippi, your document will require notarization. If your agent will have the authority to manage real estate transactions, the Power of Attorney will need to be acknowledged by a notary and recorded or filed with the county.

Individual Document Preparation Specific document preparation, like drafting a single will or power of attorney, can cost between $150 and $400 per document in Mississippi.