Foreclosure Timelines By State With Pictures

Description

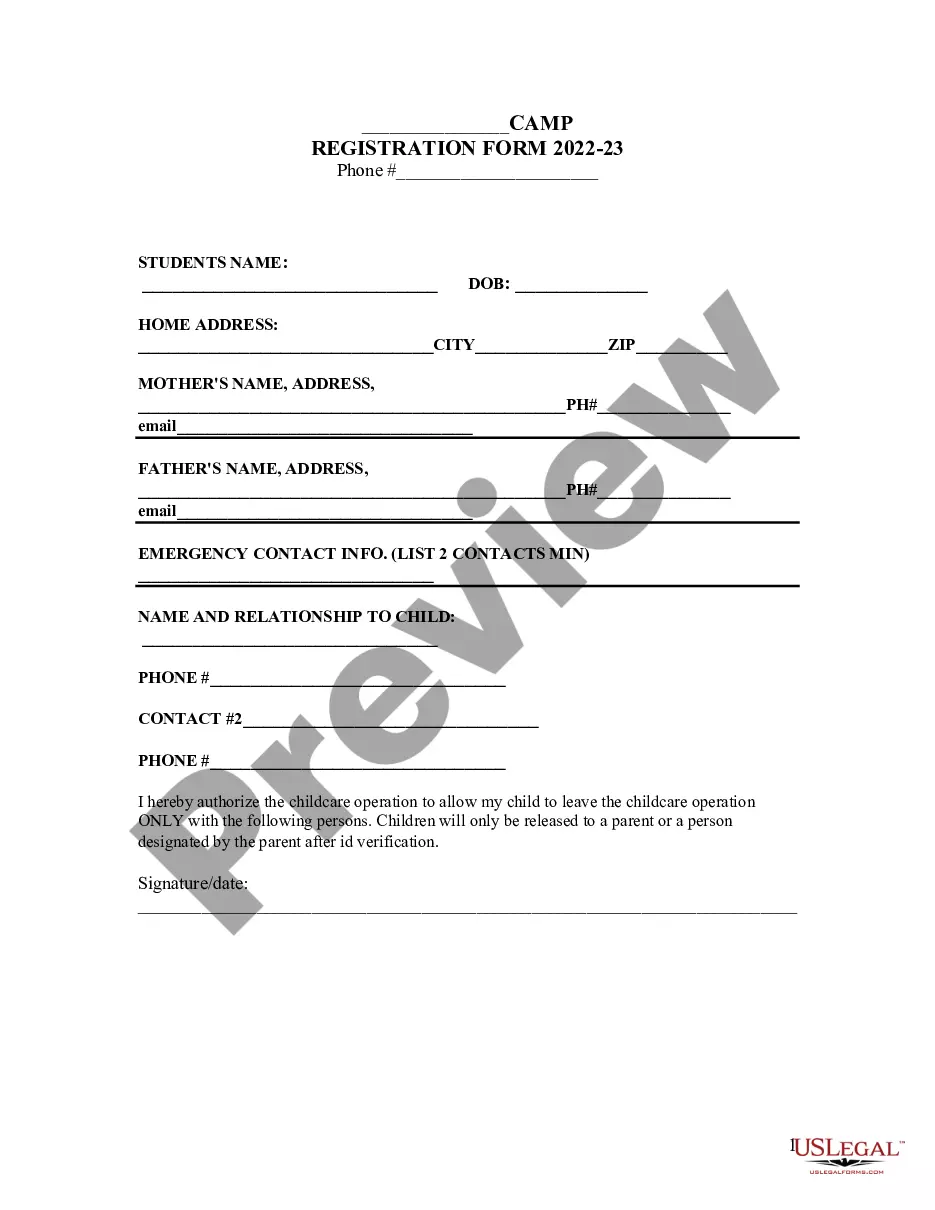

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Creating legal documents from the ground up can often be daunting.

Certain situations may require extensive investigation and significant financial investment.

If you're looking for a more straightforward and budget-friendly method for producing Foreclosure Timelines By State With Pictures or other documents without hassle, US Legal Forms is readily available to you.

Our online library of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-specific templates meticulously prepared by our legal professionals.

Confirm that the form you choose meets the criteria of your state and county. Select the most appropriate subscription plan to acquire the Foreclosure Timelines By State With Pictures. Download the form, then complete, authenticate, and print it. US Legal Forms is known for its solid reputation and over 25 years of experience. Join us now and simplify your document handling into an effortless and efficient process!

- Access our platform whenever you require a dependable service to effortlessly locate and download the Foreclosure Timelines By State With Pictures.

- If you are familiar with our site and have previously registered an account, simply Log In, select your desired template, and proceed with the download or re-download it anytime in the My documents section.

- Not yet registered? No problem. It takes little time to create an account and explore the library.

- Before diving straight into downloading Foreclosure Timelines By State With Pictures, consider these suggestions.

- Review the document preview and descriptions to ensure it is the document you seek.

Form popularity

FAQ

Redemption Period ? starts day of Sheriff Sale -Six (6) months is most common. -If the amount claimed to be due on the mortgage at the date of foreclosure is less than 2/3 of the original indebtedness, the redemption period is 12 months. -Farming property can be up to twelve (12) months.

The foreclosure process in Texas is a relatively quick process, usually around 6 months. Though foreclosure action can be taken after the first missed payment, most lenders include a grace period for late payments. After 10-15 days, the lender will usually charge a late fee.

ATTOM's latest foreclosure market analysis reported that states with the longest average foreclosure timelines for homes foreclosed in Q1 2022 were Hawaii (2,578 days); Louisiana (1,976 days); Kentucky (1,891 days); Nevada (1,808 days); and Connecticut (1,632 days).

Which state has the quickest foreclosure process? The state with the quickest foreclosure process is Montana, followed by Mississippi, West Virginia, Wyoming, and Minnesota.

States with the shortest average foreclosure timelines for homes foreclosed in Q3 2023 were Texas (160 days); Montana (169 days); Wyoming (177 days); Missouri (211 days); and Michigan (213 days). Nationwide in September 2023 one in every 3,706 properties had a foreclosure filing.