Foreclosure Deed Lieu With Mortgage

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Whether for commercial objectives or personal matters, everyone has to confront legal circumstances at some stage in their life.

Completing legal documentation requires meticulous care, starting with selecting the correct form template.

With a comprehensive US Legal Forms catalog available, you will never have to waste time searching for the correct template online. Utilize the library’s straightforward navigation to locate the suitable document for any circumstance.

- Acquire the template you need using the search bar or catalog browse.

- Review the form's description to ensure it aligns with your circumstance, state, and county.

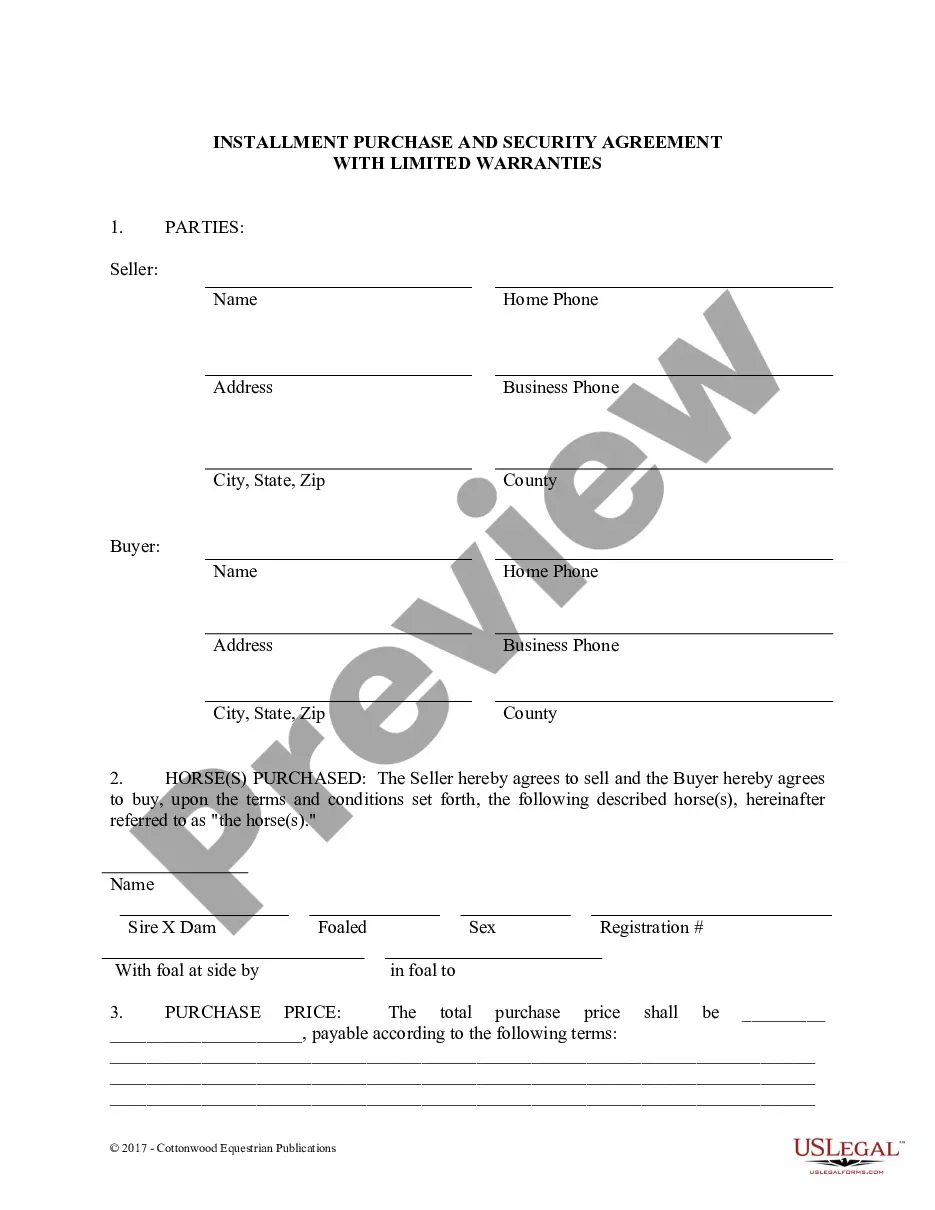

- Click on the form's preview to view it.

- If it is the incorrect form, return to the search feature to find the Foreclosure Deed Lieu With Mortgage template you need.

- Download the template when it fits your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- In case you do not have an account yet, you may download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you prefer and download the Foreclosure Deed Lieu With Mortgage.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for relief from the mortgage debt. Choosing a deed in lieu of foreclosure can be less damaging financially than going through a full foreclosure proceeding.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.