Foreclosure Answer Form With Two Points

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Whether for corporate reasons or personal matters, everyone must deal with legal issues at some point in their lives. Completing legal documentation necessitates meticulous attention, starting from selecting the correct form template.

For instance, if you select an incorrect version of the Foreclosure Answer Form With Two Points, it will be declined upon submission. Therefore, it is crucial to obtain a trustworthy source of legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the appropriate sample across the internet. Utilize the library’s straightforward navigation to locate the right template for any purpose.

- Obtain the sample you require by utilizing the search field or browsing through the catalog.

- Review the form’s description to ensure it fits your circumstances, state, and county.

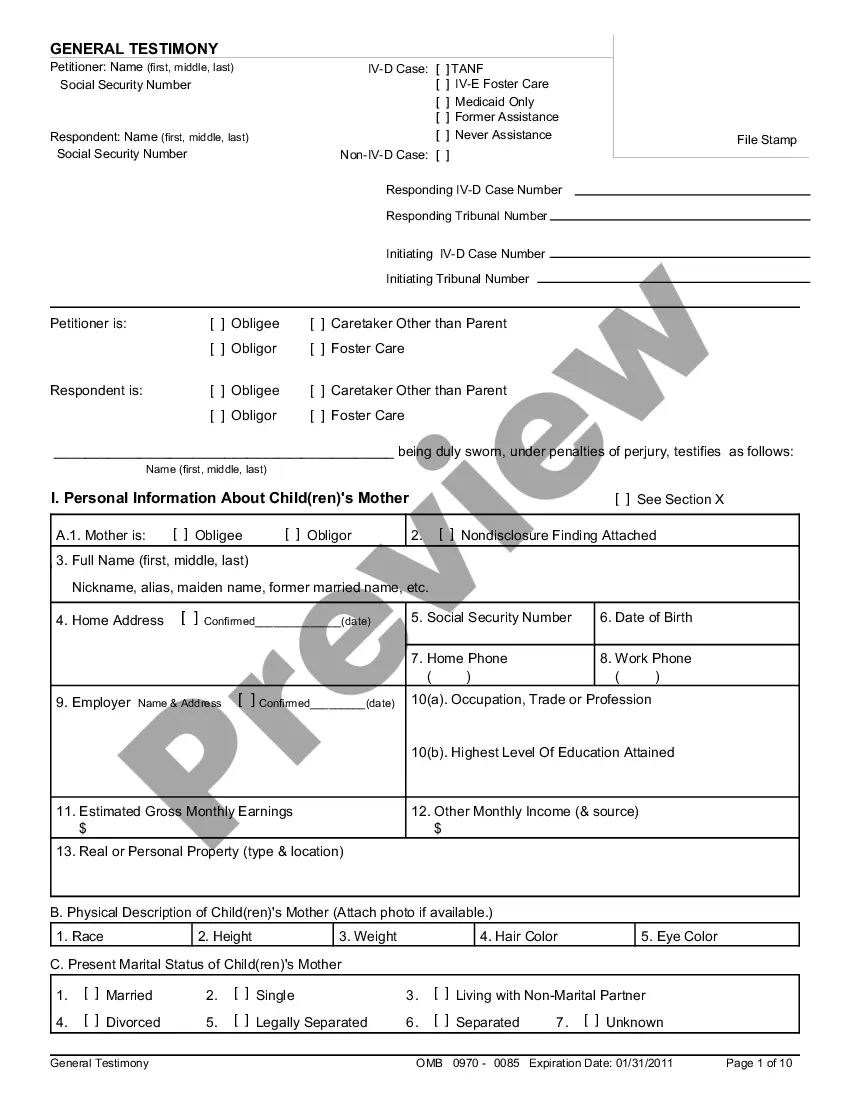

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to find the Foreclosure Answer Form With Two Points template you need.

- Acquire the file if it meets your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the profile registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the file format you desire and download the Foreclosure Answer Form With Two Points.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

File and send an Answer The first step for you after receiving the summons and complaint is to file an Answer with the court and to send the Answer to the law firm that is representing the lender. If the lawsuit is given to you by personal service, you have 20 days from the date of delivery to file and send an Answer.

If you got a Summons and Complaint, you need to deliver a written Answer form to the plaintiff and the Court. Your Answer is what you tell the court about what the plaintiff said in the Complaint. The Answer tells the court your defenses or reasons the plaintiff must not win the case.

Foreclosure is a process that begins when a borrower fails to make their mortgage payments. When a home is foreclosed upon, the lender typically repossesses and attempts to sell the house. This happens because mortgage loans are secured by real estate, meaning your home is used as collateral.

A foreclosure stays on your credit report for seven years from the date of the first missed payment that led to it, but its impact on your credit score will likely fade earlier than that. Foreclosure may hurt your ability to get a new mortgage.

Judicial foreclosure, as the term suggests, begins with the lender filing a complaint against the bor- rower. As with most litigation, this process can be drawn out and expensive.