Deed Lieu Agreement With Ukraine

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Legal oversight can be perplexing, even for the most informed experts.

When you are looking for a Deed Lieu Agreement With Ukraine and lack the time to seek out the correct and current version, the process might be overwhelming.

For those holding a monthly membership, Log In to your US Legal Forms account, look for the form, and acquire it.

Check My documents section to view the documents you have previously saved and manage your folders according to your preference.

Enjoy the US Legal Forms digital library, supported by 25 years of expertise and trustworthiness. Revolutionize your everyday document management into a straightforward and user-friendly experience today.

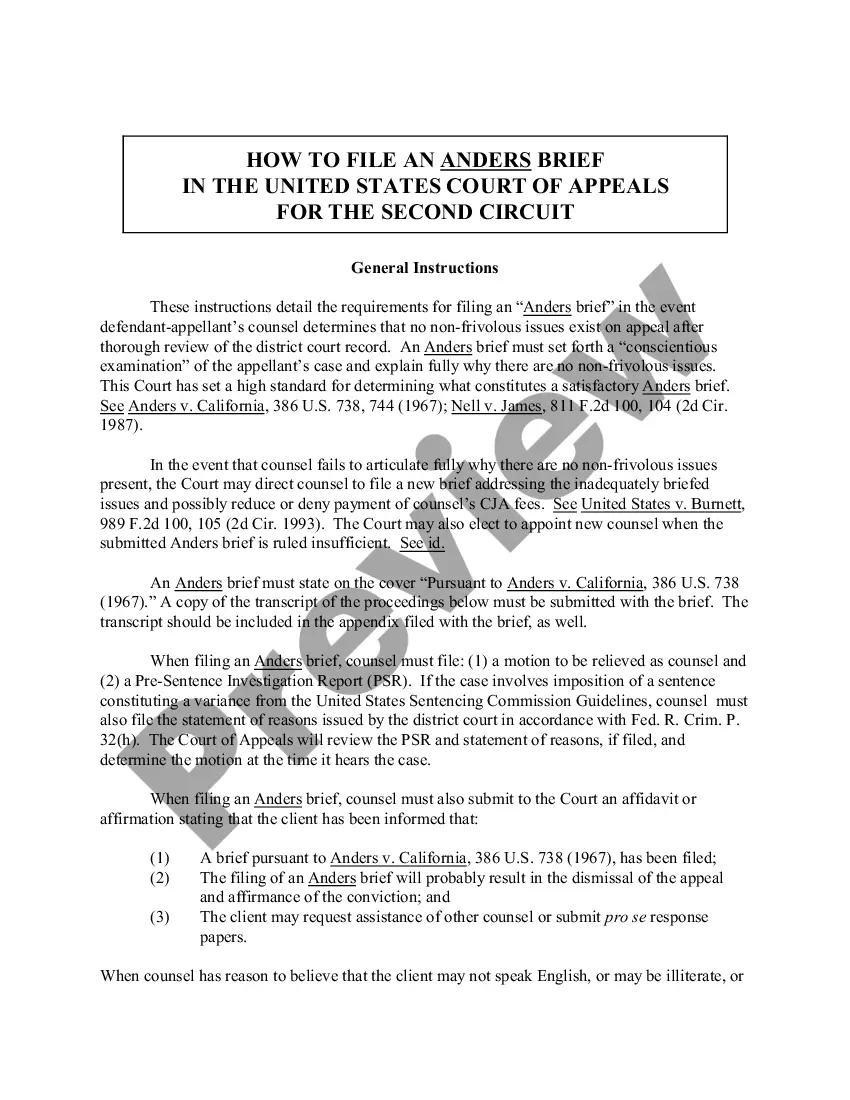

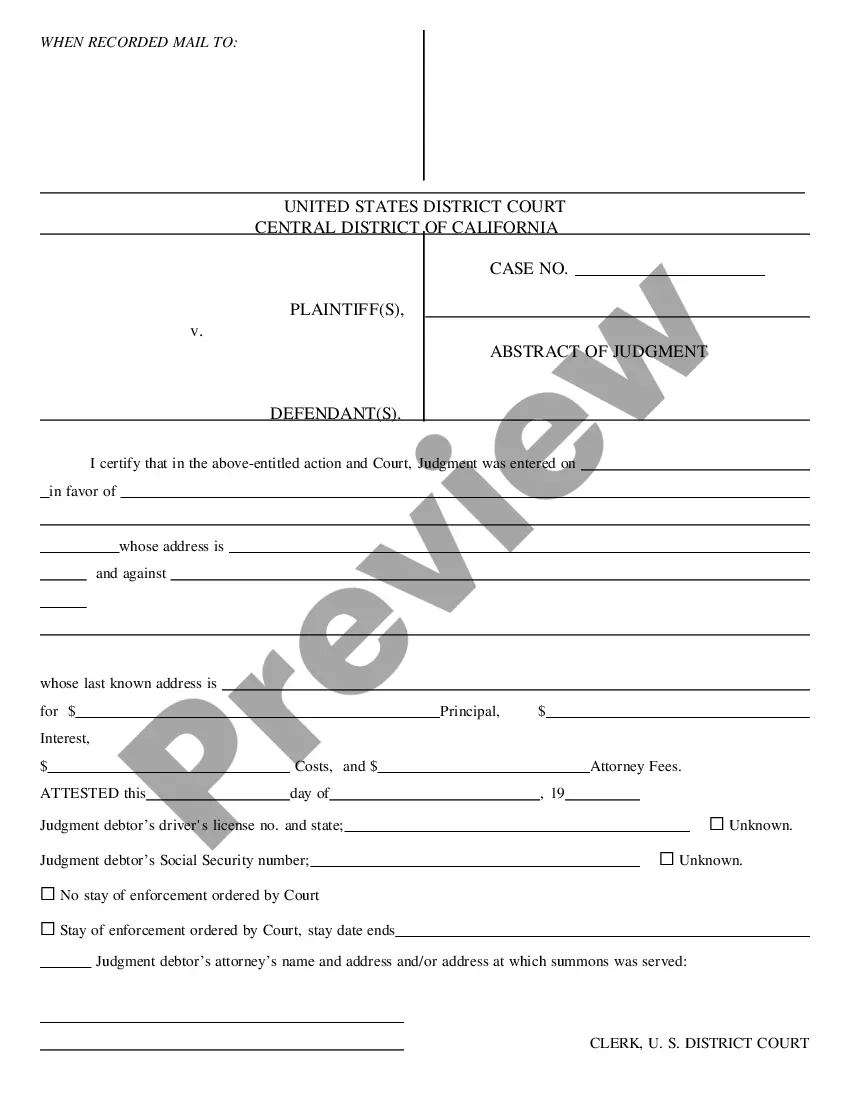

- Verify this is the correct form by previewing it and reviewing its content.

- Confirm that the document is valid in your state or county.

- Click Buy Now when you are ready.

- Choose a subscription plan.

- Select the format you desire, and Download, complete, sign, print, and submit your documents.

- Utilize cutting-edge tools to complete and manage your Deed Lieu Agreement With Ukraine.

- Access a reservoir of articles, tutorials, and resources relevant to your situation and requirements.

- Save time and energy searching for the paperwork you need, and leverage US Legal Forms’ sophisticated search and Preview feature to find Deed Lieu Agreement With Ukraine and obtain it.

Form popularity

FAQ

Double Tax Treaties of Ukraine A Double Tax Agreement (DTA) is a bilateral agreement which provides clarity on the taxing rights of each country on all forms of income flows between two countries. The DTA also eliminates instances of double taxation which can arise from cross-border trade and investment activities.

Do the US and Ukraine have a Tax Treaty? Yes, Ukraine and the US do have a tax treaty in place. This protects US expats in Ukraine from paying double taxes on the same income. Under the treaty, US citizens and residents living in Ukraine can claim foreign tax credits on their US tax returns for taxes paid to Ukraine.

See Table 3 of the Tax Treaty Tables for the general effective date of each treaty and protocol. A. Armenia. Australia. Austria. Azerbaijan. B. desh. Barbados. Belarus. Belgium. ... C. Canada. China. Cyprus. Czech Republic. D. Denmark. H. Hungary. K. Kazakhstan. Korea. Kyrgyzstan. L. Latvia. Lithuania. Luxembourg. M. Malta. Mexico. Moldova. Morocco.

Donations to registered Ukrainian charities and not-for-profit organisations are deductible in an amount that is not higher than 4% of the taxpayer's taxable income. For the tax year 2022, this limit was increased to 16%.

In general, in order to be eligible for a tax treaty in the US, a person must meet the following criteria: 1) be a resident of a country that has a tax treaty with the US, 2) be a Non-Resident Alien for Tax Purposes in the United States, 3) currently be earning qualifying income in the United States, and 4) have a US ...