Jury Misconduct In Murdaugh Trial

Description

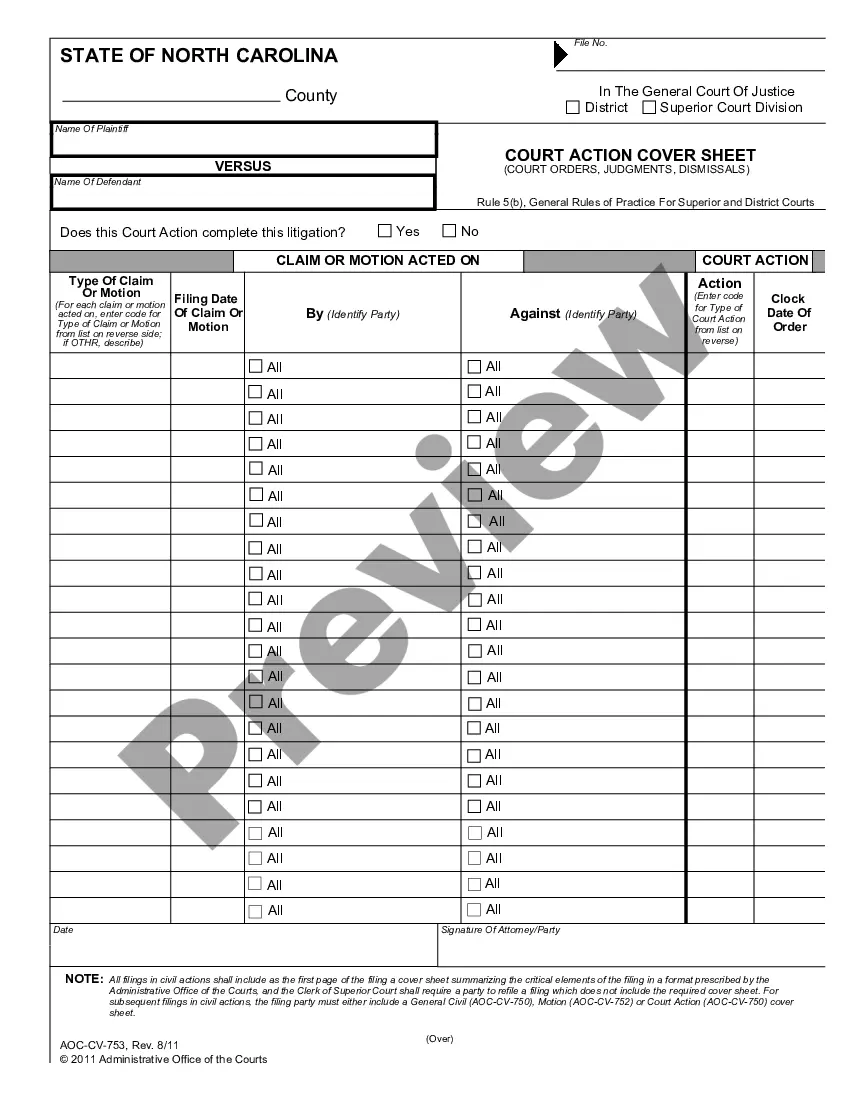

How to fill out Motion To Dismiss, Quash, Or Set Aside Due To Abuse Of Grand Jury And Prosecutorial Misconduct?

The Jury Impropriety In Murdaugh Trial you see on this page is a reusable formal template crafted by experienced attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal situation. It’s the quickest, most efficient, and most trustworthy method to acquire the paperwork you require, as the service ensures the highest degree of data protection and anti-malware safeguards.

Register for US Legal Forms to have verified legal templates for every one of life's situations at your fingertips.

- Search for the document you need and review it. Browse the file you looked for and preview it or examine the form description to affirm it meets your requirements. If it doesn't, utilize the search feature to find the appropriate one. Click Buy Now once you have identified the template you require.

- Subscribe and Log In. Select the pricing plan that fits your needs and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the fillable template. Choose the format you desire for your Jury Impropriety In Murdaugh Trial (PDF, Word, RTF) and download the sample onto your device.

- Fill out and sign the document. Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Redownload your documents when required. Access the same document again whenever necessary. Open the My documents tab in your profile to retrieve any previously purchased forms.

Form popularity

FAQ

Why Create an Idaho LLC? Create, manage, regulate, administer and stay in compliance easily. Easily file your taxes and discover potential advantages for tax treatment. Protect your personal assets from your business liability and debts. Low cost to file ($100)

How much does it cost to form an LLC in Idaho? The Idaho Secretary of State charges $100 to file the Certificate of Organization online and $120 to file by mail. You can reserve your LLC name with the Idaho Secretary of State for $20.

You can get an LLC in Idaho in 5-7 business days if you file online (or 2-3 weeks if you file by mail). If you need your Idaho LLC faster, you can pay for expedited processing.

The primary cost to start an LLC in Idaho is the state registration fee of $100 ($120 for paper filings). While there is no annual report fee, you will have additional expenses to budget for, including possibly hiring a registered agent, insuring your business, and in many cases, business licensing costs.

How to start an Idaho LLC Name your Idaho LLC. Create a business plan. Get a federal employer identification number (EIN) File an Idaho Certificate of Organization. Choose a registered agent in Idaho. Obtain business licenses and permits. Understand Idaho state tax requirements. Prepare an operating agreement.

NOTE: You can, as an individual, act as your own registered agent if you have an Idaho physical address. Or, you may use another legal business entity who is filed with our office with an Idaho physical address, but not your own entity.

The Limited Liability Company (LLC) has some of the characteristics of a sole proprietorship, some of a partnership, and some of a corporation. An LLC may, for tax purposes, be disregarded, be taxed like a partnership or taxed like a corporation (Idaho Code 63-3006A). The LLC has members rather than shareholders.

1. Kentucky. Kentucky is the cheapest state to form an LLC, with a filing fee of just $40. The state also offers business owners incentive programs that provide small businesses with financial assistance.