Bad Debt Write Off In Sap Tcode

Description

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

Whether for commercial objectives or personal matters, everyone must confront legal circumstances at some stage in their life.

Filling out legal documents necessitates meticulous consideration, starting from selecting the suitable form sample.

With a comprehensive US Legal Forms catalog available, you never need to waste time searching for the correct sample across the web. Utilize the library’s straightforward navigation to find the suitable template for any purpose.

- Obtain the sample you require by using the search bar or catalog navigation.

- Review the form’s description to ensure it aligns with your situation, state, and county.

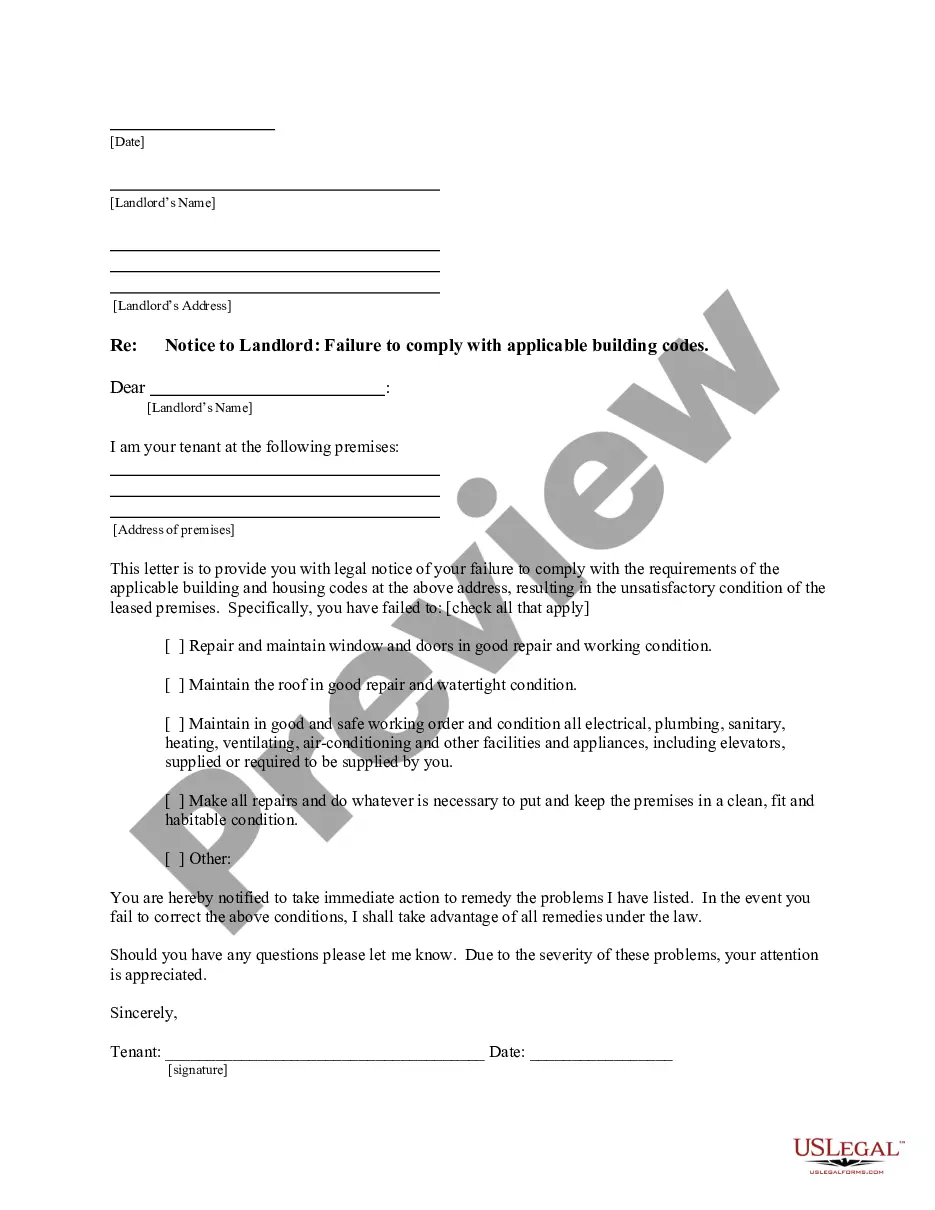

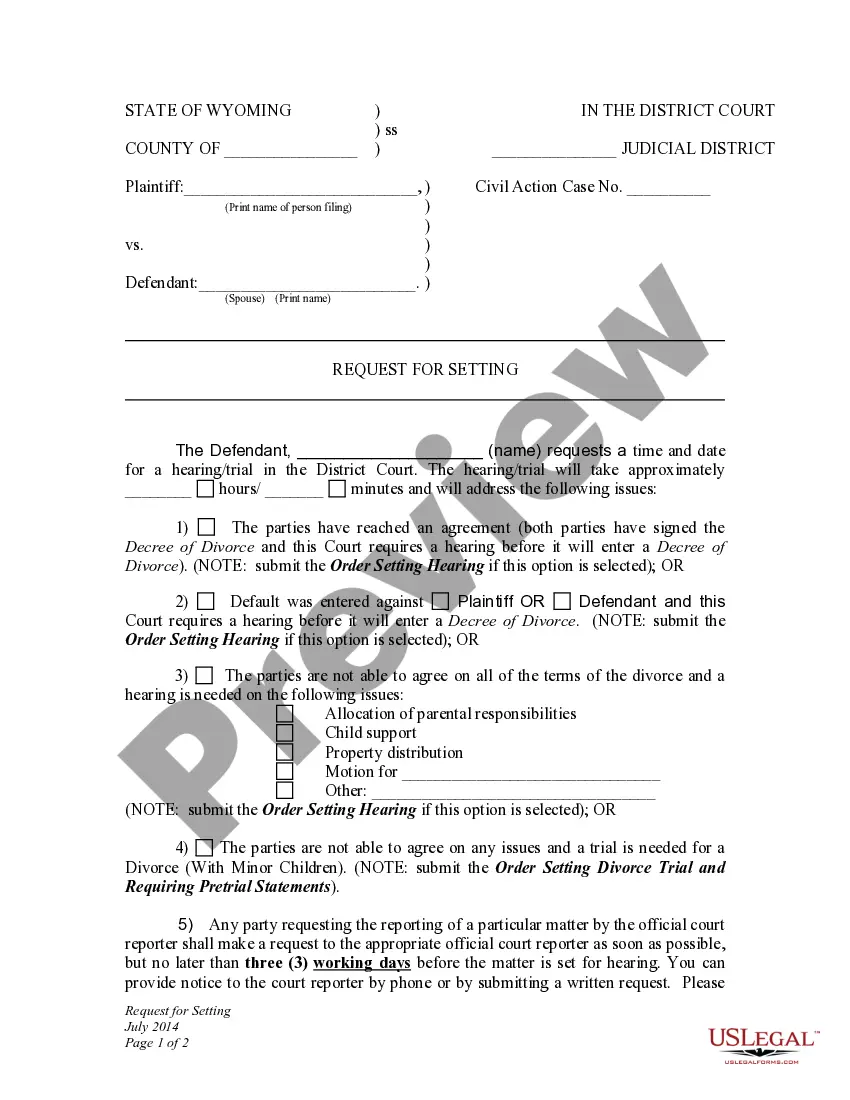

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search function to locate the Bad Debt Write Off In Sap Tcode sample you need.

- Download the file if it fulfills your criteria.

- If you already possess a US Legal Forms account, click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you prefer and download the Bad Debt Write Off In Sap Tcode.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

To write off a transaction, first determine which transaction qualifies for write-off. Once identified, utilize the bad debt write off in sap tcode to officially document the write-off. This process helps maintain the integrity of your financial statements and supports accurate financial reporting.

The best way to write off a bad debt is to follow a systematic approach that includes verifying the debt and documenting the reasons for write-off. Using the bad debt write off in sap tcode will streamline this process. This not only simplifies accounting but also aids in ensuring compliance with internal policies.

To write off bad debt in SAP, start by accessing the designated transaction code. Next, enter the detail of the customer account along with the amount to be written off. This process effectively clears uncollectible amounts from your records while maintaining compliance with accounting standards.

The procedure to write off bad debts typically involves identifying which debts are uncollectible. After assessment, input the relevant information into your bad debt write off in sap tcode. This ensures that your financial records are current and that liabilities are accurately represented.

Ending a transaction in SAP involves ensuring all necessary steps are completed and validated. Once you confirm that all entries are correct, you can execute the finalization command. This process is crucial for accurate financial reporting and operational efficiency.

To write off stock in transit in SAP, first locate the relevant transaction code for inventory management. Then, specify the stock that needs to be written off. This process helps maintain clarity in inventory records, contributing to efficient stock management.

Writing off bad debt entries involves identifying debts that are unlikely to be collected. Once identified, enter the bad debt write off in sap tcode to adjust your financial records accordingly. This ensures that your accounting reflects only collectible receivables, maintaining financial accuracy.

To write-off customer balance in SAP, navigate to the appropriate transaction code. You will enter relevant customer details and specify the amount to be written off. This process ensures that your financial records remain accurate and that the impact of bad debts is properly accounted for.

The write-off method refers to the process of removing an uncollectible amount from your accounts receivable. This method is essential for maintaining accurate financial records. Specifically, in the context of bad debt write off in sap tcode, it simplifies the accounting process by reflecting true financial standing.

To pass a write-off entry in SAP, use the designated Tcode that aligns with your company's procedures, such as 'F-42' for customer write-offs. Input essential details like the account involved, transaction type, and amounts you wish to write off. This is crucial for maintaining clean financial records. Don't forget that handling bad debt efficiently with the 'Bad debt write off in sap tcode' helps ensure your financial reports remain accurate.